The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

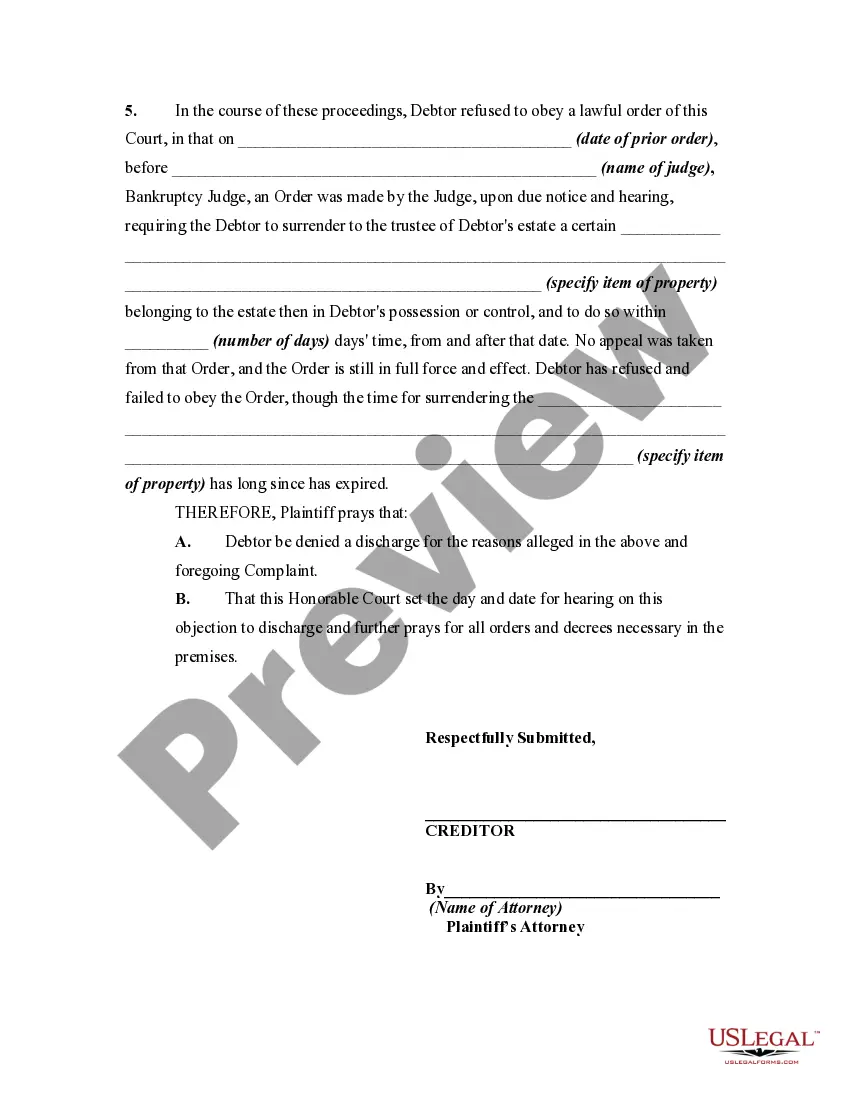

Harris Texas Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the Court In Harris County, Texas, a Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the Court can be filed when a debtor fails to comply with a lawful order as part of their bankruptcy case. This complaint aims to prevent the debtor from receiving a discharge of their debts based on non-compliance. Types of Harris Texas Complaints Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the Court: 1. Failure to Attend Mandatory Credit Counseling: As part of the bankruptcy process, debtors are required to attend credit counseling sessions. If the debtor refuses to attend or complete these mandatory sessions, a complaint objecting to discharge can be filed. 2. Non-Disclosure of Assets or Income: Debtors are legally obligated to disclose all of their assets and income during bankruptcy proceedings. If it is discovered that they purposely neglected to disclose certain assets or income, a complaint objecting to discharge can be filed. 3. Failure to Provide Required Documentation: Bankruptcy filings often require the submission of various documents, such as tax returns, financial statements, and proof of income. If the debtor fails to provide the necessary documentation despite lawful requests, a complaint objecting to discharge may be appropriate. 4. Violation of a Court Order: In some cases, the court may issue specific orders to the debtor in regard to their bankruptcy case. If the debtor knowingly disobeys any of these orders, a complaint objecting to discharge can be filed. In all the above types of complaints, it is essential to demonstrate that the debtor's actions were intentional, willful, or fraudulent. This may involve gathering evidence, such as correspondence, financial records, or witness testimonies, to support the claim of non-compliance. Filing a Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the Court is an important step for creditors seeking to enforce their rights and protect their interests. It allows them to challenge the debtor's eligibility for a discharge and potentially recover the debts owed. It is important to consult with a qualified attorney experienced in bankruptcy law in Harris County, Texas, to properly draft and file a complaint and navigate the legal proceedings. Proper documentation, evidence, and adherence to procedural rules are crucial to increase the likelihood of a successful outcome in these types of cases.