A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

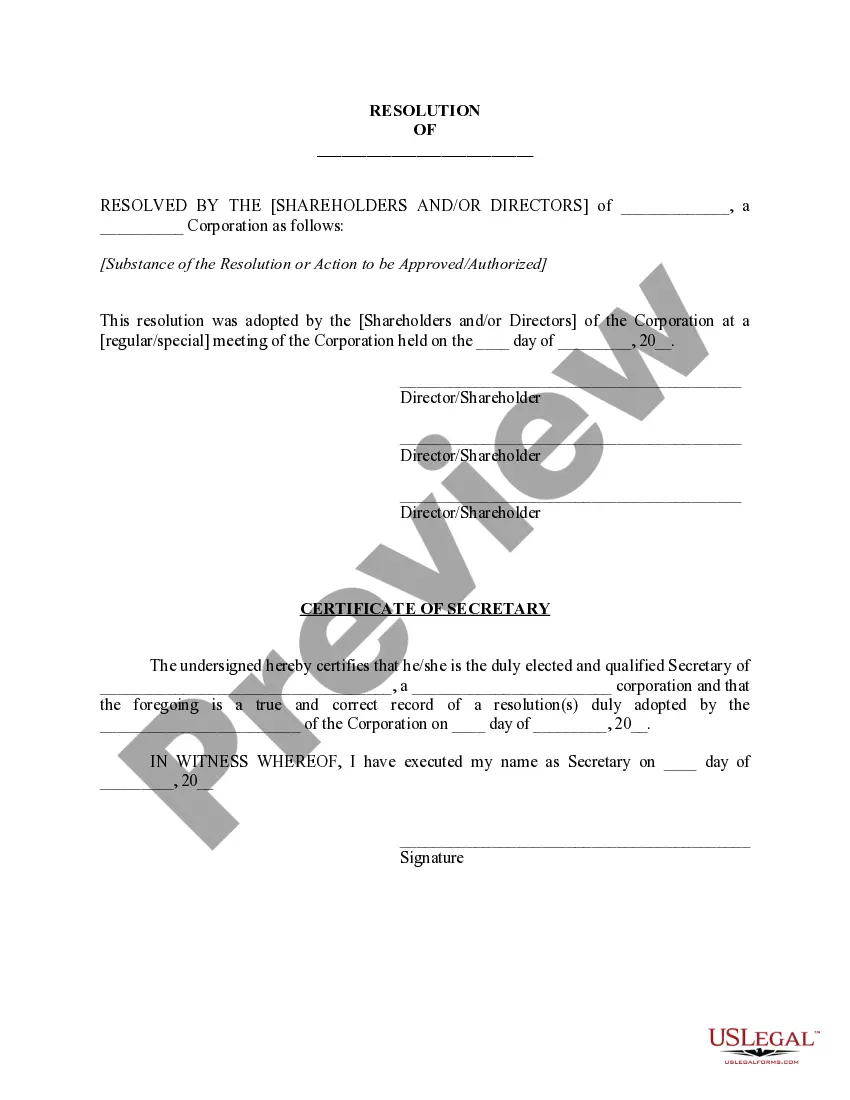

The Lima Arizona Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legal document that outlines the responsibilities and liabilities of corporate stockholders in guaranteeing a business's debts and obligations. This type of guaranty is a commonly used tool to provide additional security or assurance to lenders or creditors when extending credit to a business entity. In Lima, Arizona, corporate stockholders who sign a Continuing Guaranty of Business Indebtedness become personally liable for the debts and obligations of the business entity in the event of default. It serves as a legal agreement that ensures the creditors have recourse to both the business entity and the corporate stockholders for the repayment of outstanding debts or obligations. There are several key elements that may be included in a Lima Arizona Continuing Guaranty of Business Indebtedness By Corporate Stockholders, such as: 1. Identification of the Business Entity: The guaranty specifies the name, legal structure, and details of the business entity for which the guaranty is being provided. 2. Names of Corporate Stockholders: The guaranty lists the names of the corporate stockholders who are assuming personal liability for the business's debts and obligations. 3. Extent of Guaranty: The document outlines the scope of the guaranty, including whether it applies to existing debts or future obligations incurred by the business entity. 4. Indebtedness Covered: It specifies the types of debts or obligations covered by the guaranty, including loans, credit facilities, leases, or any other form of indebtedness related to the business entity. 5. Guarantor's Obligations: The guaranty details the specific obligations of the corporate stockholders, including the responsibility to pay the outstanding debts in the event of default by the business entity. 6. Release and Termination: It may outline the conditions or events that can lead to the release or termination of the guaranty, such as full repayment of the indebtedness, written consent of the creditors, or changes in ownership structure. Some other variations or types of the Lima Arizona Continuing Guaranty of Business Indebtedness By Corporate Stockholders may include: 1. Limited Guaranty: This type of guaranty limits the liability of the corporate stockholders to a specific amount or timeframe. 2. Joint and Several guaranties: Here, the guarantors are jointly and severally liable for the entire debt or obligation, meaning that each guarantor is responsible for the full amount if required. 3. Continuing Guaranty with Collateral: This kind of guaranty is backed by additional collateral assets offered by the corporate stockholders as security for the debt. In conclusion, the Lima Arizona Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legal agreement that holds corporate stockholders accountable for a business entity's debts and obligations. It is essential to seek legal advice and thoroughly understand the terms and conditions before entering into such guaranty agreements.The Lima Arizona Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legal document that outlines the responsibilities and liabilities of corporate stockholders in guaranteeing a business's debts and obligations. This type of guaranty is a commonly used tool to provide additional security or assurance to lenders or creditors when extending credit to a business entity. In Lima, Arizona, corporate stockholders who sign a Continuing Guaranty of Business Indebtedness become personally liable for the debts and obligations of the business entity in the event of default. It serves as a legal agreement that ensures the creditors have recourse to both the business entity and the corporate stockholders for the repayment of outstanding debts or obligations. There are several key elements that may be included in a Lima Arizona Continuing Guaranty of Business Indebtedness By Corporate Stockholders, such as: 1. Identification of the Business Entity: The guaranty specifies the name, legal structure, and details of the business entity for which the guaranty is being provided. 2. Names of Corporate Stockholders: The guaranty lists the names of the corporate stockholders who are assuming personal liability for the business's debts and obligations. 3. Extent of Guaranty: The document outlines the scope of the guaranty, including whether it applies to existing debts or future obligations incurred by the business entity. 4. Indebtedness Covered: It specifies the types of debts or obligations covered by the guaranty, including loans, credit facilities, leases, or any other form of indebtedness related to the business entity. 5. Guarantor's Obligations: The guaranty details the specific obligations of the corporate stockholders, including the responsibility to pay the outstanding debts in the event of default by the business entity. 6. Release and Termination: It may outline the conditions or events that can lead to the release or termination of the guaranty, such as full repayment of the indebtedness, written consent of the creditors, or changes in ownership structure. Some other variations or types of the Lima Arizona Continuing Guaranty of Business Indebtedness By Corporate Stockholders may include: 1. Limited Guaranty: This type of guaranty limits the liability of the corporate stockholders to a specific amount or timeframe. 2. Joint and Several guaranties: Here, the guarantors are jointly and severally liable for the entire debt or obligation, meaning that each guarantor is responsible for the full amount if required. 3. Continuing Guaranty with Collateral: This kind of guaranty is backed by additional collateral assets offered by the corporate stockholders as security for the debt. In conclusion, the Lima Arizona Continuing Guaranty of Business Indebtedness By Corporate Stockholders is a legal agreement that holds corporate stockholders accountable for a business entity's debts and obligations. It is essential to seek legal advice and thoroughly understand the terms and conditions before entering into such guaranty agreements.