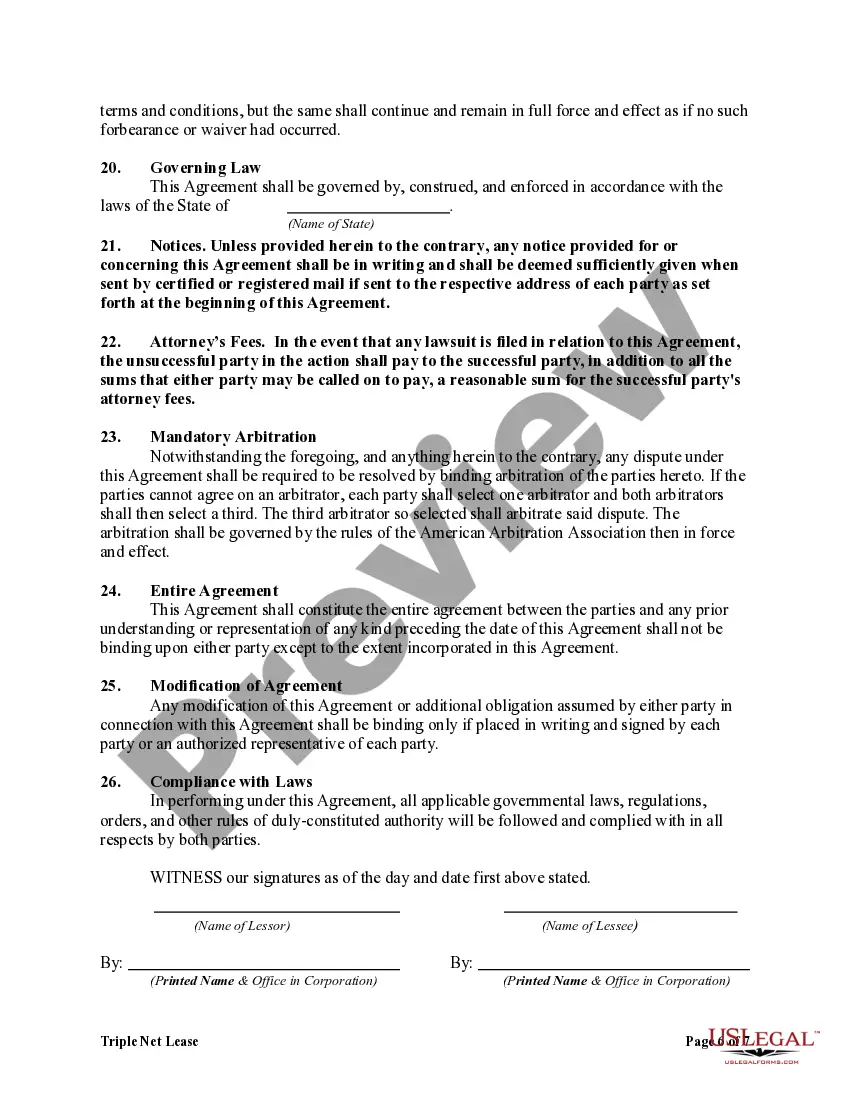

Santa Clara California Triple Net Lease

Description

How to fill out Santa Clara California Triple Net Lease?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Santa Clara Triple Net Lease, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different types varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find information resources and tutorials on the website to make any tasks related to paperwork execution simple.

Here's how to find and download Santa Clara Triple Net Lease.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the validity of some documents.

- Examine the similar document templates or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and purchase Santa Clara Triple Net Lease.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Santa Clara Triple Net Lease, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you have to cope with an exceptionally difficult case, we advise getting a lawyer to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-compliant documents with ease!

Form popularity

FAQ

Calculating a Triple Net Lease Triple net leases are calculated by adding the yearly taxes on the property and the insurance for the space together and dividing that amount by the building total rental square footage.

Example: $15/SF In most cases (at least on the east coast of the US) this means you will pay $15.00 per square foot per year. Example: $15 per square foot for 1200 square foot would be calculated $15.00 X 1200 = $18,000 for the year or ($15.00 X 1200)/12 = $1,500 per month.

Example of Calculating Monthly Rent in a NNN Lease Let's say an office building has a quoted rate of $30 NNN. This means that the rent is $30 per square foot per year PLUS the NNN. The estimated operating expenses (aka NNN) are $10 per square foot per year. The total yearly rent you would pay equals $40 sf per year.

Triple Net Lease Expenses The tenant in a triple net lease pays for all three categories of expenses on top of his base rent, as well as his own personal insurance premiums, utilities, and for things such as janitorial services.

Cons of a Triple Net Lease-Tenants Tax Liabilities: Because the tenant is responsible for annual property taxes in a triple net lease, this also means that they will be prone to all the liabilities of taxes as well, including fines and penalties for late or incorrect tax remittance.

A triple net lease (triple-net or NNN) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance.

Cons of a Triple Net Lease-Tenants Tax Liabilities: Because the tenant is responsible for annual property taxes in a triple net lease, this also means that they will be prone to all the liabilities of taxes as well, including fines and penalties for late or incorrect tax remittance.

NNN Properties in California are an excellent investment option. They offer greater cash flow, appreciation potential, and diversification. If you're looking for a safe investment that will pay off over time then it's definitely worth considering NNN properties in California!