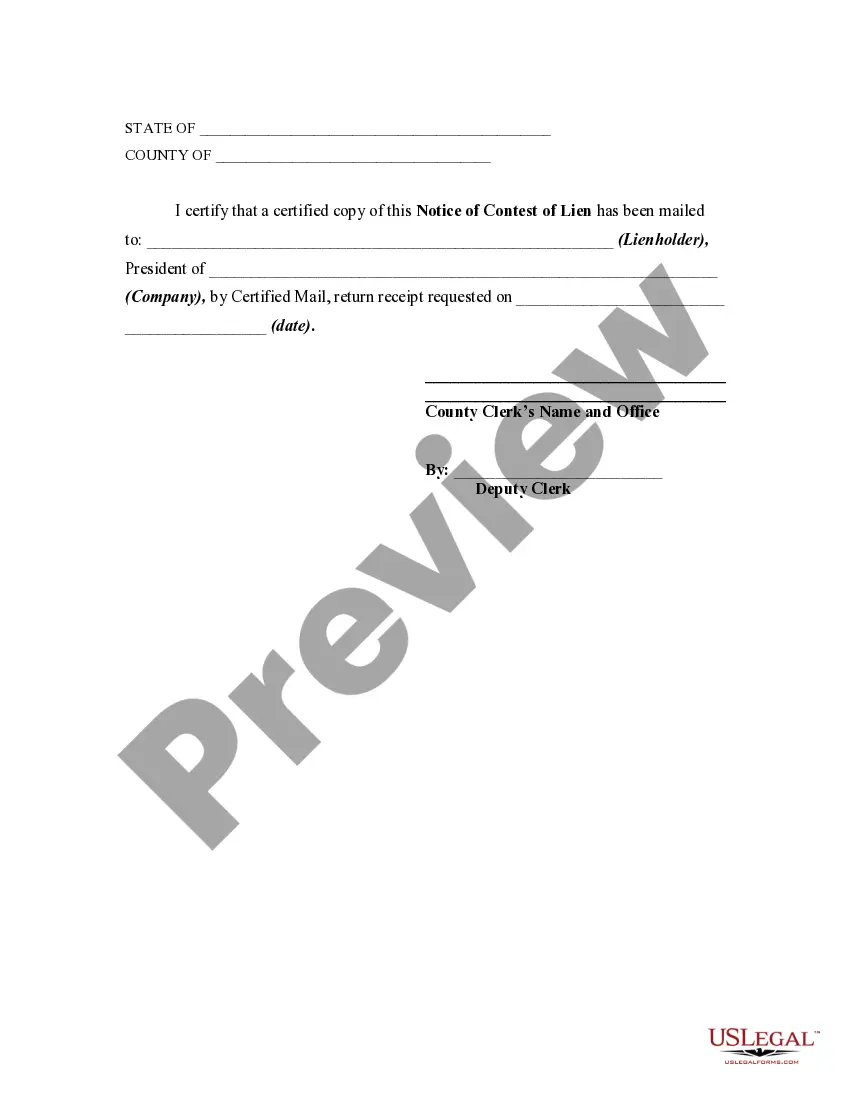

This form is a sample of a notice contesting a lien that has been recorded in the office of the appropriate county official.This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The San Bernardino California Notice of Contest of Lien is a legal document that allows property owners or interested parties to contest a lien recorded against their property. A lien is a legal claim usually placed by a creditor or contractor to ensure payment for services rendered or debts owed. When a property owner receives a Notice of Lien, they may believe that the lien has been filed in error, that the amount claimed is inaccurate, or that they have already satisfied the debt. In these cases, the property owner may choose to file a Notice of Contest of Lien in order to challenge the validity of the lien. By filing the Notice of Contest of Lien, the property owner is essentially notifying the lien holder that they dispute the claim and are seeking to have the lien removed or modified. This document initiates a legal process wherein the lien holder must prove the validity and amount of the lien, or else release it. There are different types of Notice of Contest of Lien in San Bernardino, California, depending on the circumstances of the lien. Some common types include: 1. Notice of Contest of Mechanic's Lien: This type of Notice is filed when the lien in question is related to construction or improvements made to the property. It allows the property owner to contest the lien and request proof of the work performed and the amount claimed. 2. Notice of Contest of Judgment Lien: If a judgment lien has been recorded against the property due to a court judgment, the property owner may file this Notice to contest the validity of the judgment or question the accuracy of the amount claimed. 3. Notice of Contest of Tax Lien: In cases where a tax lien has been placed on the property by the government entity, the property owner can file this Notice to challenge the tax assessment or dispute the amount owed. Filing a Notice of Contest of Lien is a crucial step for property owners in protecting their interests and ensuring the accuracy of the liens placed against their property. It initiates a legal process that allows the property owner to contest the validity of the lien and request documentation, giving them the opportunity to resolve any disputes or discrepancies.The San Bernardino California Notice of Contest of Lien is a legal document that allows property owners or interested parties to contest a lien recorded against their property. A lien is a legal claim usually placed by a creditor or contractor to ensure payment for services rendered or debts owed. When a property owner receives a Notice of Lien, they may believe that the lien has been filed in error, that the amount claimed is inaccurate, or that they have already satisfied the debt. In these cases, the property owner may choose to file a Notice of Contest of Lien in order to challenge the validity of the lien. By filing the Notice of Contest of Lien, the property owner is essentially notifying the lien holder that they dispute the claim and are seeking to have the lien removed or modified. This document initiates a legal process wherein the lien holder must prove the validity and amount of the lien, or else release it. There are different types of Notice of Contest of Lien in San Bernardino, California, depending on the circumstances of the lien. Some common types include: 1. Notice of Contest of Mechanic's Lien: This type of Notice is filed when the lien in question is related to construction or improvements made to the property. It allows the property owner to contest the lien and request proof of the work performed and the amount claimed. 2. Notice of Contest of Judgment Lien: If a judgment lien has been recorded against the property due to a court judgment, the property owner may file this Notice to contest the validity of the judgment or question the accuracy of the amount claimed. 3. Notice of Contest of Tax Lien: In cases where a tax lien has been placed on the property by the government entity, the property owner can file this Notice to challenge the tax assessment or dispute the amount owed. Filing a Notice of Contest of Lien is a crucial step for property owners in protecting their interests and ensuring the accuracy of the liens placed against their property. It initiates a legal process that allows the property owner to contest the validity of the lien and request documentation, giving them the opportunity to resolve any disputes or discrepancies.