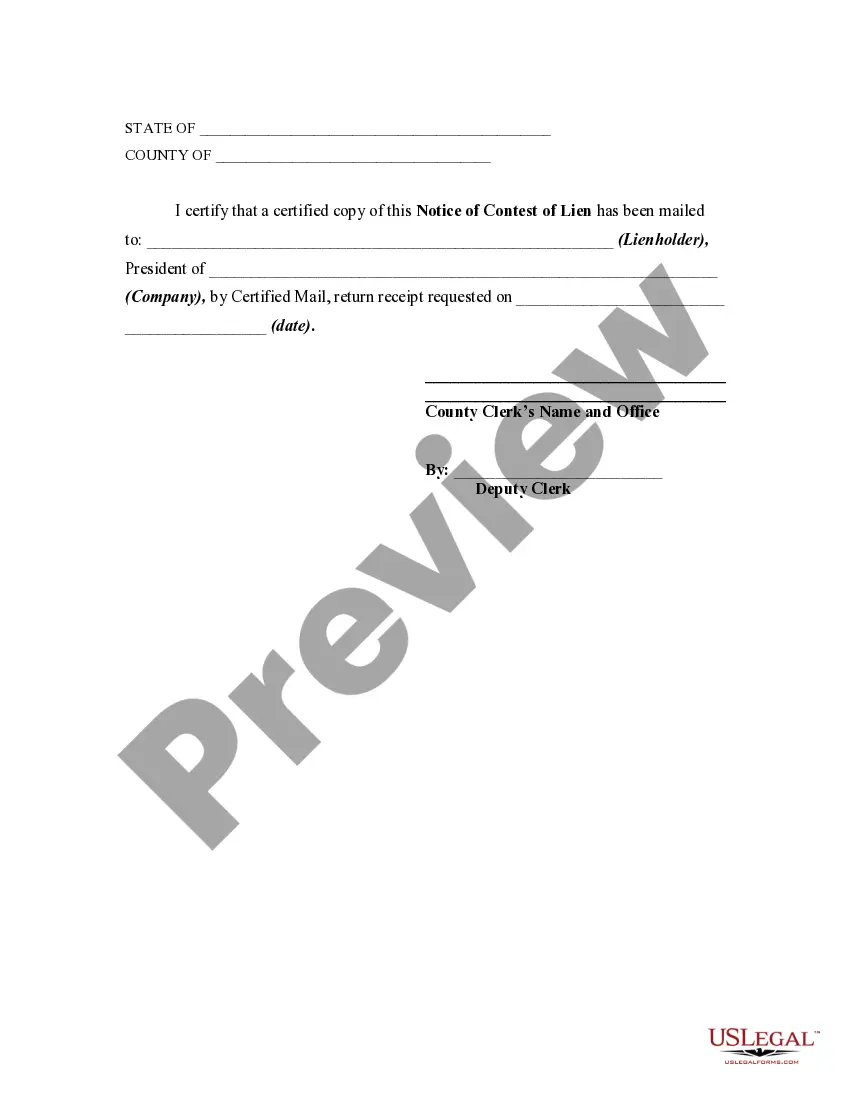

This form is a sample of a notice contesting a lien that has been recorded in the office of the appropriate county official.This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cook County, located in the state of Illinois, allows property owners to file a Notice of Contest of Lien to dispute the validity of a lien placed on their property. This legal document serves as a means for property owners to protect their rights and contest any unjust liens that may have been imposed on their property. A Notice of Contest of Lien is typically filed when a property owner believes that a lien placed on their property is invalid, incorrect, or unjustified. It is crucial to remember that a lien is a legal claim against a property that serves as a security interest for the payment of a debt. However, false or erroneous liens can cause significant problems for property owners, potentially impacting their ability to sell or refinance the property. In Cook County, there are different types of Notice of Contest of Lien that can be filed, each serving a specific purpose. These include: 1. Notice of Contest of Mechanics Lien: This type of notice is filed when the property owner disputes a mechanics lien placed on their property by a contractor or subcontractor. Property owners may argue that the work was not properly completed, the charges are incorrect, or the lien was not timely filed. 2. Notice of Contest of Property Tax Lien: This notice is filed when a property owner wants to challenge a tax lien on their property. Reasons for contesting may include errors in tax assessment, incorrect tax delinquency notifications, or disputes over the ownership or value of the property. 3. Notice of Contest of Judgment Lien: If a property owner believes that a judgment lien placed on their property is wrongful or fraudulent, they can file this notice to challenge its validity. This could be due to errors in the judgment, improper service, or lack of proper legal procedures. The process of filing a Notice of Contest of Lien in Cook County involves several steps. Property owners must carefully review the lien document they received and consult with an attorney specializing in real estate or property law to assess the validity of the lien. If they determine that the lien is unjust, they can proceed with filing the notice in the appropriate court within a prescribed timeframe. It is essential to strictly adhere to the filing requirements and deadlines to effectively contest the lien. Once the Notice of Contest of Lien is filed, the court will notify all interested parties, including the lien holder, about the contestation. A hearing will then be scheduled, where both parties will have the opportunity to present their arguments and evidence. The court will make a final determination on the validity of the lien based on the evidence presented and applicable laws. In conclusion, the Notice of Contest of Lien is a legal document that property owners in Cook County, Illinois, can utilize to challenge the validity of liens on their properties. This process ensures that property owners have a fair chance to protect their rights and rectify any unjust liens that may hinder their property's value or sale. By filing a Notice of Contest of Lien, property owners can navigate the legal system to resolve disputes and assert their property rights effectively.