Agreements among family members for the settlement of an intestate's estate will be upheld in the absence of fraud and when the rights of creditors are met. Intestate means that the decedent died without a valid will. The termination of any family controversy or the release of a reasonable, bona fide claim in an intestate estate have been held to be sufficient consideration for a family settlement.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

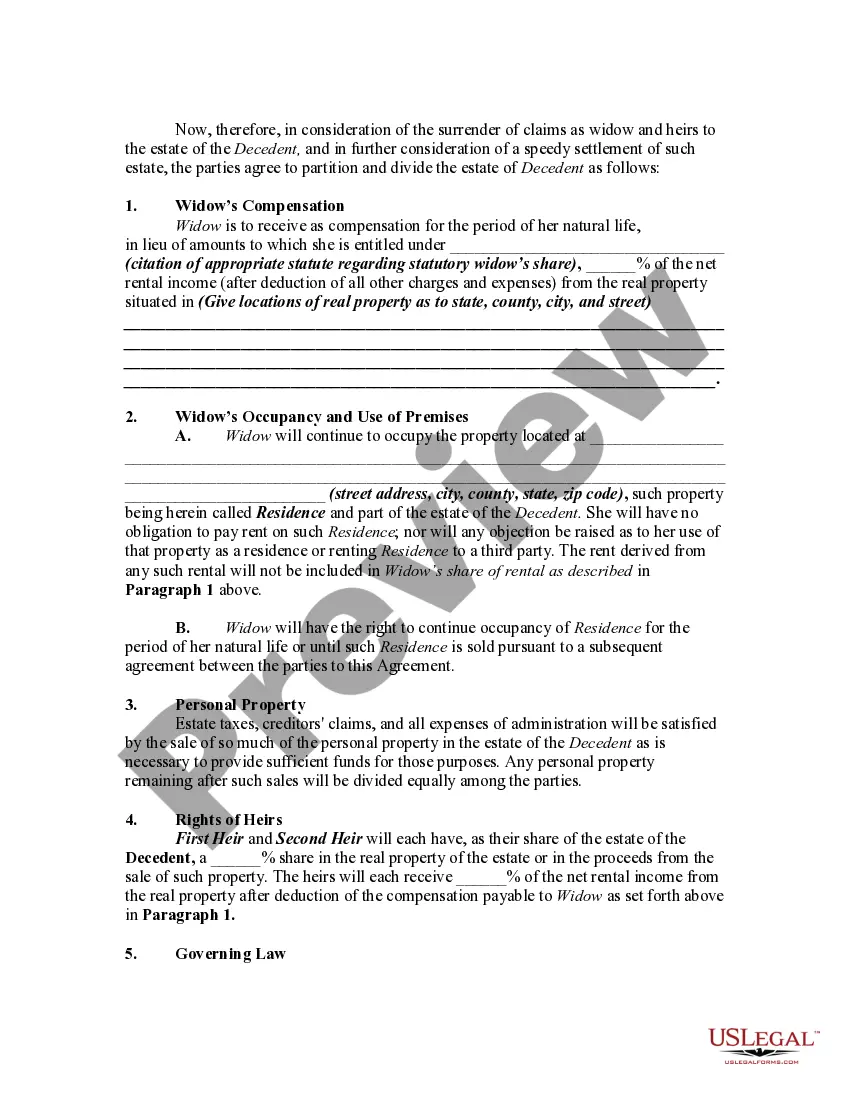

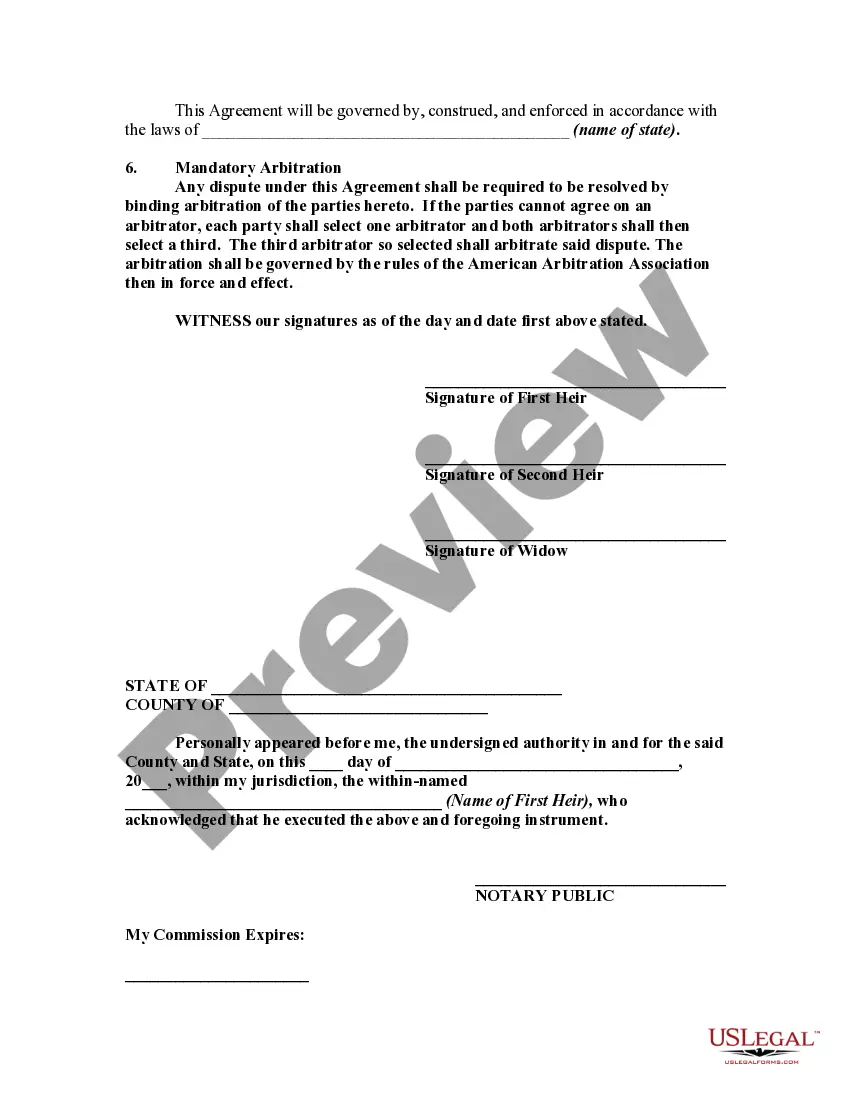

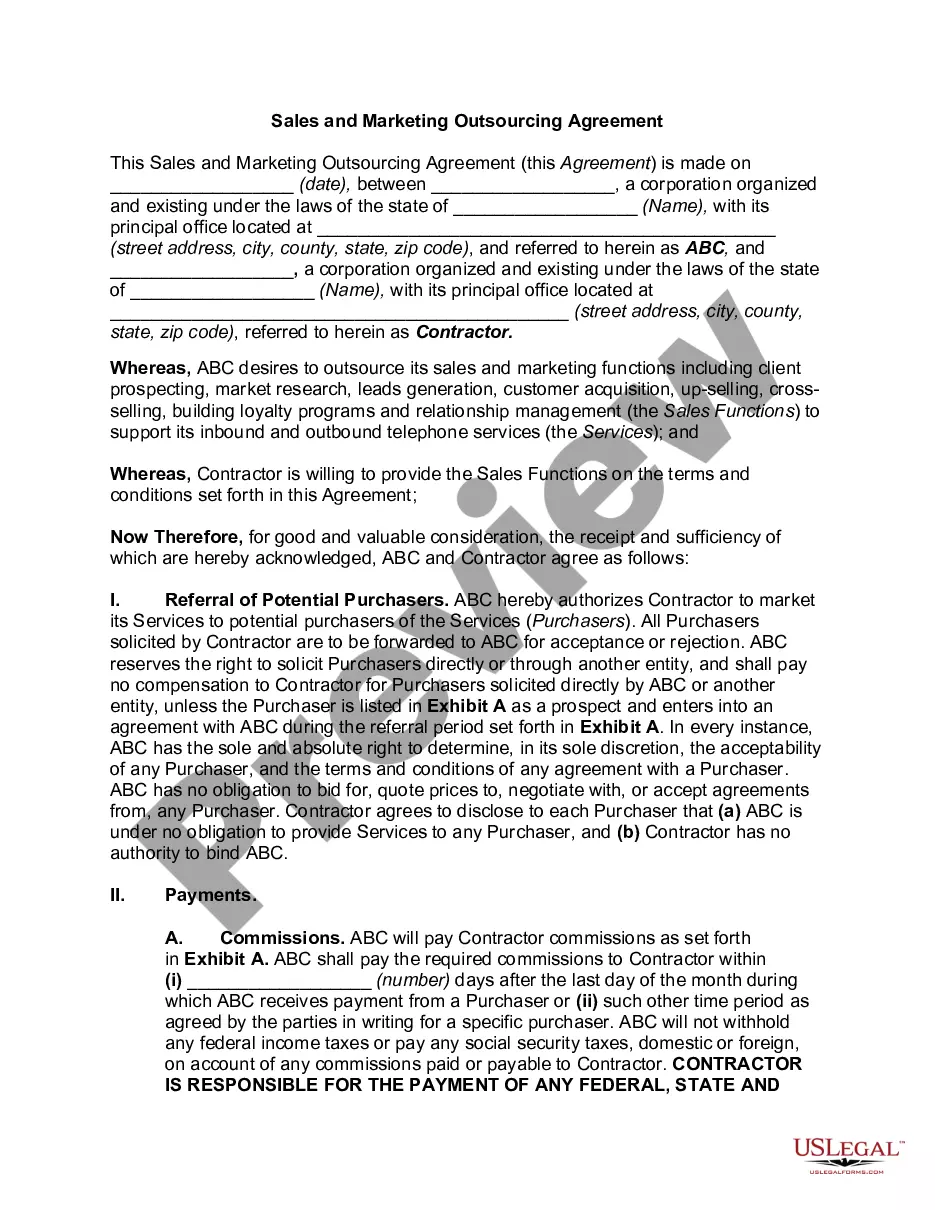

Queens New York Agreement Between Widow and Heirs as to Division of Estate: A Queens New York Agreement Between Widow and Heirs as to Division of Estate is a legally binding document that establishes the distribution of a deceased individual's assets among their surviving spouse (widow) and heirs. This agreement ensures a fair and equitable division of the estate, providing clarity and avoiding potential disputes among the involved parties. Types of Queens New York Agreement Between Widow and Heirs as to Division of Estate: 1. Queens New York Agreement Between Widow and Heirs — Equal Division: In this type of agreement, the estate is divided equally among the widow and heirs. Each party receives an equal share of the assets, ensuring a balanced distribution. 2. Queens New York Agreement Between Widow and Heirs — Customized Division: This agreement allows for a more customized distribution of the estate. The widow and heirs have the flexibility to negotiate a division that takes into account individual circumstances, needs, and preferences. 3. Queens New York Agreement Between Widow and Heirs — Proportional Division: In this arrangement, the estate is divided among the widow and heirs based on a proportionate share. Factors such as the number of heirs, their relationship to the deceased, and the value of each asset contribute to determining the distribution ratio. 4. Queens New York Agreement Between Widow and Heirs — Set-aside Provisions: This type of agreement may include set-aside provisions, where specific assets or sums of money are allocated for certain individuals or purposes. For example, it may set aside funds for minor children's education or designate a particular heir to receive a family heirloom. 5. Queens New York Agreement Between Widow and Heirs — Contingency Clauses: Contingency clauses can be included in this agreement to address potential changes in circumstances. For instance, if a major life event occurs, such as the remarriage of the widow or the birth of additional heirs, the agreement may outline how the division of assets will be adjusted to accommodate such changes. 6. Queens New York Agreement Between Widow and Heirs — Mediation or Arbitration: In situations where disagreements arise during the division of estate process, some agreements may include provisions for mediation or arbitration. This allows neutral third parties to help resolve conflicts, ensuring a fair resolution that respects the wishes of the deceased individual. In summary, a Queens New York Agreement Between Widow and Heirs as to Division of Estate is a crucial legal document that ensures a fair distribution of assets among the widow and heirs. It can come in various types, allowing for customization, proportional division, set-aside provisions, contingency clauses, and optional mediation or arbitration to address potential disputes.Queens New York Agreement Between Widow and Heirs as to Division of Estate: A Queens New York Agreement Between Widow and Heirs as to Division of Estate is a legally binding document that establishes the distribution of a deceased individual's assets among their surviving spouse (widow) and heirs. This agreement ensures a fair and equitable division of the estate, providing clarity and avoiding potential disputes among the involved parties. Types of Queens New York Agreement Between Widow and Heirs as to Division of Estate: 1. Queens New York Agreement Between Widow and Heirs — Equal Division: In this type of agreement, the estate is divided equally among the widow and heirs. Each party receives an equal share of the assets, ensuring a balanced distribution. 2. Queens New York Agreement Between Widow and Heirs — Customized Division: This agreement allows for a more customized distribution of the estate. The widow and heirs have the flexibility to negotiate a division that takes into account individual circumstances, needs, and preferences. 3. Queens New York Agreement Between Widow and Heirs — Proportional Division: In this arrangement, the estate is divided among the widow and heirs based on a proportionate share. Factors such as the number of heirs, their relationship to the deceased, and the value of each asset contribute to determining the distribution ratio. 4. Queens New York Agreement Between Widow and Heirs — Set-aside Provisions: This type of agreement may include set-aside provisions, where specific assets or sums of money are allocated for certain individuals or purposes. For example, it may set aside funds for minor children's education or designate a particular heir to receive a family heirloom. 5. Queens New York Agreement Between Widow and Heirs — Contingency Clauses: Contingency clauses can be included in this agreement to address potential changes in circumstances. For instance, if a major life event occurs, such as the remarriage of the widow or the birth of additional heirs, the agreement may outline how the division of assets will be adjusted to accommodate such changes. 6. Queens New York Agreement Between Widow and Heirs — Mediation or Arbitration: In situations where disagreements arise during the division of estate process, some agreements may include provisions for mediation or arbitration. This allows neutral third parties to help resolve conflicts, ensuring a fair resolution that respects the wishes of the deceased individual. In summary, a Queens New York Agreement Between Widow and Heirs as to Division of Estate is a crucial legal document that ensures a fair distribution of assets among the widow and heirs. It can come in various types, allowing for customization, proportional division, set-aside provisions, contingency clauses, and optional mediation or arbitration to address potential disputes.