Hennepin Minnesota Triple Net Lease: A Comprehensive Overview Introduction: A Hennepin Minnesota Triple Net Lease is a legal agreement typically used in commercial real estate transactions. It is crucial for landlords, tenants, and investors to understand the intricacies of this lease type to make informed decisions. This detailed description will cover the essentials of a Hennepin Minnesota Triple Net Lease, including its definition, structure, benefits, and different types. Definition and Structure: A Hennepin Minnesota Triple Net Lease, also known as an NNN lease, is a lease agreement in which the tenant is responsible for covering not only the base rent but also the property's operating expenses, including property taxes, insurance, and maintenance costs. This lease structure significantly shifts the financial burden from the landlord to the tenant. Key Features and Benefits: 1. Enhanced predictability for landlords: With a Hennepin Minnesota Triple Net Lease, property owners receive a consistent stream of rental income while minimizing their involvement in day-to-day property operations and expenses. 2. Cost control for tenants: Renters benefit from enhanced control over their expenditure, as they have direct responsibility for property-related expenses. This arrangement allows tenants to better plan and predict their total occupancy costs. 3. Attractive investment opportunities: The stability and predictability provided by Hennepin Minnesota Triple Net Leases make them appealing for real estate investors seeking steady cash flow and reduced management responsibilities. Different Types of Hennepin Minnesota Triple Net Lease: 1. Single Tenant Triple Net Lease (SNL): In an SNL, a single tenant leases an entire property and is responsible for all related expenses, including taxes, insurance, and maintenance costs. Still often involve national or regional companies and are commonly used for retail spaces, office buildings, or industrial properties. 2. Multi-Tenant Triple Net Lease: A multi-tenant NNN lease involves multiple tenants within the same property, where each tenant is individually responsible for their share of operating expenses. This type is frequently seen in shopping centers or commercial buildings with multiple units or spaces. 3. Ground Lease: A ground lease is a specific type of Hennepin Minnesota Triple Net Lease that primarily applies to land. The tenant is responsible for the land's usage, taxes, and maintenance, while the landlord retains ownership of any buildings or improvements on the property. Conclusion: A Hennepin Minnesota Triple Net Lease is an essential aspect of commercial real estate transactions that offers distinct advantages for both landlords and tenants. Landlords can enjoy a predictable income stream while minimizing expenses, while tenants can maintain cost control and plan accordingly. Understanding the different types, such as single tenant, multi-tenant, and ground leases, allows interested parties to select the most suitable option based on their specific needs and investment goals.

Hennepin Minnesota Triple Net Lease

Description

How to fill out Hennepin Minnesota Triple Net Lease?

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life sphere, finding a Hennepin Triple Net Lease meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Apart from the Hennepin Triple Net Lease, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Hennepin Triple Net Lease:

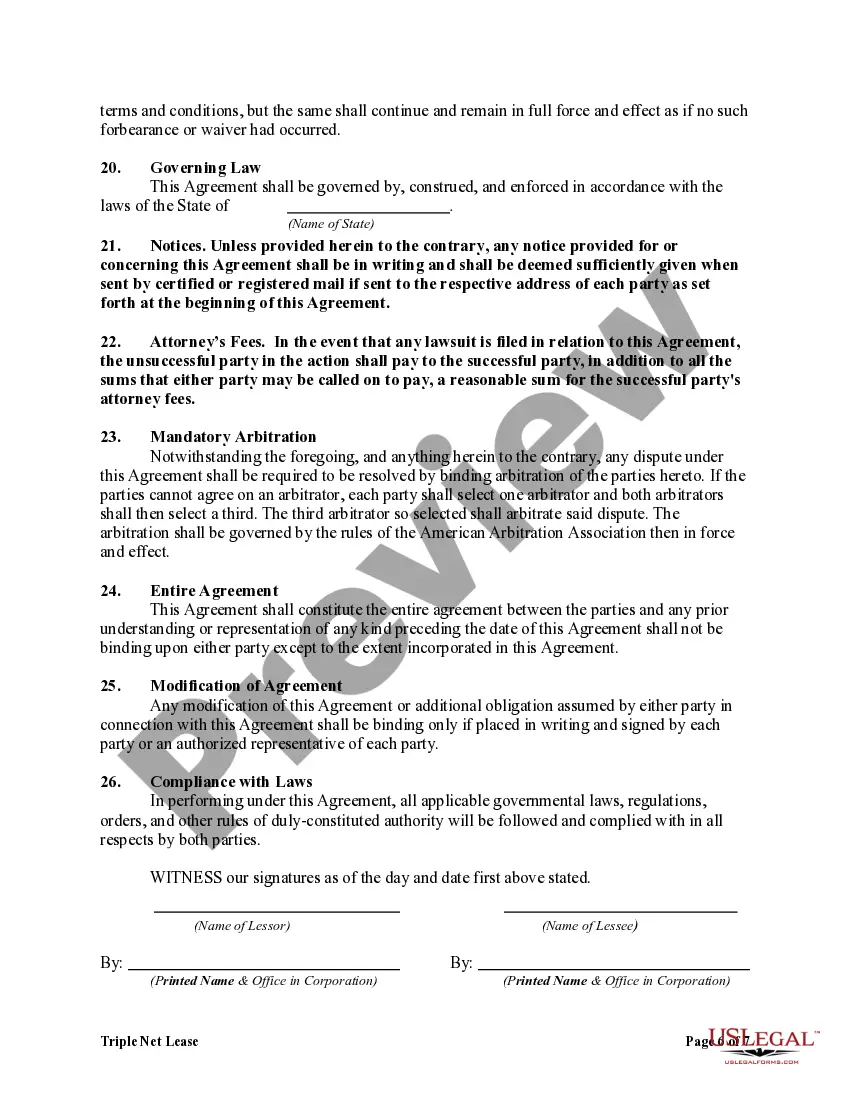

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Hennepin Triple Net Lease.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!