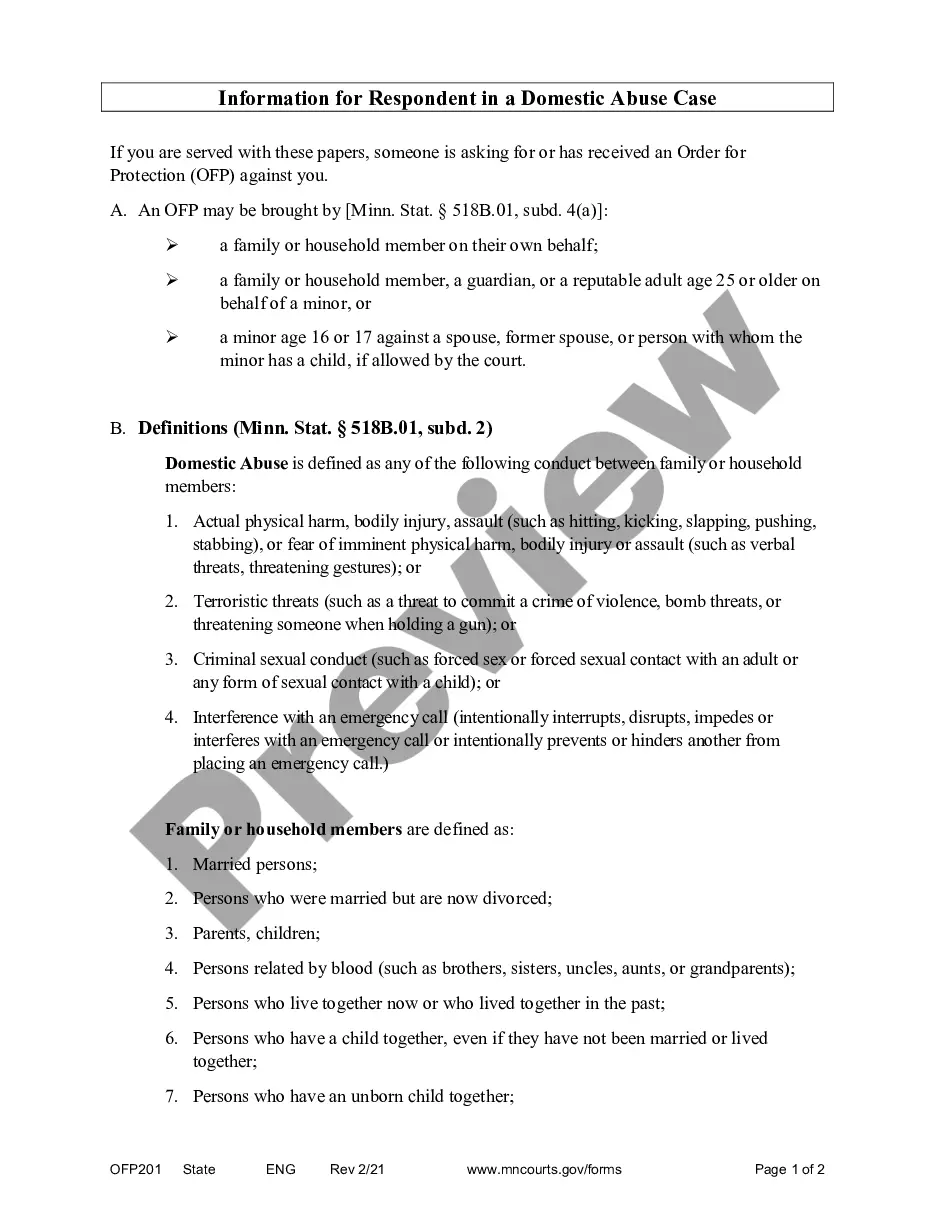

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Suffolk New York Mortgage Securing Guaranty of Performance of Lease is a legally binding agreement that ensures the landlord's financial protection in the event that a tenant fails to fulfill their lease obligations. This guarantee acts as a security measure by involving a third party, usually a mortgage company, to guarantee the tenant's performance under the lease. With this agreement in place, the mortgage company secures the lease by assuming liability for rent payments and other lease-related expenses if the tenant defaults. This provides landlords with peace of mind and financial stability, especially when dealing with long-term leases or tenants with uncertain financial backgrounds. Types of Suffolk New York Mortgage Securing Guaranty of Performance of Lease: 1. Personal Guarantee: In this type of guarantee, the tenant or an individual associated with the tenant becomes the guarantor. They are legally bound to pay outstanding rent or fulfill lease obligations if the tenant defaults. This usually involves a thorough review of the guarantor's financial standing and creditworthiness. 2. Corporate Guarantee: In some cases, instead of a personal guarantee, a corporation associated with the tenant provides the guarantee. This ensures that the corporation takes responsibility for the tenant's performance and any outstanding obligations. 3. Lender Guarantee: A lender, often a mortgage company or financial institution, can provide the guarantee on behalf of the tenant. This is common when the tenant requires financial assistance to secure the lease and the lender seeks additional security for their investment. 4. Combined Guarantee: Sometimes, both a personal guarantor and a lender or corporate guarantor are involved in securing the lease. This provides additional layers of security for the landlord, as both parties are responsible for fulfilling the tenant's obligations. 5. Limited Guarantee: In certain cases, the guarantee may be limited to a specific period or a specific aspect of the lease. For instance, a personal guarantor may only be responsible for rent payments for the first year, while subsequent years are secured by a lender. When entering into a Suffolk New York Mortgage Securing Guaranty of Performance of Lease, it is crucial to consult with legal professionals to ensure the agreement meets all legal requirements in Suffolk County, New York.