Alameda California Partial Assignment of Life Insurance Policy as Collateral: In Alameda, California, a partial assignment of a life insurance policy is a legal arrangement where a policyholder transfers a portion of the policy's death benefit to serve as collateral for a loan or debt. This type of arrangement allows individuals to leverage the cash value within their life insurance policies to obtain financing for various purposes. One common form of partial assignment of a life insurance policy as collateral is known as an "irrevocable assignment." Under this arrangement, the policyholder transfers the ownership of a specific percentage or amount of the policy's death benefit to a lender. The lender holds this assigned portion as security for the loan provided. It is important to note that once the assignment is made, the policyholder cannot modify or cancel it without the lender's consent. Another variant of the partial assignment of a life insurance policy as collateral in Alameda, California is a "reversible assignment." In this case, the policyholder maintains the ability to change or cancel the assignment at any time without requiring the lender's approval. This type of assignment provides more flexibility for the policyholder but may result in less favorable loan terms. By utilizing a partial assignment of a life insurance policy as collateral, Alameda residents can secure loans from lenders that may have stricter eligibility requirements or offer more favorable interest rates than traditional personal loans. This collateral assignment allows individuals to leverage the accumulated cash value in their life insurance policies and tap into the financial security they have built over time. When considering a partial assignment of a life insurance policy as collateral in Alameda, California, it is crucial to carefully review the terms and conditions set by the lender. Policyholders should assess the impact of the assignment on future policy benefits, such as potential reductions in the death benefit or growth of the cash value. Consulting with a financial advisor or an experienced insurance professional is highly advised to ensure informed decision-making and to explore alternative financing options. In conclusion, a partial assignment of a life insurance policy as collateral in Alameda, California, offers residents a valuable tool to access financing by using the built-up value of their policies. Whether through an irrevocable assignment or a reversible assignment, this arrangement can enable individuals to obtain loans while still retaining ownership of their insurance policies. Careful consideration and professional guidance are essential to make the most informed choices regarding such assignments.

Alameda California Partial Assignment of Life Insurance Policy as Collateral

Description

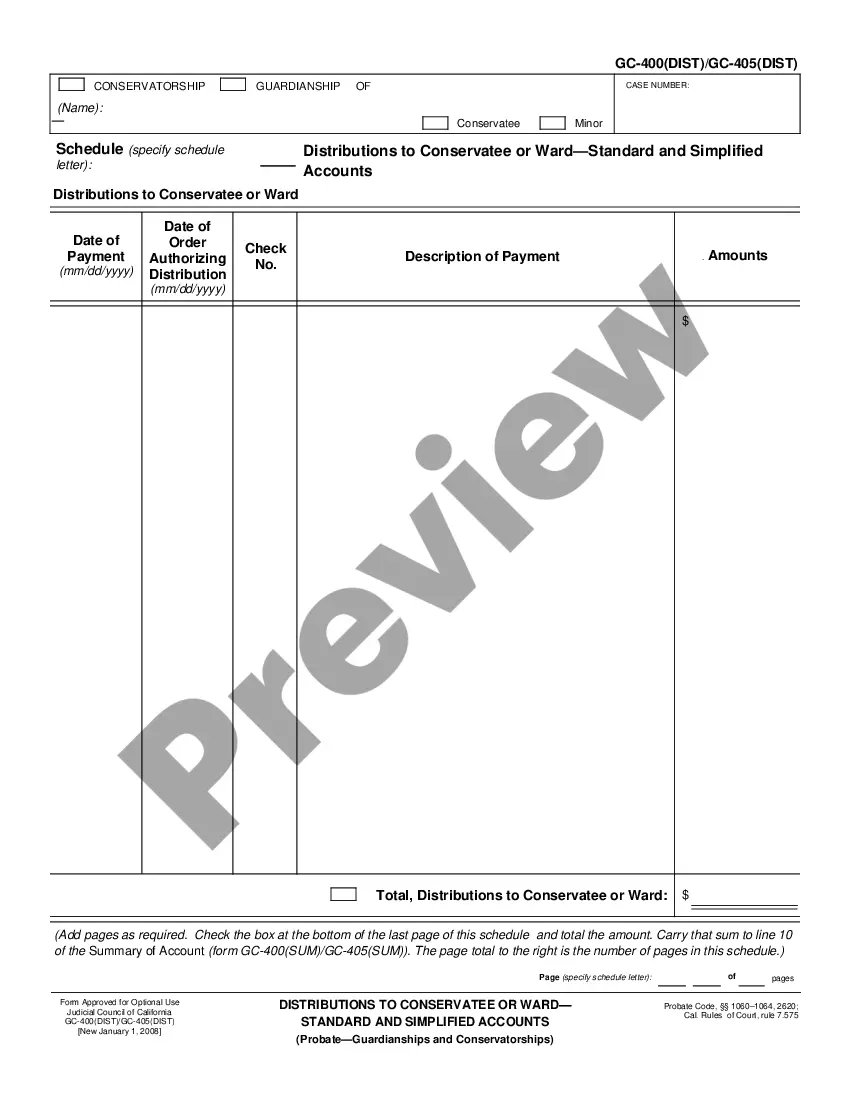

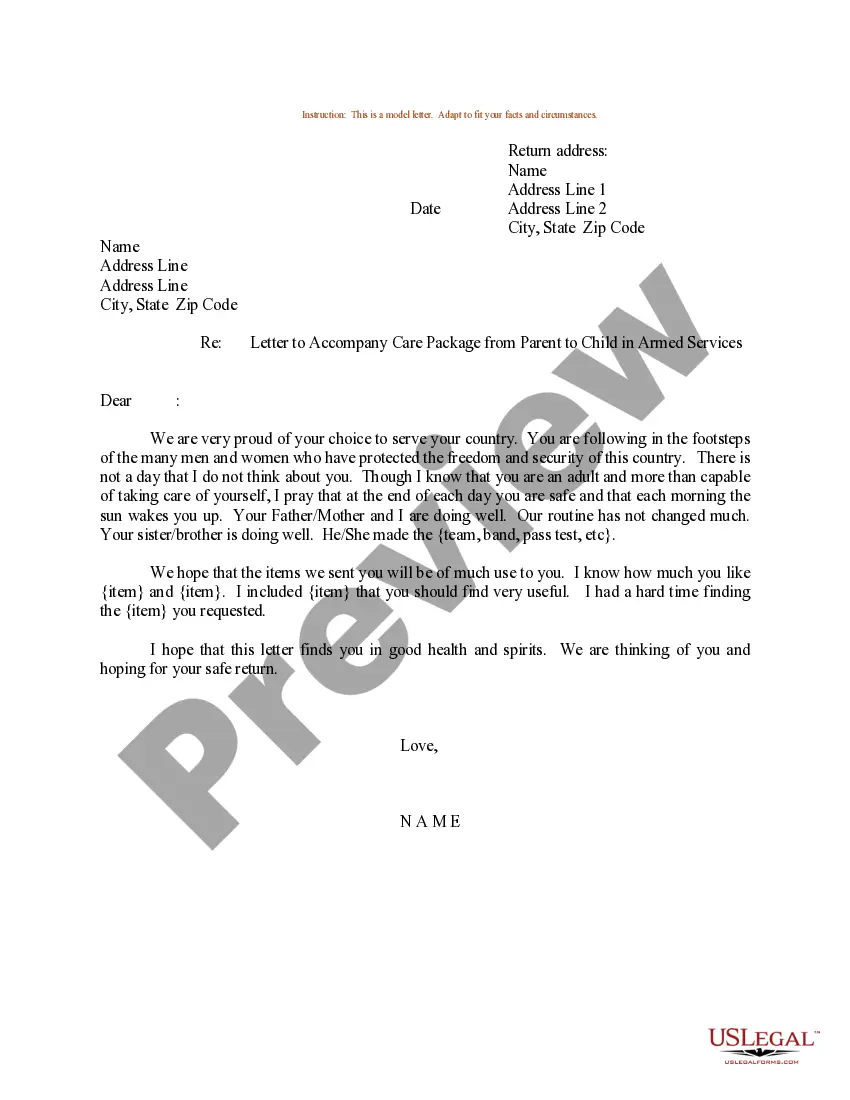

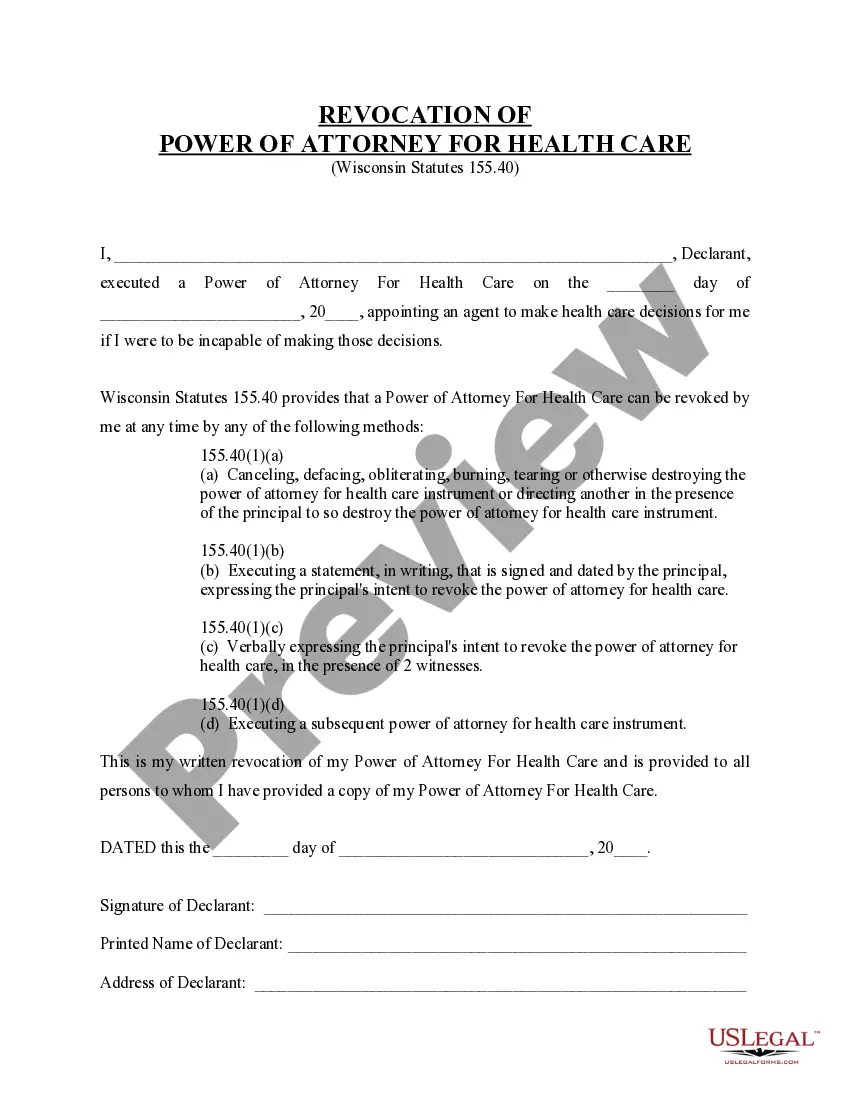

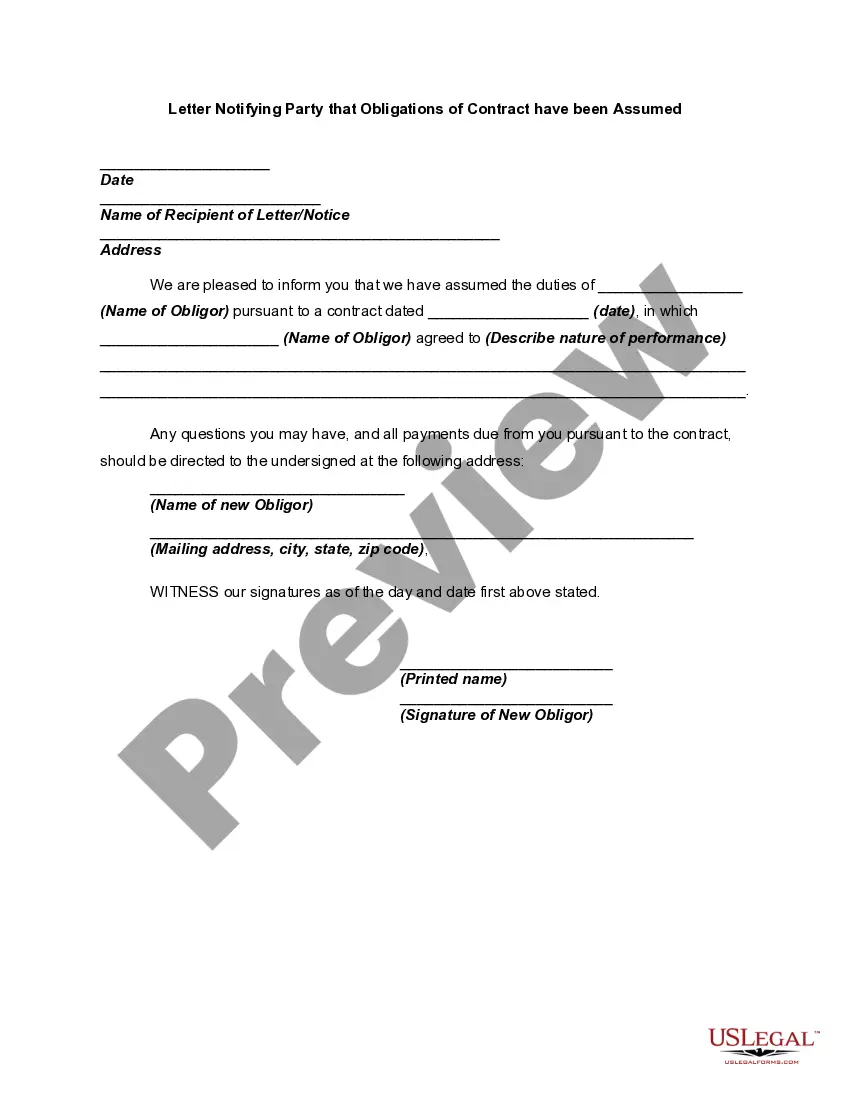

How to fill out Alameda California Partial Assignment Of Life Insurance Policy As Collateral?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Alameda Partial Assignment of Life Insurance Policy as Collateral, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information resources and tutorials on the website to make any activities associated with document execution straightforward.

Here's how to find and download Alameda Partial Assignment of Life Insurance Policy as Collateral.

- Take a look at the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the legality of some documents.

- Check the related forms or start the search over to locate the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment method, and buy Alameda Partial Assignment of Life Insurance Policy as Collateral.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Alameda Partial Assignment of Life Insurance Policy as Collateral, log in to your account, and download it. Needless to say, our platform can’t replace an attorney entirely. If you have to deal with an exceptionally challenging situation, we advise getting a lawyer to check your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant documents with ease!

Form popularity

FAQ

Any type of life insurance policy is acceptable for collateral assignment, provided the insurance company allows assignment for the policy. A permanent life insurance policy with a cash value allows the lender access to the cash value to use as loan payment if the borrower defaults.

A collateral assignment of life insurance is a conditional assignment appointing a lender as the primary beneficiary of a death benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the life insurance policy and recover what is owed.

By using life insurance as collateral, you might be able to take out a secured loan without putting your home or vehicle at risk. If you pass away before the loan is repaid, the lender will use funds available from your life insurance policy's death benefit to pay off the loan. It may be attractive to lenders.

200bWhat is meant by assigning? Interest in a life insurance policy can be transferred from the policyholder to a lender or relative by assignment of policy. Here the policyholder is known as the assignor and the person in whose favour the policy has been assigned is called assignee.

Most people purchase life insurance to protect their loved ones at the time of their death. By using a life insurance product as collateral, you can tap into its value while you're still living. You can use your plan as collateral for various types of loans, including mortgages or a business loan.

What types of life insurance can I use as collateral for a loan? Any type of life insurance policy can be used to secure a loan. This includes term, traditional whole life, universal life and variable universal life, according to the Insurance Information Institute.

Collateral assignment of life insurance lets you use a life insurance policy as an asset to secure a loan. If you die while the policy is in place and still owe money on the loan, the death benefit goes to pay off the remaining debt. Any money remaining goes to your beneficiaries.

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

Collateral refers to the cash value in a life insurance policy whole life or universal life policies that build up cash value but it does not apply to term policies.

Whole life insurance policy must be issued by one of the following approved insurance carriers to be eligible as collateral: Guardian Life, New York Life, MassMutual, Metropolitan Life, John Hancock, Northwestern Mutual, Brighthouse Financial, Penn Mutual Ohio National Life Insurance Company, and Pacific Life.