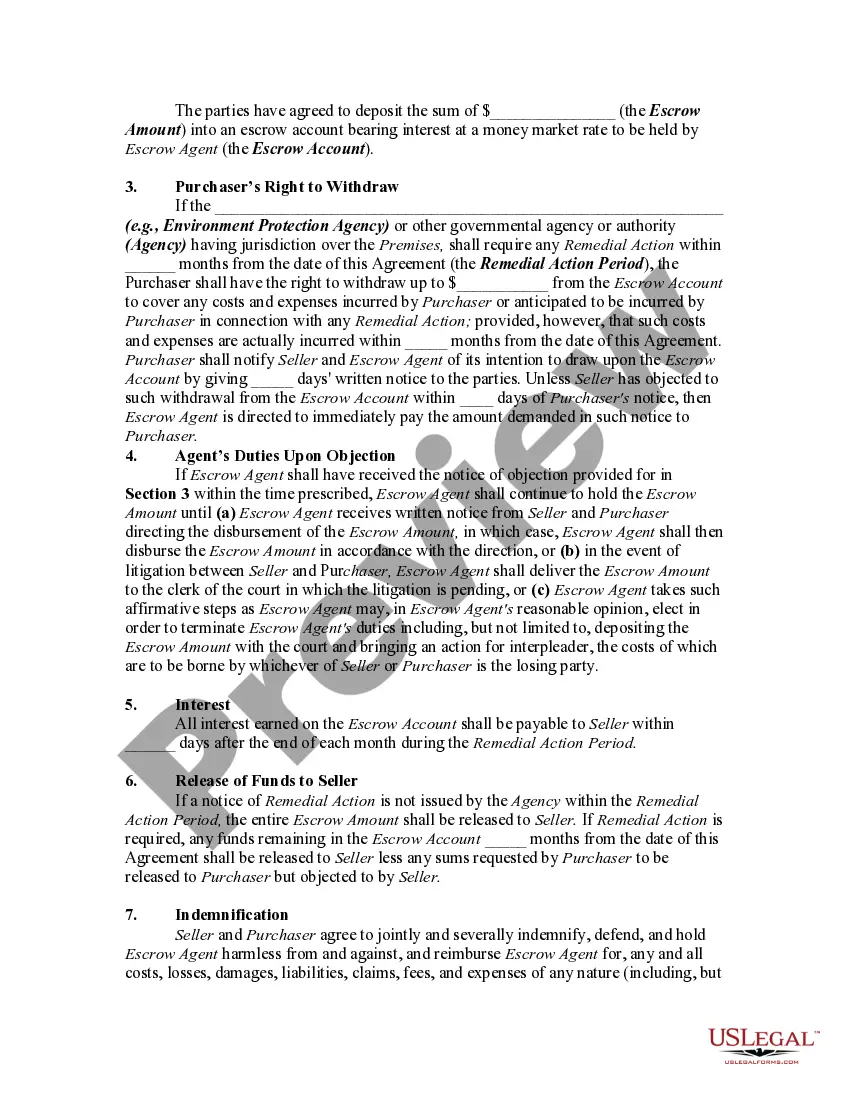

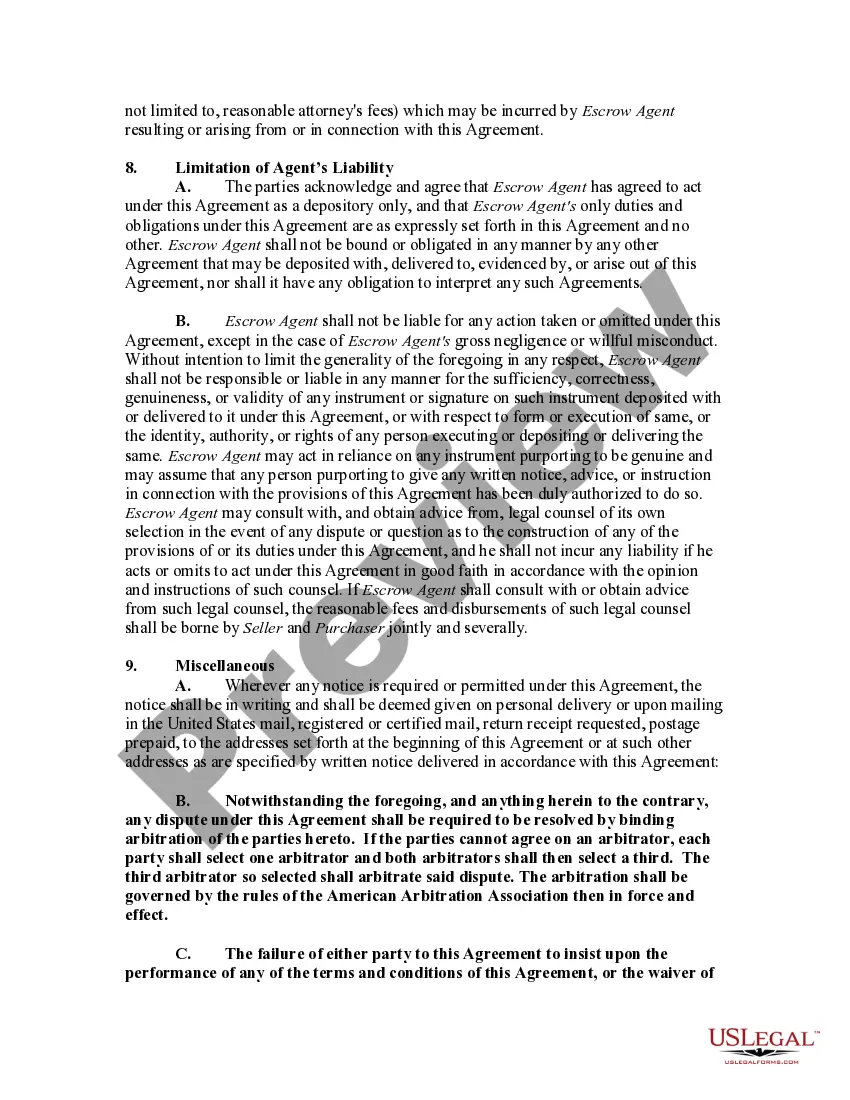

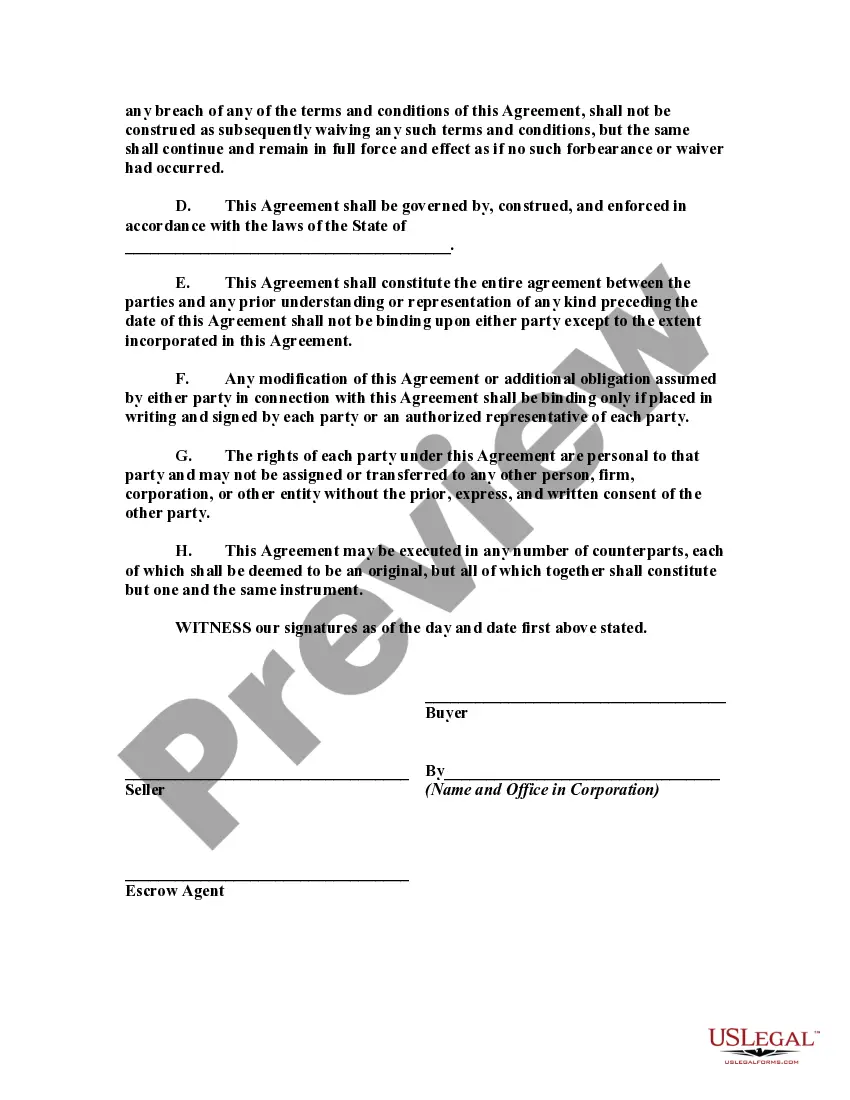

An escrow is the deposit of a written instrument or something of value with a third person with instructions to deliver it to another when a stated condition is performed or a specified event occurs. The use of an escrow in this form is to protect the purchaser of real property from having to pay for a possible defect in the real property after the sale has been made.

San Diego California Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action is a legal document that facilitates the smooth and secure transfer of real estate ownership in San Diego, California. This agreement outlines the terms and conditions under which the sale of the property will take place, ensuring that both the buyer and seller are protected throughout the transaction. The main purpose of this escrow agreement is to safeguard the purchaser against potential financial risks associated with any required remedial actions needed on the property. By depositing a specific amount into an escrow account, the buyer ensures that funds are readily available for remediation, should any unforeseen issues arise after the sale is finalized. This type of escrow agreement is crucial in protecting the buyer's interests, as it ensures that they will not be burdened with substantial costs related to remedial actions, such as repairs, cleanup, or compliance with regulatory requirements. The seller, on the other hand, is shielded from potential legal liabilities and disputes that may arise from these remedial actions, as the agreement clearly defines their responsibilities and obligations. There may be different types of San Diego California Escrow Agreements for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action, depending on the specific terms and conditions agreed upon by both parties. Some key variations may include: 1. General Escrow Agreement: This standard agreement covers the fundamental aspects of the sale and deposit protection, ensuring that all necessary precautions are taken to secure the purchaser against potential costs of remedial action. 2. Contingency-based Escrow Agreement: In some cases, the buyer may require specific contingencies to be met before proceeding with the sale. These contingencies could include satisfactory inspections, surveys, or environmental assessments. This type of agreement outlines the conditions under which the deposit will be released or forfeited based on the results of such contingencies. 3. Specialized Remedial Action Escrow Agreement: In situations where the property being sold has known or potential issues that may require significant remedial action, a specialized agreement may be drafted to address these specific concerns. This agreement would typically entail additional provisions to protect the purchaser and seller from unexpected financial burdens related to the particular types of remediation needed. Overall, the San Diego California Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action ensures a fair and transparent real estate transaction for both parties involved. It provides peace of mind, financial security, and legal protection to both the buyer and the seller, minimizing the risks associated with potential property issues and costly remedial actions.San Diego California Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action is a legal document that facilitates the smooth and secure transfer of real estate ownership in San Diego, California. This agreement outlines the terms and conditions under which the sale of the property will take place, ensuring that both the buyer and seller are protected throughout the transaction. The main purpose of this escrow agreement is to safeguard the purchaser against potential financial risks associated with any required remedial actions needed on the property. By depositing a specific amount into an escrow account, the buyer ensures that funds are readily available for remediation, should any unforeseen issues arise after the sale is finalized. This type of escrow agreement is crucial in protecting the buyer's interests, as it ensures that they will not be burdened with substantial costs related to remedial actions, such as repairs, cleanup, or compliance with regulatory requirements. The seller, on the other hand, is shielded from potential legal liabilities and disputes that may arise from these remedial actions, as the agreement clearly defines their responsibilities and obligations. There may be different types of San Diego California Escrow Agreements for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action, depending on the specific terms and conditions agreed upon by both parties. Some key variations may include: 1. General Escrow Agreement: This standard agreement covers the fundamental aspects of the sale and deposit protection, ensuring that all necessary precautions are taken to secure the purchaser against potential costs of remedial action. 2. Contingency-based Escrow Agreement: In some cases, the buyer may require specific contingencies to be met before proceeding with the sale. These contingencies could include satisfactory inspections, surveys, or environmental assessments. This type of agreement outlines the conditions under which the deposit will be released or forfeited based on the results of such contingencies. 3. Specialized Remedial Action Escrow Agreement: In situations where the property being sold has known or potential issues that may require significant remedial action, a specialized agreement may be drafted to address these specific concerns. This agreement would typically entail additional provisions to protect the purchaser and seller from unexpected financial burdens related to the particular types of remediation needed. Overall, the San Diego California Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action ensures a fair and transparent real estate transaction for both parties involved. It provides peace of mind, financial security, and legal protection to both the buyer and the seller, minimizing the risks associated with potential property issues and costly remedial actions.