A guaranty is an agreement by one person (the guarantor) to perform an obligation in the event of default by the debtor or obligor. A guaranty acts as a type of collateral for an obligation of another person (the debtor or obligor). A guaranty agreement is a type of contract. Questions regarding such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Chicago Illinois Guaranty of Payment of Rent under Lease Agreement

Description

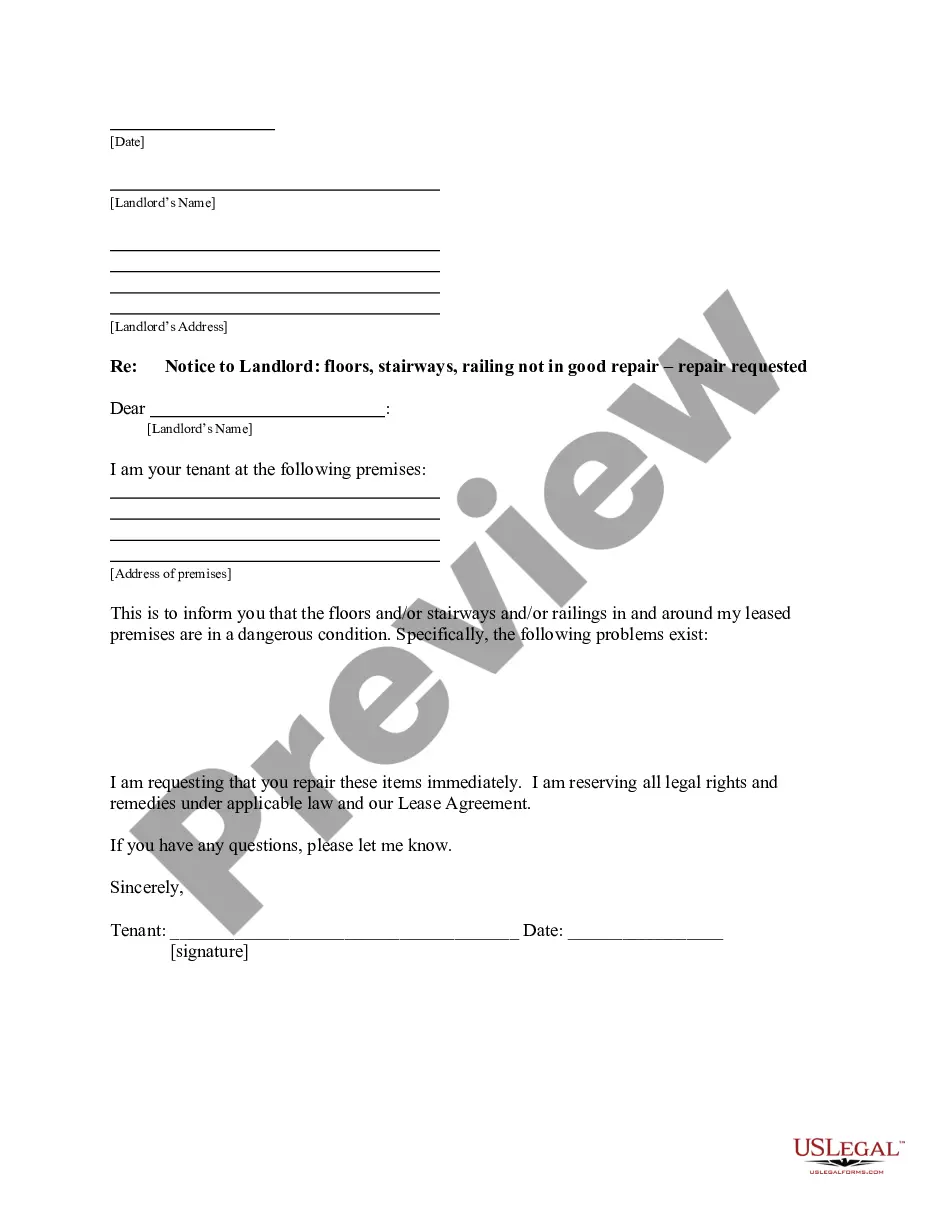

How to fill out Guaranty Of Payment Of Rent Under Lease Agreement?

Whether you intend to launch your enterprise, enter into a contract, request an update to your identification, or address family-related legal issues, you must prepare specific documentation that complies with your local statutes and regulations.

Locating the appropriate documents can consume considerable time and effort unless you utilize the US Legal Forms library.

The service offers users over 85,000 expertly crafted and validated legal templates for any personal or business circumstance. All documents are categorized by state and purpose, making it quick and simple to select a version, such as the Chicago Guaranty of Payment of Rent within a Lease Agreement.

Documents available on our website are reusable. With an active subscription, you can access all your previously obtained paperwork whenever needed in the My documents section of your account. Stop spending time on an ongoing search for current official documents. Register for the US Legal Forms platform and maintain your paperwork organized with the largest online collection of forms!

- Ensure the template aligns with your specific requirements and state legal stipulations.

- Review the form description and examine the Preview if available on the page.

- Use the search feature specifying your state above to locate another template.

- Click Buy Now to acquire the document once you identify the correct one.

- Select the subscription plan that best fits your needs to continue.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Chicago Guaranty of Payment of Rent within a Lease Agreement in the file format you require.

- Print the document or fill it out and sign it electronically through an online editor to save time.

Form popularity

FAQ

The minimum guarantee on a lease often depends on the rental terms and the landlord’s requirements, which can vary. Typically, landlords may ask for a guarantor with sufficient income or assets to cover one to three times the monthly rent. Understanding the stipulations of the Chicago Illinois Guaranty of Payment of Rent under Lease Agreement is essential for potential tenants and guarantors to navigate these requirements effectively.

To include a guarantor on your lease, start by discussing it with your landlord or property manager. You will need to have the guarantor fill out a rental application and provide their financial information. Once approved, the guarantor will sign the lease agreement, which often includes a clause detailing their responsibility under the Chicago Illinois Guaranty of Payment of Rent under Lease Agreement.

While many landlords in Chicago may prefer a guarantor to earn five times the rent for security reasons, it is not an absolute requirement. This figure can vary based on the landlord and specific lease agreement. Discussing your financial situation openly with the landlord can sometimes lead to more flexible terms.

Removing yourself as a guarantor is possible, but it often requires the landlord's consent. You can negotiate with the landlord for a release, especially if the tenant demonstrates a stable income or creditworthiness. Utilize resources like US Legal Forms to create a formal request for this removal under your Chicago Illinois Guaranty of Payment of Rent under Lease Agreement.

Typically, a guarantor remains liable for the duration of the lease term under the Chicago Illinois Guaranty of Payment of Rent under Lease Agreement. This liability continues until the lease ends or the landlord releases the guarantor in writing. Understanding this timeframe is crucial, as it can impact financial planning and obligations.

A personal guarantee is quite common in Chicago Illinois Guaranty of Payment of Rent under Lease Agreements, particularly for residential leases. Landlords often require them to secure payment, especially when tenants have limited credit history or income. This practice protects landlords while providing tenants an option to secure the lease.

Writing a guarantor letter for rent involves outlining your commitment to cover the rent obligations of the tenant. Begin by stating your relationship with the tenant and your understanding of the lease terms, emphasizing your financial stability. In the arena of a Chicago Illinois Guaranty of Payment of Rent under Lease Agreement, it’s helpful to mention your creditworthiness and willingness to fulfill the rent responsibilities. Platforms like US Legal Forms also provide useful templates to guide you in creating a concise and effective letter.

The guaranty of a lease agreement is a contract that places the responsibility of rent payments on the guarantor if the tenant fails to fulfill their obligations. This agreement is crucial for landlords in cities like Chicago, ensuring they receive their rent on time. In a Chicago Illinois Guaranty of Payment of Rent under Lease Agreement, the guarantor's role is to provide an assurance that financial commitments will be met. This structure promotes trust between landlords and tenants, fostering a more stable rental environment.