Agreements among family members for the settlement of an intestate's estate will be upheld in the absence of fraud and when the rights of creditors are met. Intestate means that the decedent died without a valid will. The termination of any family controversy or the release of a reasonable, bona fide claim in an intestate estate have been held to be sufficient consideration for a family settlement.

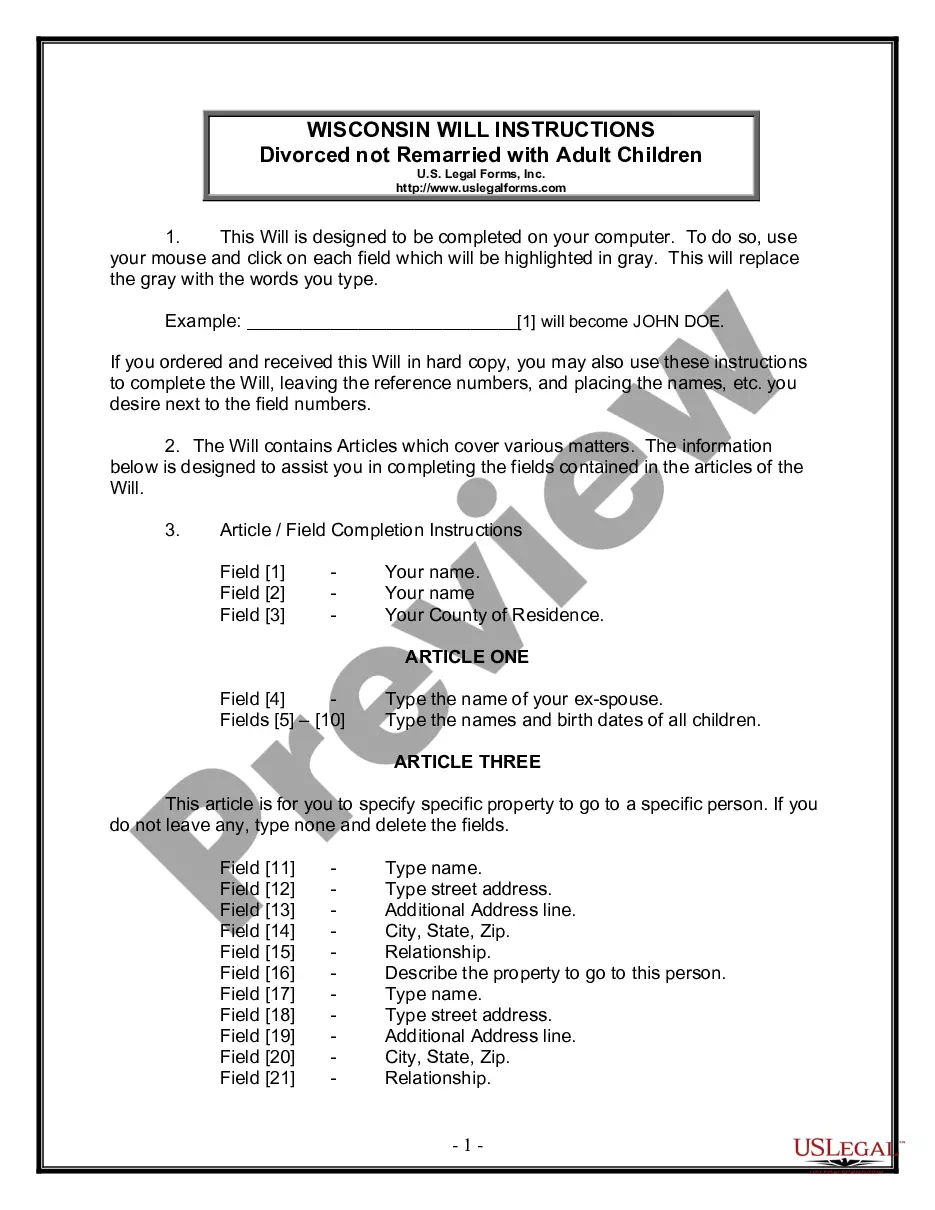

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

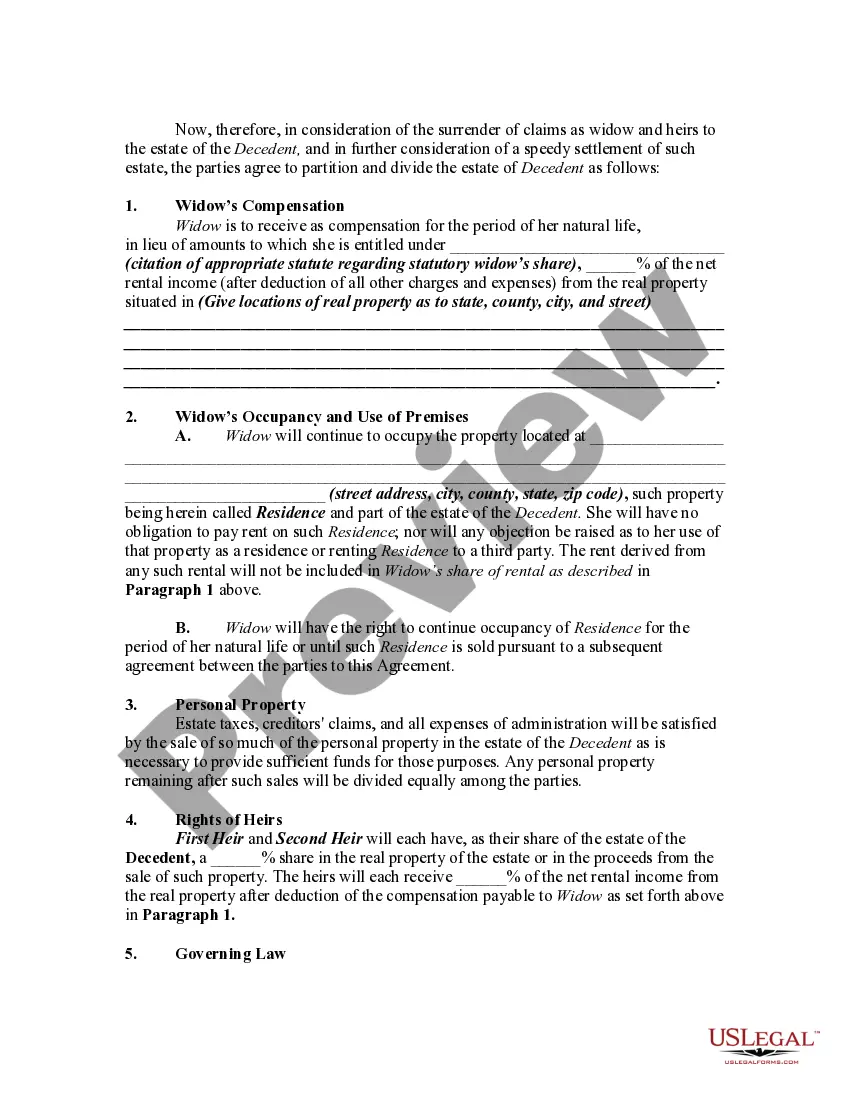

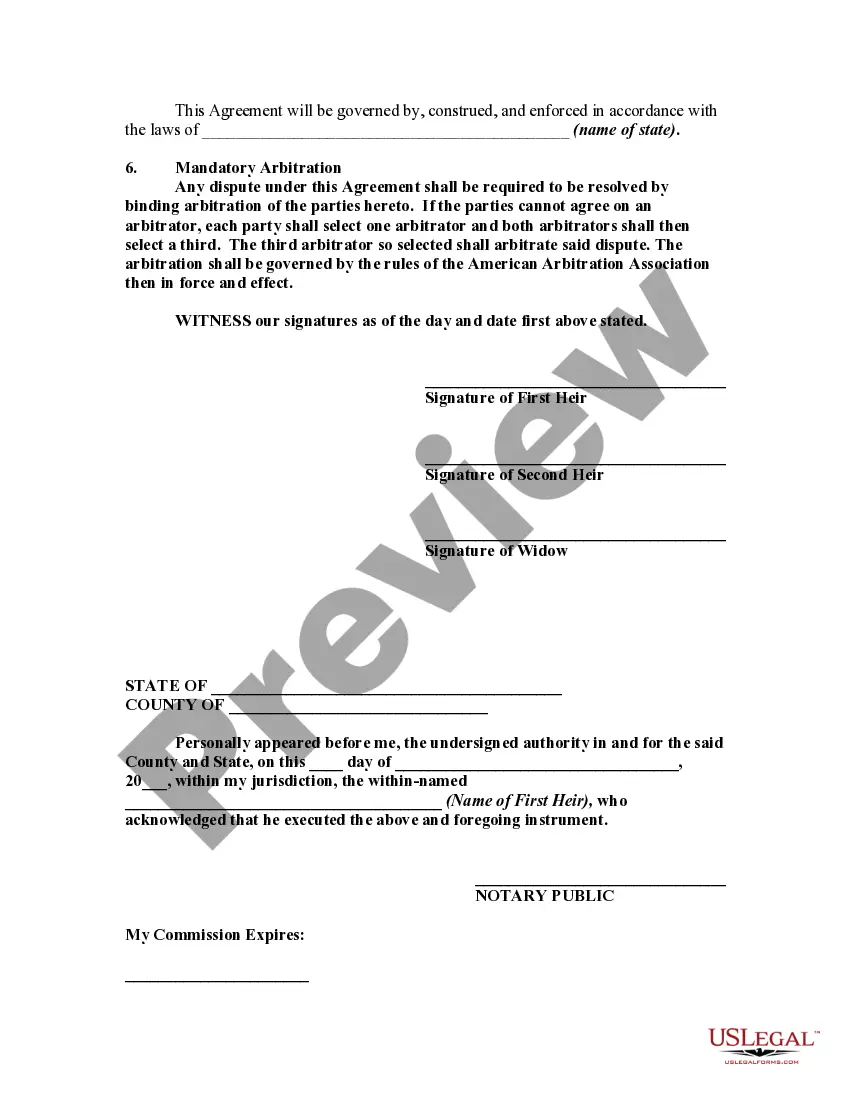

Nassau New York Agreement Between Widow and Heirs as to Division of Estate is a legal document that outlines the distribution and division of an estate between a widow and the heirs. This agreement is relevant in cases where the deceased person has left behind a surviving spouse and multiple heirs, such as children, grandchildren, or other family members. The agreement is intended to provide clarity and avoid potential conflicts or disputes that may arise during the estate settlement process. It covers various aspects of the division, including assets, liabilities, properties, belongings, finances, and any other relevant components of the estate. The Nassau New York Agreement Between Widow and Heirs as to Division of Estate can take several forms, depending on the specific circumstances and requirements of the individuals involved. Some common types of such agreements include: 1. Full Distribution Agreement: This agreement specifies that the entire estate will be distributed among the widow and heirs according to a predetermined distribution plan, considering the wishes of the deceased as expressed in their will or testament. 2. Partial Distribution Agreement: In situations where the deceased has left specific instructions regarding the division of certain assets, a partial distribution agreement can be established. This agreement clarifies which assets will be distributed among the widow and heirs, and how they will be divided. 3. Trust Establishment Agreement: If the estate includes substantial assets or financial resources, a trust establishment agreement may be created. This agreement stipulates that a trust will be set up to manage and distribute the estate's assets and income among the widow and heirs. It ensures that the distribution is carried out in a fair and organized manner, following legal regulations. 4. Mediated Agreement: In some instances, when conflicts or disputes arise between the widow and heirs regarding the division of the estate, a mediated agreement can be reached. This type of agreement involves the use of a neutral third-party mediator who helps facilitate communication and negotiation between the parties, working towards a mutually agreed-upon division plan. In all forms of the Nassau New York Agreement Between Widow and Heirs as to Division of Estate, it is crucial to consider the legal requirements, tax implications, and potential challenges that may arise during the estate settlement process. Seeking the assistance of an experienced attorney or estate planner is highly recommended ensuring that the agreement is legally valid and effectively protects the interests of all parties involved.