A guaranty is an agreement by one person (the guarantor) to perform an obligation in the event of default by the debtor or obligor. A guaranty acts as a type of collateral for an obligation of another person (the debtor or obligor). A guaranty agreement is a type of contract. Questions regarding such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

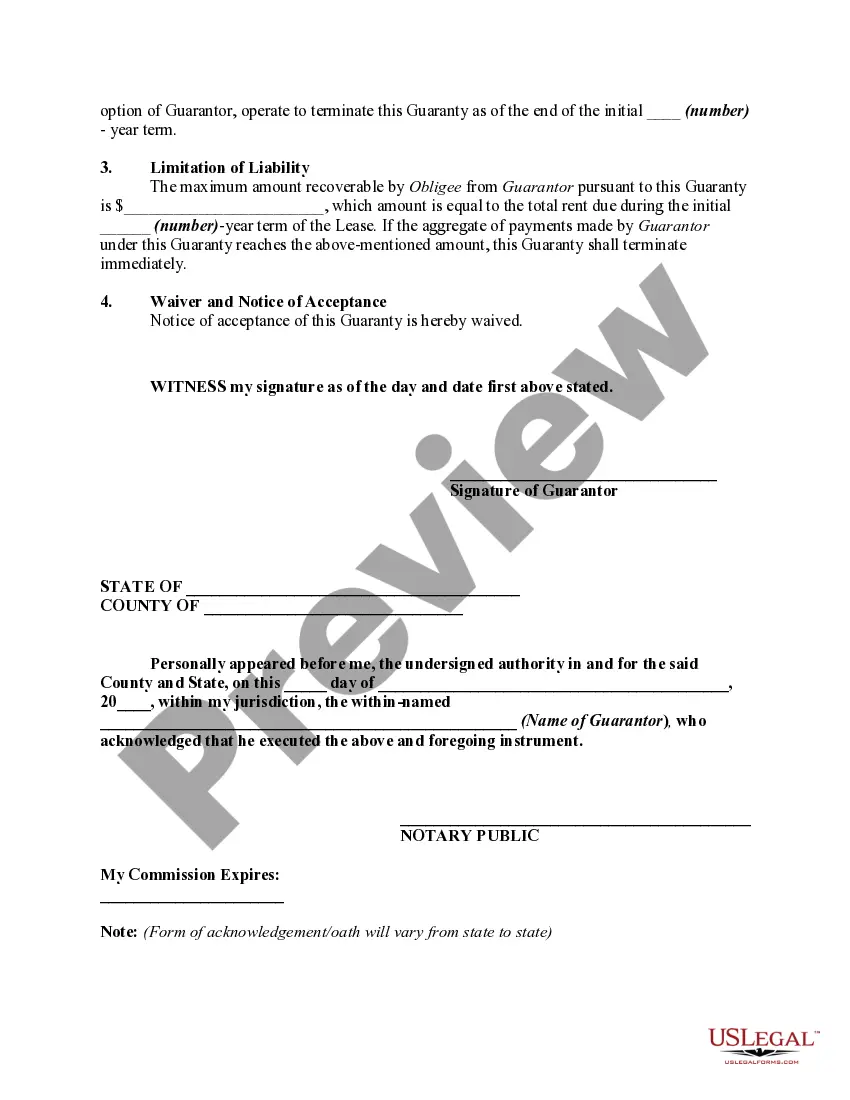

Harris Texas Guaranty of Payment of Rent under Lease Agreement is a legally binding contract that secures the payment of rent by a guarantor in the event that the tenant defaults on their rent obligations. This agreement provides assurance to the landlord that even if the tenant fails to make rental payments, the guarantor will step in and fulfill the financial responsibility. To understand the different types of Harris Texas Guaranty of Payment of Rent under a Lease Agreement, it is essential to identify the specific variations that may exist. 1. Individual Guarantor: This type of guarantor refers to an individual person who assumes the responsibility of paying rent on behalf of the tenant in case of default. It could be a family member, friend, or any individual with a trustworthy financial standing. 2. Corporate Guarantor: In some cases, commercial leases involve corporate entities that guarantee the payment of rent. This type of guarantor is typically a company that has the financial resources and willingness to accept the responsibility of rent payment. 3. Unlimited Guaranty: An unlimited guaranty holds the guarantor financially liable for all aspects of the lease, not just the payment of rent. This means that the guarantor may be responsible for any damages, legal fees, or other expenses incurred by the tenant during the lease term. 4. Limited Guaranty: A limited guaranty, on the other hand, restricts the guarantor's liability to a specific amount or duration. For instance, the guarantor might only be responsible for rent payments up to a predetermined limit or for a fixed period. 5. Conditional Guaranty: A conditional guaranty becomes active only under certain circumstances. For example, it may stipulate that the guarantor is obliged to pay rent only if the tenant fails to make the payment within a specified grace period. In a Harris Texas Guaranty of Payment of Rent under Lease Agreement, it is important to include essential information such as the names and signatures of all involved parties, the property address, lease term, rent amount, terms of default, and the guarantor's obligations. It is advisable to consult legal counsel when drafting or entering into such an agreement to ensure compliance with local laws and regulations. To sum up, a Harris Texas Guaranty of Payment of Rent under Lease Agreement acts as a safeguard for the landlord, providing financial security in case the tenant fails to fulfill their rent obligations. Understanding the different types of guaranty options is important when drafting or reviewing such agreements to meet the specific needs and circumstances of the parties involved.Harris Texas Guaranty of Payment of Rent under Lease Agreement is a legally binding contract that secures the payment of rent by a guarantor in the event that the tenant defaults on their rent obligations. This agreement provides assurance to the landlord that even if the tenant fails to make rental payments, the guarantor will step in and fulfill the financial responsibility. To understand the different types of Harris Texas Guaranty of Payment of Rent under a Lease Agreement, it is essential to identify the specific variations that may exist. 1. Individual Guarantor: This type of guarantor refers to an individual person who assumes the responsibility of paying rent on behalf of the tenant in case of default. It could be a family member, friend, or any individual with a trustworthy financial standing. 2. Corporate Guarantor: In some cases, commercial leases involve corporate entities that guarantee the payment of rent. This type of guarantor is typically a company that has the financial resources and willingness to accept the responsibility of rent payment. 3. Unlimited Guaranty: An unlimited guaranty holds the guarantor financially liable for all aspects of the lease, not just the payment of rent. This means that the guarantor may be responsible for any damages, legal fees, or other expenses incurred by the tenant during the lease term. 4. Limited Guaranty: A limited guaranty, on the other hand, restricts the guarantor's liability to a specific amount or duration. For instance, the guarantor might only be responsible for rent payments up to a predetermined limit or for a fixed period. 5. Conditional Guaranty: A conditional guaranty becomes active only under certain circumstances. For example, it may stipulate that the guarantor is obliged to pay rent only if the tenant fails to make the payment within a specified grace period. In a Harris Texas Guaranty of Payment of Rent under Lease Agreement, it is important to include essential information such as the names and signatures of all involved parties, the property address, lease term, rent amount, terms of default, and the guarantor's obligations. It is advisable to consult legal counsel when drafting or entering into such an agreement to ensure compliance with local laws and regulations. To sum up, a Harris Texas Guaranty of Payment of Rent under Lease Agreement acts as a safeguard for the landlord, providing financial security in case the tenant fails to fulfill their rent obligations. Understanding the different types of guaranty options is important when drafting or reviewing such agreements to meet the specific needs and circumstances of the parties involved.