The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

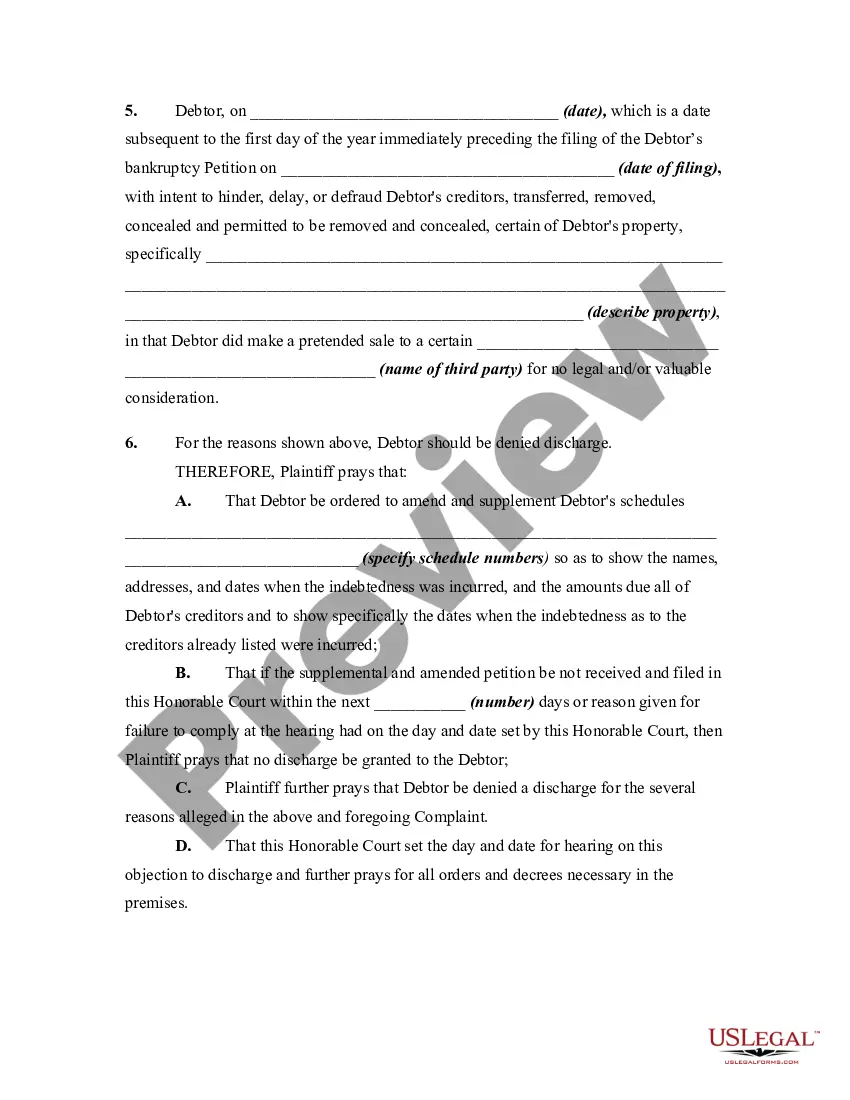

A Travis Texas Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property is a legal document filed when a creditor or trustee suspects that a debtor has engaged in fraudulent activities related to their bankruptcy case. This complaint is an objection to the debtor's request for a discharge of debts, which would release them from any further legal responsibility for those debts. When an individual files for bankruptcy, they must disclose all of their assets and liabilities to the court. They are also required to be open and honest about any transfers, removals, destruction, or concealment of property. If a creditor or trustee believes that the debtor has intentionally hidden assets or fraudulently transferred them to another party to avoid their inclusion in the bankruptcy estate, they can file a complaint objecting to the discharge. This type of complaint helps protect the integrity of the bankruptcy system, ensuring that all eligible debts are appropriately considered and discharged, while fraudulent actions are held accountable. If the court determines that the debtor has engaged in fraudulent behavior regarding their assets or property transfers, it may deny the discharge of debts or take other necessary legal actions. Under the category of Travis Texas Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property, there may be different subtypes or scenarios, each with its specific context and details. Some possible types could include: 1. Transfer of Property: This complaint may be filed when a debtor, prior to filing for bankruptcy, transfers title or ownership of a property, such as a house or a vehicle, to another party without proper authorization or in an attempt to hide it from creditors. 2. Removal of Property: This complaint may arise if a debtor intentionally removes assets, such as valuable items or bank accounts, from their possession before or during the bankruptcy proceedings to avoid their inclusion in the bankruptcy estate. 3. Destruction of Property: A complaint objecting to discharge for the destruction of property can occur if a debtor willfully damages or destroys assets in an effort to devalue their worth or prevent their distribution to creditors. 4. Concealment of Property: This type of complaint can be filed when a debtor purposely conceals or fails to disclose certain assets or property during the bankruptcy process, intending to keep them hidden or unavailable for liquidation to pay off debts. In conclusion, a Travis Texas Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property is a legal mechanism that ensures the fair treatment of creditors and protects the bankruptcy system from fraudulent activities. Various types of complaints can be filed if the debtor is suspected of engaging in unauthorized property transfers, removals, destruction, or concealment.A Travis Texas Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property is a legal document filed when a creditor or trustee suspects that a debtor has engaged in fraudulent activities related to their bankruptcy case. This complaint is an objection to the debtor's request for a discharge of debts, which would release them from any further legal responsibility for those debts. When an individual files for bankruptcy, they must disclose all of their assets and liabilities to the court. They are also required to be open and honest about any transfers, removals, destruction, or concealment of property. If a creditor or trustee believes that the debtor has intentionally hidden assets or fraudulently transferred them to another party to avoid their inclusion in the bankruptcy estate, they can file a complaint objecting to the discharge. This type of complaint helps protect the integrity of the bankruptcy system, ensuring that all eligible debts are appropriately considered and discharged, while fraudulent actions are held accountable. If the court determines that the debtor has engaged in fraudulent behavior regarding their assets or property transfers, it may deny the discharge of debts or take other necessary legal actions. Under the category of Travis Texas Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property, there may be different subtypes or scenarios, each with its specific context and details. Some possible types could include: 1. Transfer of Property: This complaint may be filed when a debtor, prior to filing for bankruptcy, transfers title or ownership of a property, such as a house or a vehicle, to another party without proper authorization or in an attempt to hide it from creditors. 2. Removal of Property: This complaint may arise if a debtor intentionally removes assets, such as valuable items or bank accounts, from their possession before or during the bankruptcy proceedings to avoid their inclusion in the bankruptcy estate. 3. Destruction of Property: A complaint objecting to discharge for the destruction of property can occur if a debtor willfully damages or destroys assets in an effort to devalue their worth or prevent their distribution to creditors. 4. Concealment of Property: This type of complaint can be filed when a debtor purposely conceals or fails to disclose certain assets or property during the bankruptcy process, intending to keep them hidden or unavailable for liquidation to pay off debts. In conclusion, a Travis Texas Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property is a legal mechanism that ensures the fair treatment of creditors and protects the bankruptcy system from fraudulent activities. Various types of complaints can be filed if the debtor is suspected of engaging in unauthorized property transfers, removals, destruction, or concealment.