A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Philadelphia Pennsylvania Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Description

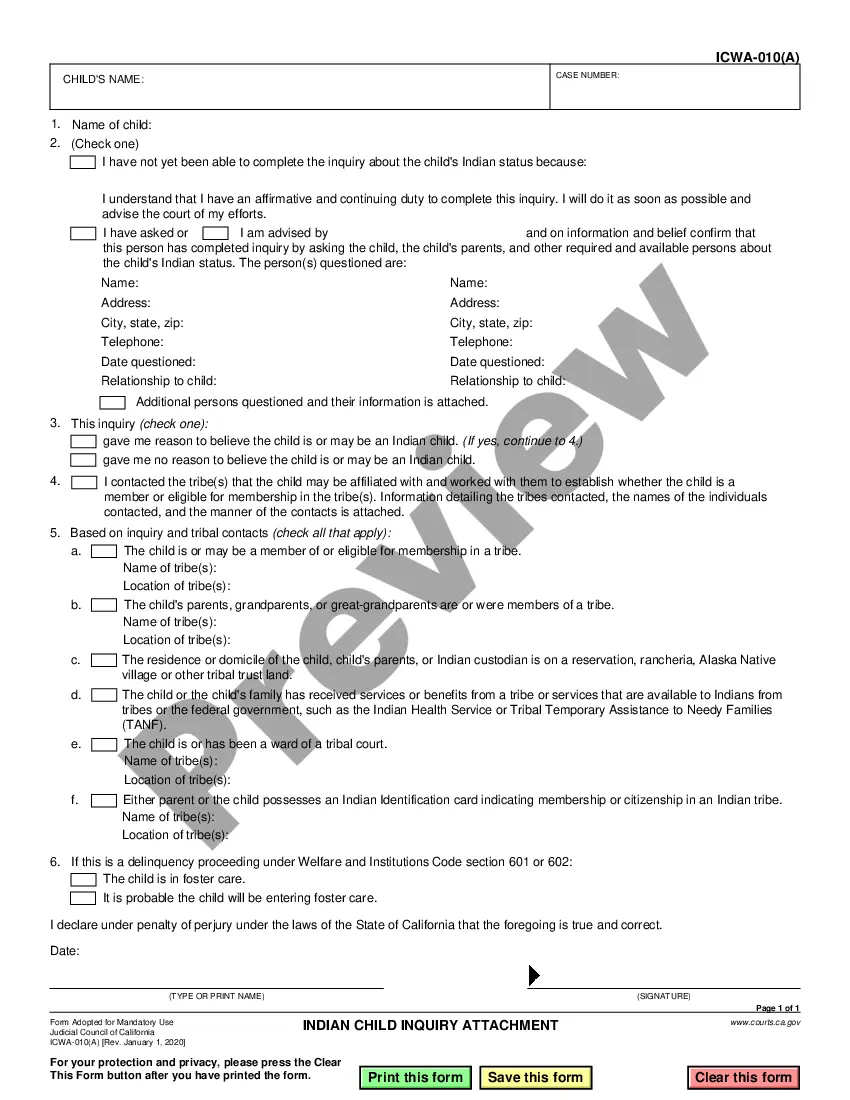

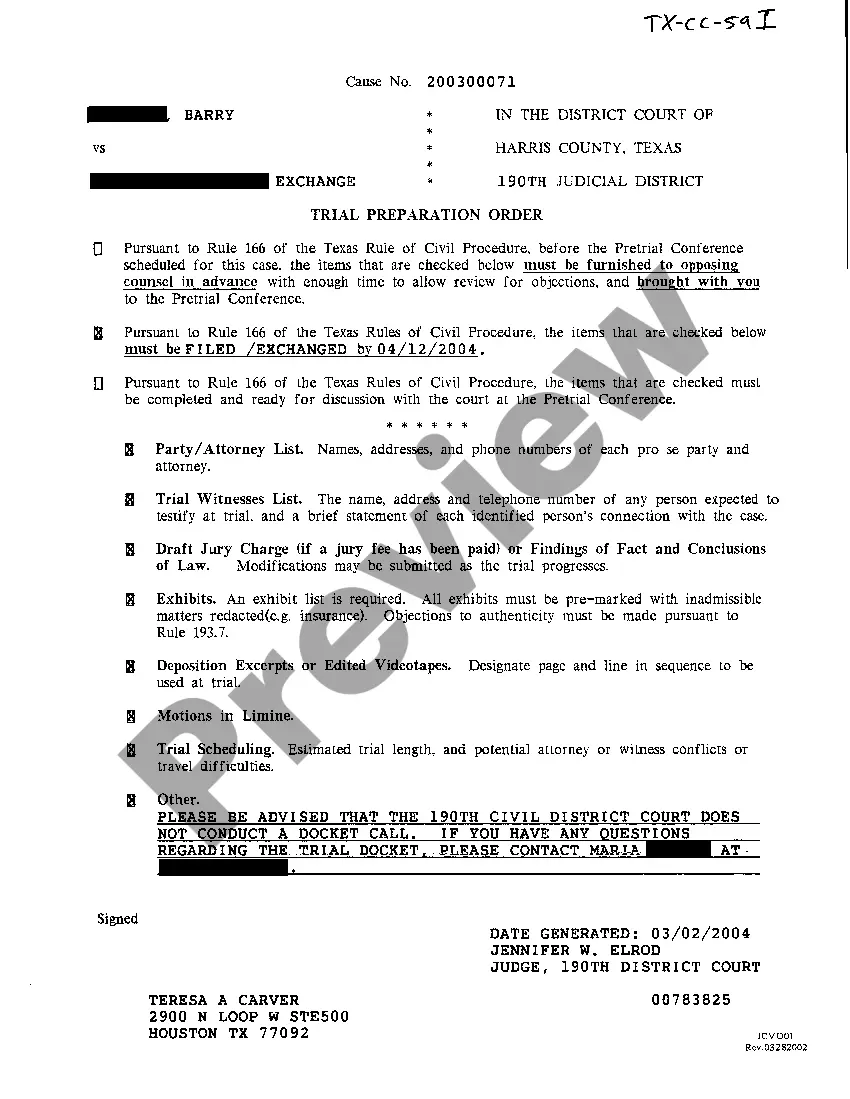

How to fill out Philadelphia Pennsylvania Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

Preparing paperwork for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Philadelphia Continuing Guaranty of Business Indebtedness By Corporate Stockholders without expert assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Philadelphia Continuing Guaranty of Business Indebtedness By Corporate Stockholders on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Philadelphia Continuing Guaranty of Business Indebtedness By Corporate Stockholders:

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

Differences Between Form 1120 and 1120-S Form 1120-S is filed by S Corps for federal taxes, while Form 1120 is filed by C Corps for taxes.

The answer is b. The stockholders, themselves, do not have the right to declare dividends to be paid to the...

Each shareholder's distribution amount for the corporation's fiscal year should be reported on Schedule K-1, Line 16, with a reference code of "D." When the shareholder follows the IRS instructions for Schedule K-1, this amount will not flow through to his income tax return as ordinary taxable income.

The owners of a corporation are shareholders (also known as stockholders) who obtain interest in the business by purchasing shares of stock. Shareholders elect a board of directors, who are responsible for managing the corporation.

A share certificate is a written document signed on behalf of a corporation that serves as legal proof of ownership of the number of shares indicated. A share certificate is also referred to as a stock certificate.

Ownership in a corporation is represented by stock certificates, which is why the owners are called stockholders.

Stock. a certificate of ownership in a corporation.

The answer is b. The stockholders, themselves, do not have the right to declare dividends to be paid to the...

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, dividends, the right to inspect corporate documents, and the right to sue for wrongful acts.

Terms in this set (52) The owners of a corporation are called stockholders. The owners of a corporation are called stockholders or shareholders because the ownership interests are called shares of stock.