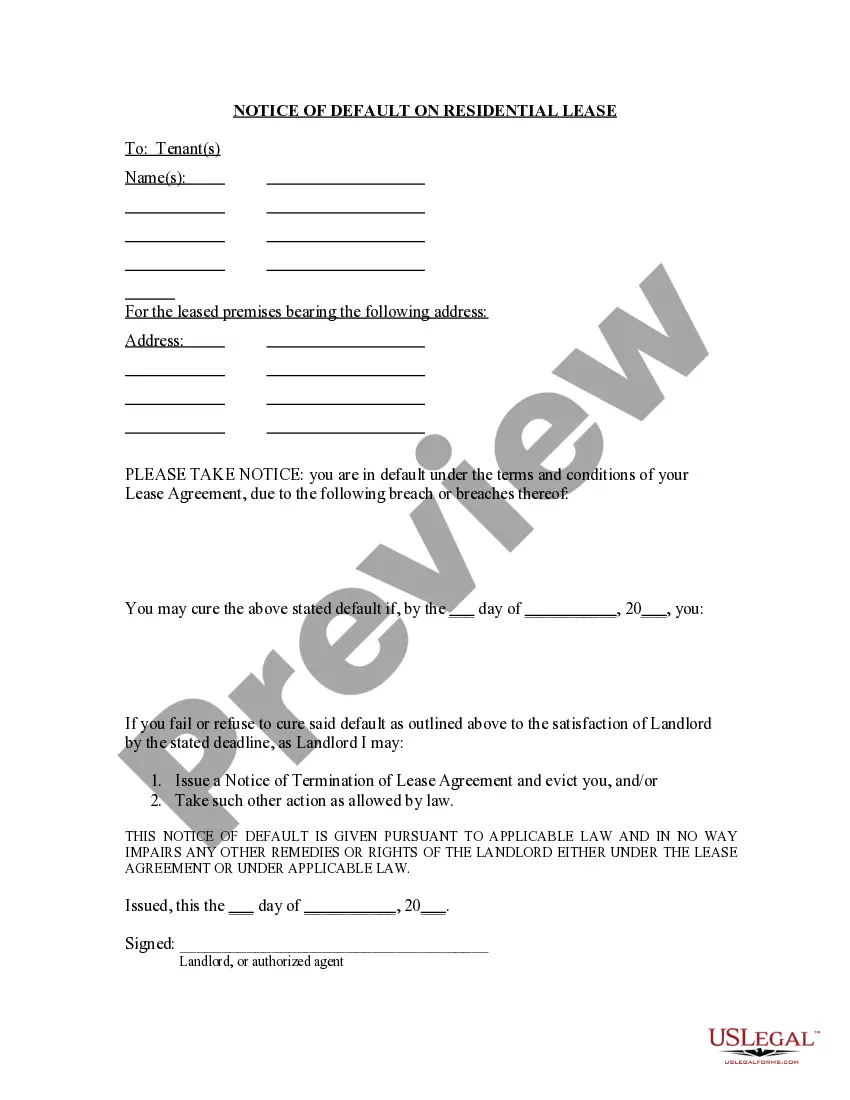

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Fulton Georgia Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty is a legally binding agreement that ensures the lessee's (tenant's) responsibility to fulfill all financial obligations and liabilities to the lessor (landlord) in Fulton, Georgia. This guarantee is further secured by a mortgage on the leased property. This type of guaranty serves as a protection for the lessor, allowing them to seek payment or performance from the guarantor (often the tenant or a third party) in case the lessee fails to meet their obligations under the lease agreement. The Fulton Georgia Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty may have different variations based on the specific terms and conditions agreed upon by the parties involved. Some possible types or variations could include: 1. Limited Guaranty: In this type, the guarantor's liability is limited to a specific maximum amount or a certain duration. This type of guaranty provides some protection to the guarantor by placing a cap on their potential financial exposure. 2. Absolute Guaranty: An absolute guaranty holds the guarantor responsible for the full amount of the lessee's obligations and liabilities. In this case, the guarantor has no limitation on their liability, and they are obligated to fulfill the entire financial burden in case of default by the lessee. 3. Joint and Several guaranties: This type applies when multiple guarantors are involved. It allows the lessor to seek payment or performance from any or all of the guarantors individually or collectively. Each guarantor is liable for the entire amount owed by the lessee, providing the lessor with flexibility in pursuing financial recovery. 4. Continuing Guaranty: As mentioned in the title, this guaranty is ongoing and extends beyond the initial term of the lease. It covers all obligations and liabilities that may arise throughout the entire lease period, including renewals or extensions. By including relevant keywords such as Fulton Georgia, continuing guaranty, payment, performance, obligations, liabilities, lease, and mortgage securing guaranty, this description provides an overview of what the Fulton Georgia Continuing Guaranty of Payment and Performance encompasses, while also addressing the possibility of different types or variations based on specific terms agreed upon by the parties involved.Fulton Georgia Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty is a legally binding agreement that ensures the lessee's (tenant's) responsibility to fulfill all financial obligations and liabilities to the lessor (landlord) in Fulton, Georgia. This guarantee is further secured by a mortgage on the leased property. This type of guaranty serves as a protection for the lessor, allowing them to seek payment or performance from the guarantor (often the tenant or a third party) in case the lessee fails to meet their obligations under the lease agreement. The Fulton Georgia Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty may have different variations based on the specific terms and conditions agreed upon by the parties involved. Some possible types or variations could include: 1. Limited Guaranty: In this type, the guarantor's liability is limited to a specific maximum amount or a certain duration. This type of guaranty provides some protection to the guarantor by placing a cap on their potential financial exposure. 2. Absolute Guaranty: An absolute guaranty holds the guarantor responsible for the full amount of the lessee's obligations and liabilities. In this case, the guarantor has no limitation on their liability, and they are obligated to fulfill the entire financial burden in case of default by the lessee. 3. Joint and Several guaranties: This type applies when multiple guarantors are involved. It allows the lessor to seek payment or performance from any or all of the guarantors individually or collectively. Each guarantor is liable for the entire amount owed by the lessee, providing the lessor with flexibility in pursuing financial recovery. 4. Continuing Guaranty: As mentioned in the title, this guaranty is ongoing and extends beyond the initial term of the lease. It covers all obligations and liabilities that may arise throughout the entire lease period, including renewals or extensions. By including relevant keywords such as Fulton Georgia, continuing guaranty, payment, performance, obligations, liabilities, lease, and mortgage securing guaranty, this description provides an overview of what the Fulton Georgia Continuing Guaranty of Payment and Performance encompasses, while also addressing the possibility of different types or variations based on specific terms agreed upon by the parties involved.