The Cook Illinois Transfer under the Uniform Transfers to Minors Act (TMA) provides a legal framework for transferring assets to minors, ensuring their protection while allowing for the management and administration of these assets until the minor reaches a certain age. This article aims to provide a detailed description of what the Cook Illinois Transfer under the TMA — Multistate Form entails, using relevant keywords and highlighting different types of transfers. The Cook Illinois Transfer under the TMA — Multistate Form is a legally recognized mechanism designed to facilitate the transfer of assets from an adult (the transferor) to a minor (the beneficiary) in the state of Illinois. This form is applicable in multiple states as it is part of the broader Uniform Transfers to Minors Act, which has been adopted by many states across the United States. The form enables the transferor to establish a custodianship for the benefit of the minor, wherein a custodian is appointed to manage and oversee the assets until the minor reaches a specified age. The custodian can be an individual, such as a trusted family member or friend, or a financial institution authorized to act as a custodian. Under the Cook Illinois Transfer under the TMA — Multistate Form, various types of assets can be transferred to the minor. These may include cash, securities, real estate, intellectual property, and other valuable assets. The transferor can specify multiple types of assets in the transfer, ensuring a comprehensive and thorough transfer of property to the minor. The form outlines the necessary information required for the transfer, such as the name and address of both the transferor and the custodian. The transferor must clearly identify the assets being transferred and provide a detailed description of each asset to ensure clarity and avoid any confusion during the transfer process. The Cook Illinois Transfer under the TMA — Multistate Form also allows the transferor to set an age at which the minor will gain full control over the transferred assets. In Illinois, the age can range from 18 to 25, giving flexibility to the transferor to choose an appropriate age based on their assessment of the minor's financial maturity and responsibility. Moreover, it is important to note that the Cook Illinois Transfer under the TMA — Multistate Form can be used for different types of transfers under the TMA. These may include outright transfers, where the assets are transferred to the minor unconditionally, or custodial transfers, wherein the assets are held and managed by the custodian until the minor reaches the specified age. In summary, the Cook Illinois Transfer under the TMA — Multistate Form is a critical legal document that enables the transfer of assets to minors in a structured and protected manner. It provides the transferor with the opportunity to appoint a custodian and specify the assets to be transferred, ensuring the minor's financial well-being until they reach a certain age.

Cook Illinois Transfer under the Uniform Transfers to Minors Act - Multistate Form

Description

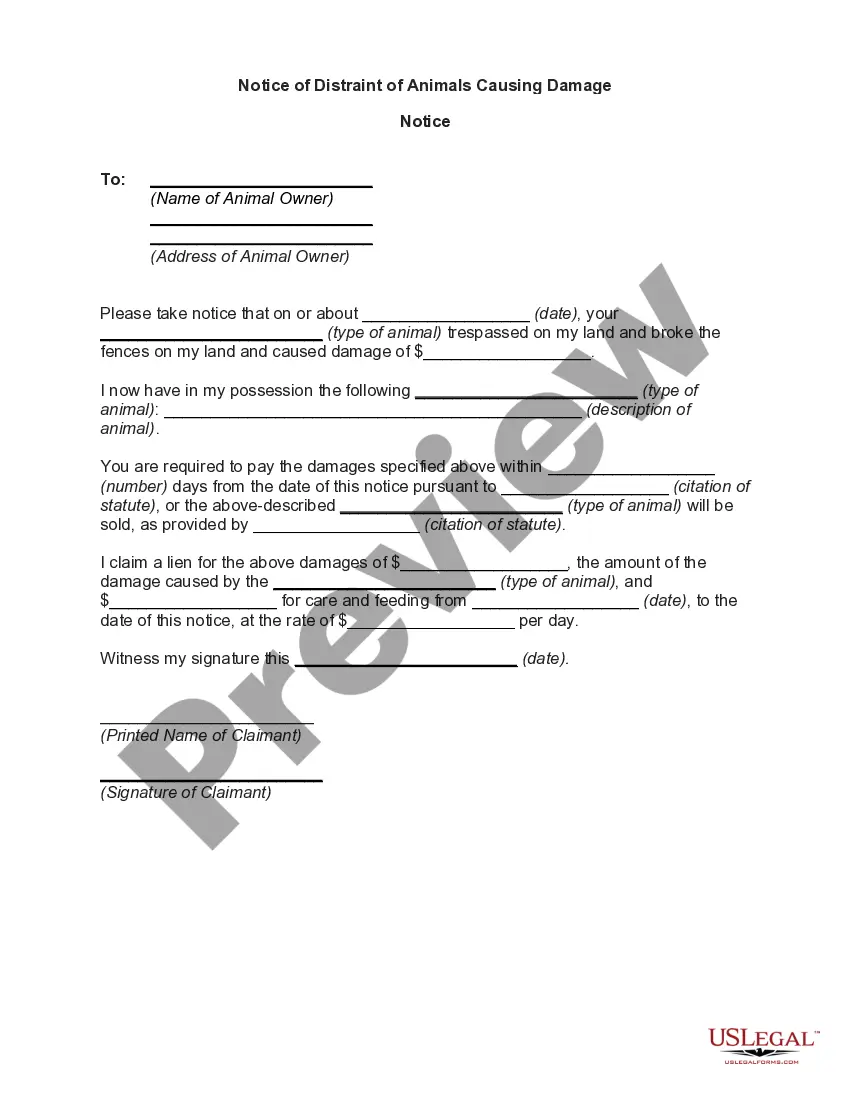

How to fill out Cook Illinois Transfer Under The Uniform Transfers To Minors Act - Multistate Form?

Whether you plan to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Cook Transfer under the Uniform Transfers to Minors Act - Multistate Form is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Cook Transfer under the Uniform Transfers to Minors Act - Multistate Form. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cook Transfer under the Uniform Transfers to Minors Act - Multistate Form in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!