Different liens on the same property usually have priorities according to the time of their creation. To achieve the subordination of a prior lien, there must be an actual agreement to that effect.

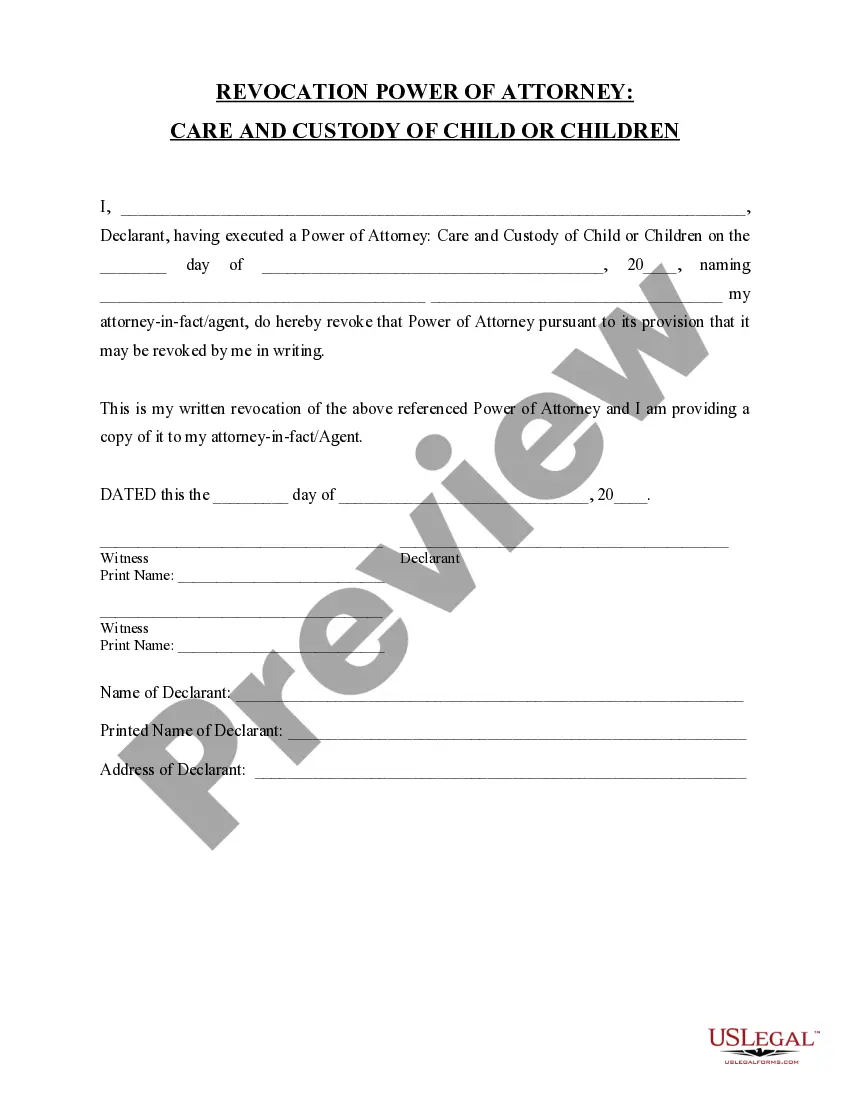

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oakland, Michigan Agreement to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien is a legal document that outlines the terms and conditions for a subordination agreement between a lien holder and a lender providing credit to the owner of a property that is already subject to a lien. This agreement is crucial in situations where a property owner needs additional financing but has an existing lien that takes priority over new debt. Keywords: Oakland, Michigan, agreement, subordinate lien, lien holder, lender, extending credit, owner of property, subject to lien. Types of Oakland, Michigan Agreements to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien: 1. First Lien Subordination Agreement: This type of agreement is used when the lien holder and lender agree to modify the priority of their respective liens. The lien holder agrees to subordinate their lien to the lender's lien, allowing the lender's lien to take priority. 2. Second Lien Subordination Agreement: In this scenario, the lien holder and lender agree to modify the priority of their liens, but the lien holder's lien still retains its priority over the lender's lien. This type of agreement is typical when the lien holder is not willing to completely subordinate their lien. 3. Partial Subordination Agreement: This type of agreement allows for the modification of lien priority on a specific portion or portion(s) of the property. For example, the lien holder may agree to subordinate their lien on a specific portion of the property to facilitate new financing. 4. Temporary Subordination Agreement: This agreement is used when the lien holder agrees to temporarily subordinate their lien to the lender's lien for a specific period or until certain conditions are met. This allows the property owner to obtain immediate financing, and once the agreed-upon conditions are fulfilled, the lien priority is restored. Each type of agreement serves specific purposes and safeguards the interests of the lien holder, lender, and property owner in different ways. It is essential for all parties involved to carefully review and understand the terms and implications of the agreement before signing to ensure a clear and legally binding arrangement.Oakland, Michigan Agreement to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien is a legal document that outlines the terms and conditions for a subordination agreement between a lien holder and a lender providing credit to the owner of a property that is already subject to a lien. This agreement is crucial in situations where a property owner needs additional financing but has an existing lien that takes priority over new debt. Keywords: Oakland, Michigan, agreement, subordinate lien, lien holder, lender, extending credit, owner of property, subject to lien. Types of Oakland, Michigan Agreements to Subordinate Lien Between Lien holder and Lender Extending Credit to Owner of Property Subject to Lien: 1. First Lien Subordination Agreement: This type of agreement is used when the lien holder and lender agree to modify the priority of their respective liens. The lien holder agrees to subordinate their lien to the lender's lien, allowing the lender's lien to take priority. 2. Second Lien Subordination Agreement: In this scenario, the lien holder and lender agree to modify the priority of their liens, but the lien holder's lien still retains its priority over the lender's lien. This type of agreement is typical when the lien holder is not willing to completely subordinate their lien. 3. Partial Subordination Agreement: This type of agreement allows for the modification of lien priority on a specific portion or portion(s) of the property. For example, the lien holder may agree to subordinate their lien on a specific portion of the property to facilitate new financing. 4. Temporary Subordination Agreement: This agreement is used when the lien holder agrees to temporarily subordinate their lien to the lender's lien for a specific period or until certain conditions are met. This allows the property owner to obtain immediate financing, and once the agreed-upon conditions are fulfilled, the lien priority is restored. Each type of agreement serves specific purposes and safeguards the interests of the lien holder, lender, and property owner in different ways. It is essential for all parties involved to carefully review and understand the terms and implications of the agreement before signing to ensure a clear and legally binding arrangement.