The Middlesex Massachusetts Transfer under the Uniform Transfers to Minors Act — Multistate Form is a legal document that facilitates the transfer of assets and property to a minor in the Middlesex County of Massachusetts. This form is designed to comply with the Uniform Transfers to Minors Act (TMA), which is a set of laws implemented by multiple states to protect the interests of minors and simplify the transfer process. This transfer form is applicable to residents of Middlesex County, Massachusetts, who wish to establish a custodial account for a minor. By utilizing the Multistate Form, residents can ensure compatibility with other states that have adopted the TMA. This is particularly important if the minor resides or is likely to reside in a different state in the future. Some key aspects that are covered in the Middlesex Massachusetts Transfer under the Uniform Transfers to Minors Act — Multistate Form include: 1. Identification: The form requires detailed identification information for both the transferor (person making the transfer) and the minor. This includes full name, address, date of birth, and Social Security number. 2. Description of Assets: The transferor must provide a comprehensive list of the assets being transferred to the minor. This can include real estate, bank accounts, securities, stocks, bonds, or any other valuable property. 3. Appointment of Custodian: The form allows the transferor to appoint a custodian to manage the assets on behalf of the minor until they reach the age of majority (18 or 21 years, depending on state-specific laws). The custodian is responsible for making investment decisions and managing the assets prudently. 4. Successor Custodian: In case the originally appointed custodian is unable or unwilling to fulfill their duties, the form permits the transferor to designate a successor custodian. This ensures a smooth transition of custodial responsibilities if necessary. It is worth noting that there may be various versions or variations of the Middlesex Massachusetts Transfer under the Uniform Transfers to Minors Act — Multistate Form. These could include updated editions, versions tailored specifically for different states within Middlesex County, or variations specific to certain types of assets. To ensure accuracy and compliance with the relevant regulations, it is recommended to consult an attorney or legal expert who is well-versed in the TMA and familiar with the specific requirements in Middlesex County.

Middlesex Massachusetts Transfer under the Uniform Transfers to Minors Act - Multistate Form

Description

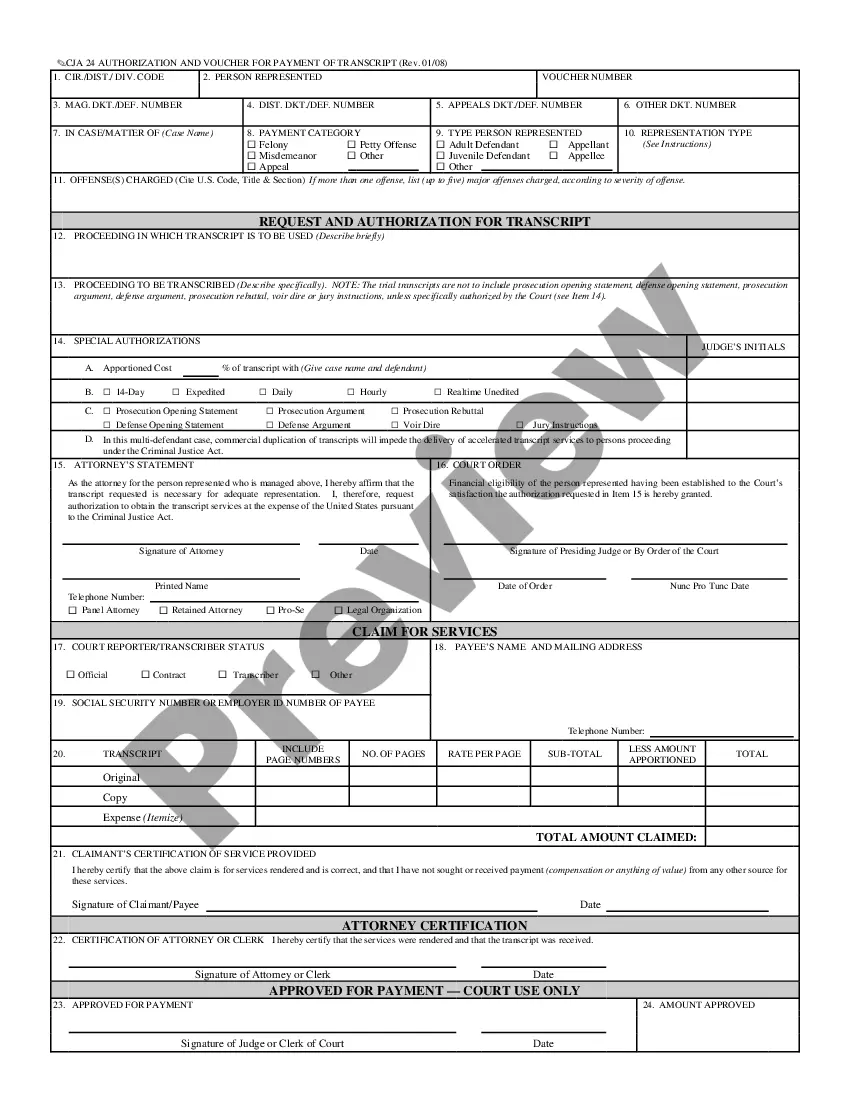

How to fill out Middlesex Massachusetts Transfer Under The Uniform Transfers To Minors Act - Multistate Form?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Middlesex Transfer under the Uniform Transfers to Minors Act - Multistate Form, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Middlesex Transfer under the Uniform Transfers to Minors Act - Multistate Form from the My Forms tab.

For new users, it's necessary to make several more steps to get the Middlesex Transfer under the Uniform Transfers to Minors Act - Multistate Form:

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

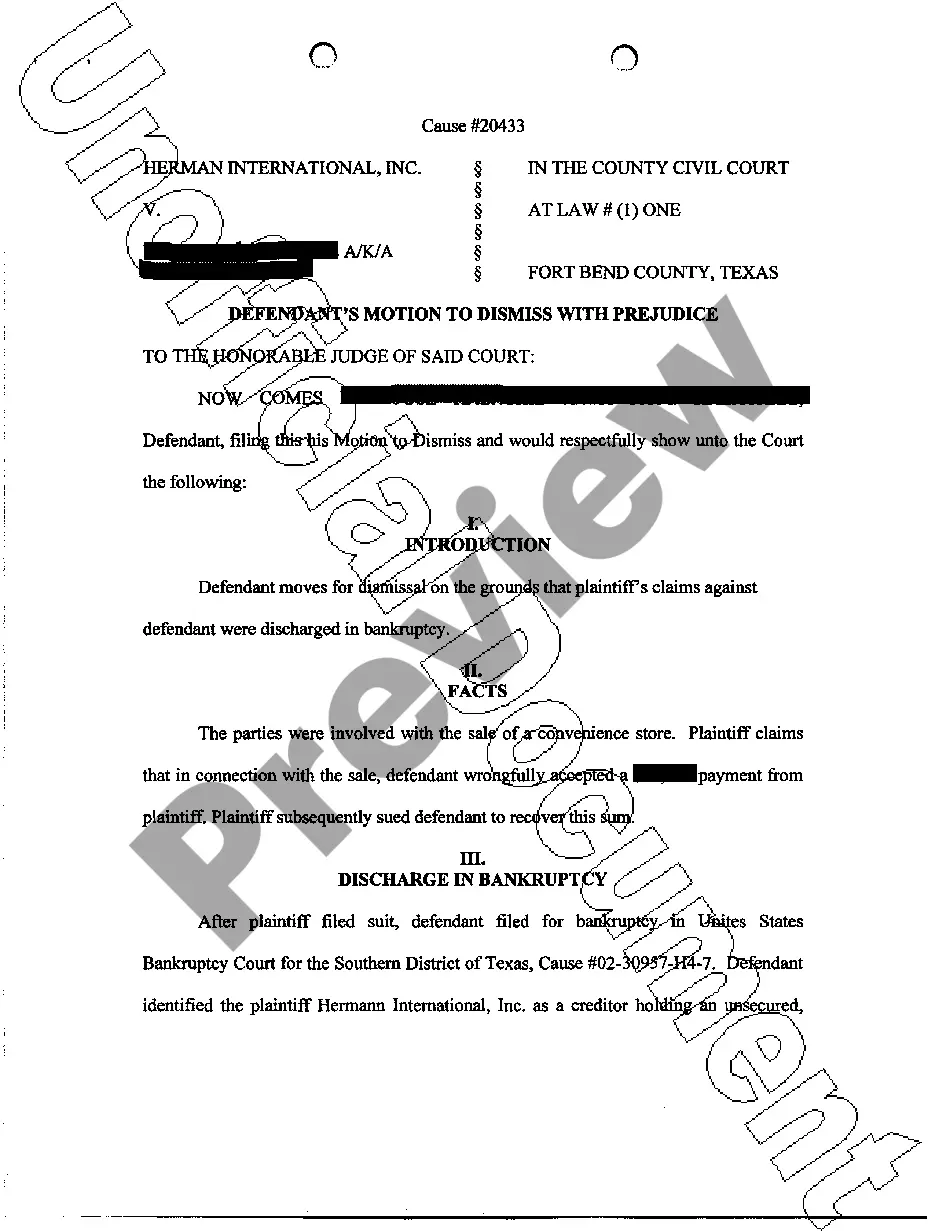

The Uniform Gifts to Minors Act (UGMA) allows money and financial securities to be transferred to minors through a UGMA account and is allowed in all states. UGMA allows the property to be gifted to a minor without establishing a formal trust.

Converting an UTMA Account You may be able to move money from an UTMA account to a Roth IRA by first selling your UTMA mutual fund, withdrawing the proceeds from the account, contributing it to the Roth account, and purchasing shares of a mutual fund.

The Uniform Transfers To Minors Act (UTMA) is a uniform act drafted and recommended by the National Conference of Commissioners on Uniform State Laws in 1986, and subsequently enacted by most U.S. States, which provides a mechanism under which gifts can be made to a minor without requiring the presence of an appointed

The most common trust for a minor is known as a custodial account (an UGMA or UTMA account). The Uniform Gift to Minors Act (UGMA) established a simple way for a minor to own securities without requiring the services of an attorney to prepare trust documents or the court appointment of a trustee.

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child'susually lowertax rate, rather than the parent's rate. For some families, this savings can be significant. Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate.

The Uniform Transfers to Minors Act (UTMA) allows gift givers to transfer money or other gifts like real estate or fine art to a minor child without the need for a guardian or trustee.

The Uniform Transfers to Minors Act (UTMA) allows a minor to receive gifts without the aid of a guardian or trustee. The law is an extension of the Uniform Gift to Minors Act. The minor named in the UTMA can avoid tax consequences until they attain legal age for the state in which the account is set up.

UGMA/UTMA account assets can be transferred into a new account established by the now adult beneficiary as a sole or joint owner. To get an account application, contact your financial professional or find one by using our financial professional locator. For additional assistance, contact us.

When children reach the age of majority, the account can be transferred into their name only with custodian consent. Otherwise, they can remove the custodian from the account at the age of termination. Ask your brokerage firm what ages apply to your son's accounts and the steps you need to take at each point.

What Happens to an UTMA When a Child Turns 21? When the child beneficiary of a custodial account reaches the age of majority in your state, everything in the account will pass onto them.