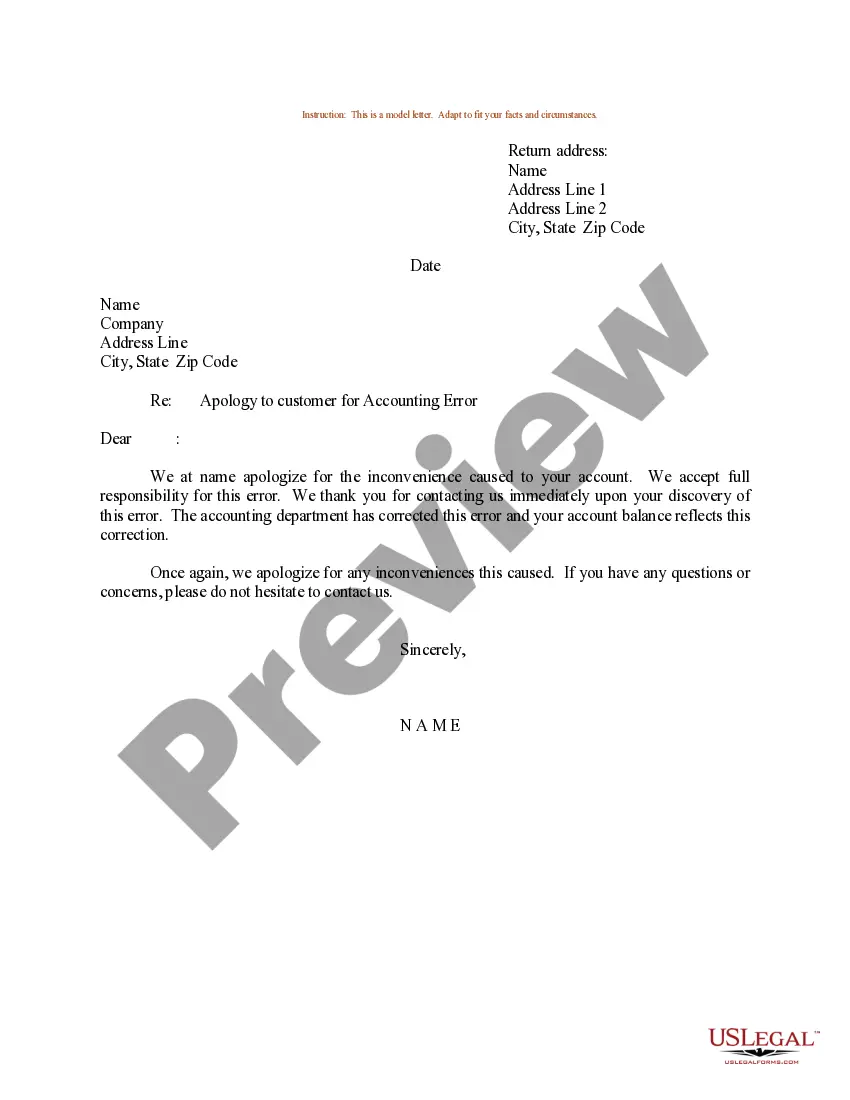

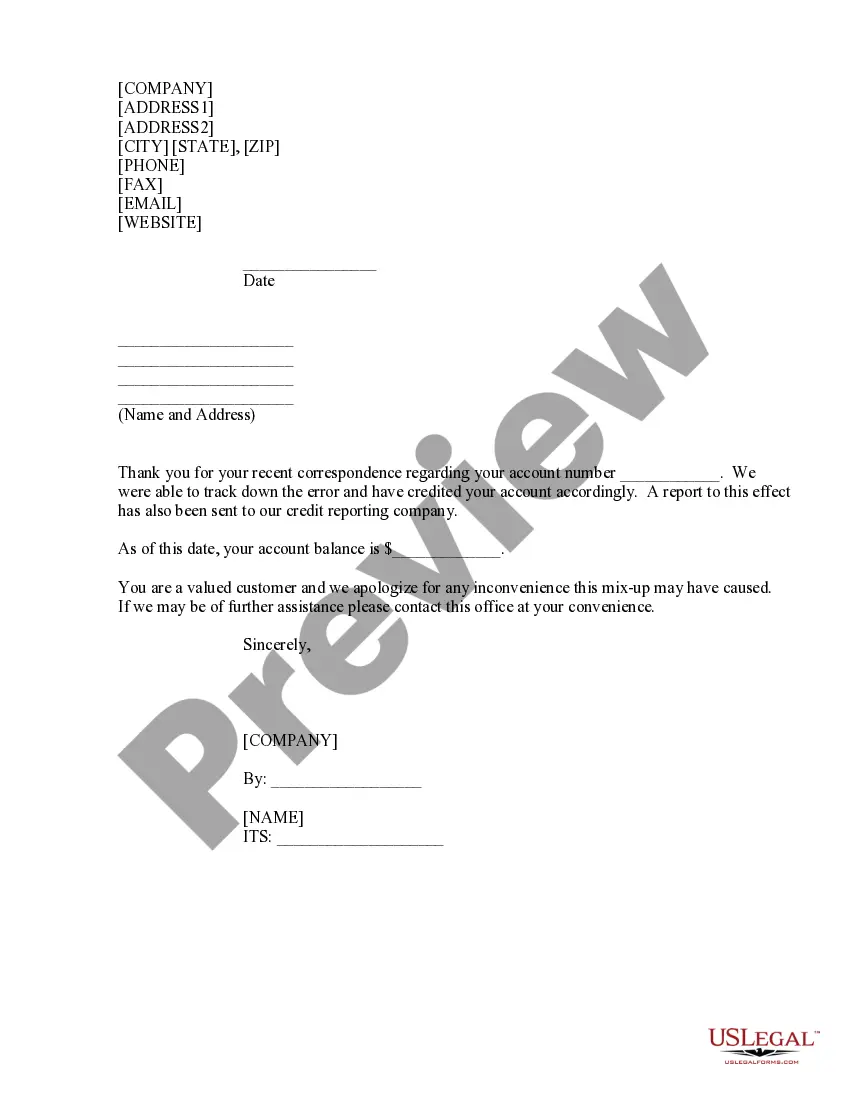

San Diego California Sample Letter for Apology for Accounting Errors and Past Due Notices

Description

How to fill out Sample Letter For Apology For Accounting Errors And Past Due Notices?

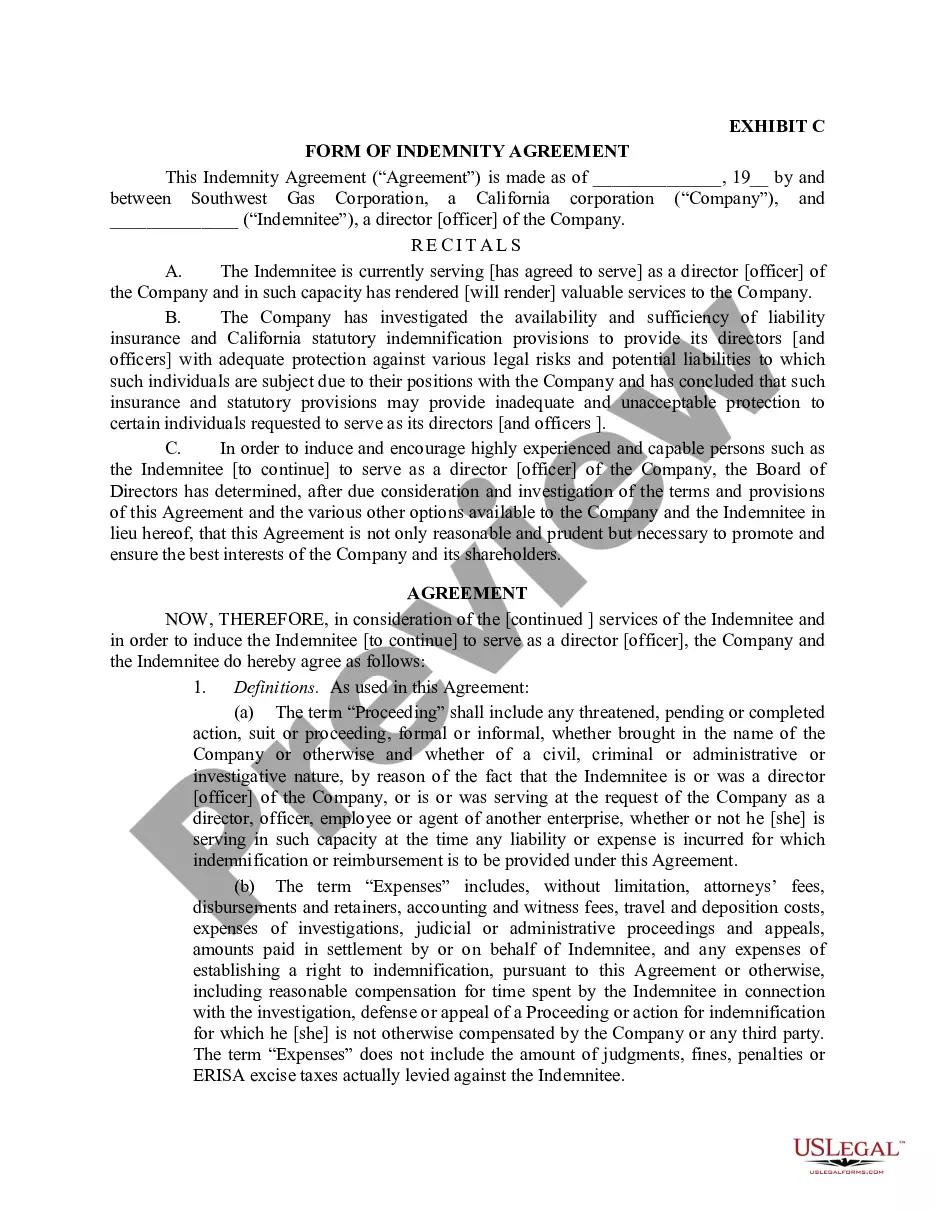

Organizing documents for commercial or personal needs is consistently a significant obligation.

When drafting a contract, a public service solicitation, or a power of attorney, it's crucial to take into account all federal and state statutes and regulations relevant to the particular area.

However, minor counties and even municipalities also have legislative protocols that you must take into consideration.

To find the document that fulfills your criteria, use the search tab located in the page header.

- All these factors render the preparation of the San Diego Sample Letter for Apology for Accounting Errors and Past Due Notices cumbersome and protracted without expert assistance.

- You can avoid incurring expenses on attorneys to prepare your documents and compose a legally sufficient San Diego Sample Letter for Apology for Accounting Errors and Past Due Notices independently, by utilizing the US Legal Forms online library.

- It is the largest virtual catalog of state-specific legal templates that are professionally validated, ensuring their legitimacy when selecting a sample for your region.

- Formerly subscribed users merely need to Log In to their accounts to retrieve the necessary file.

- If you do not have a subscription yet, follow the detailed steps below to acquire the San Diego Sample Letter for Apology for Accounting Errors and Past Due Notices.

- Review the page you've accessed and verify if it contains the document you need.

- To achieve this, use the form description and preview options if they are available.

Form popularity

FAQ

Consider following these steps when writing an apology letter to your supervisor or manager: Open with your apology.Use respectful and sincere language.Explain how you are addressing the situation.Remain professional and understanding.Express a willingness to improve.Acknowledge your manager's feelings are valid.

I got confused and mistakenly sent the wrong reports. I am truly sorry for such a lousy mistake. I want you to know that I have already apologized to the client personally and sent the correct reports. I have also arranged a meeting with the client to eliminate any chance of miscommunication about our reports.

To write an apology letter, you'll need to address your error early in the letter, acknowledge the other party's hurt feelings, and accept full responsibility for your part in the matter. In many cases, you'll also need to offer a solution that will fix any underlying issues related to the original problem.

Please accept our apologies for the reason such kind of an error occurred at our end. We are extremely sorry for all the trouble it caused you. We assure that such a thing will not happen in the future and we will take extra clear to make sure that no inconvenience is caused to you.

Top 5 Explanation Letter for a Mistake at Work Writing Takeaways Take responsibility for your actions. Be clear about what you did or didn't do that caused the mistake.Avoid focusing on anyone else's role in the mistake.Provide a little backstory.Outline a plan.Clearly apologize.

The Elements of a Good Apology Letter Say you're sorry. Not, I'm sorry, but . . . Just plain ol' I'm sorry. Own the mistake. It's important to show the wronged person that you're willing to take responsibility for your actions. Describe what happened.Have a plan.Admit you were wrong.Ask for forgiveness.

The Elements of a Good Apology Letter Say you're sorry. Not, I'm sorry, but . . . Just plain ol' I'm sorry. Own the mistake. It's important to show the wronged person that you're willing to take responsibility for your actions. Describe what happened.Have a plan.Admit you were wrong.Ask for forgiveness.

I apologize for the inconvenience our error has caused you. Write Your Letter Step-by-Step. Admit that the customer is right.Explain the error, if appropriate. Example Sentences for Step 2.Explain what you and the reader must do to remedy the problem. Example Sentences for Step 3.Offer an apology.

...with my apologies, We would like to apologize in advance for the inconvenience. We are extremely sorry for the trouble caused. We are really sorry for the inconvenience. Please accept our apologies for the inconvenience. We are sorry and apologize for the mistake. We regret the inconvenience caused.