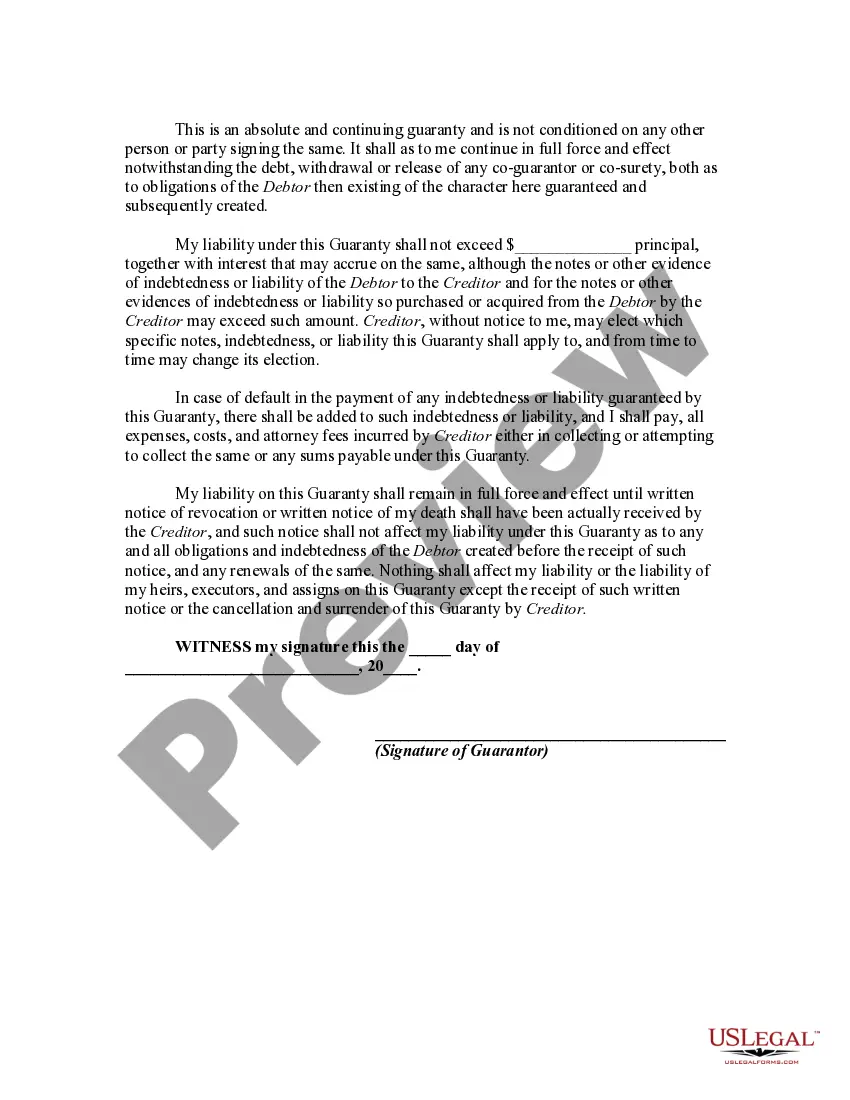

A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Fairfax Virginia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legally binding agreement or contract between a lender and a business entity, wherein a third party, known as the guarantor, agrees to assume responsibility for the repayment of the debtor's outstanding loans or financial obligations in case of default. The guarantor's liability in this type of guaranty is limited, providing a certain level of protection for the guarantor, unlike unlimited guaranties. This type of agreement is primarily used in commercial transactions involving loans, lines of credit, or other forms of business indebtedness. Its purpose is to enhance the lender's confidence in extending credit to the debtor by having an additional party committed to ensuring the debt repayment. The Fairfax Virginia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is tailored to meet the legal requirements and regulations specific to Fairfax County, Virginia. It is important to note that while the general concept and terms of this guaranty may be applicable in other jurisdictions, it is crucial to consult an attorney or legal expert familiar with the specific jurisdiction's laws when drafting or entering into such a contract. Keywords: Fairfax Virginia, continuing guaranty, business indebtedness, guarantor, limited liability, lender, debtor, default, commercial transactions, loans, lines of credit, financial obligations, repayment, credit extension, legal requirements, regulations, Fairfax County. Different types or variations of Fairfax Virginia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability can include: 1. Limited Liability Company (LLC) Guaranty: In this type, an LLC, as the guarantor, assumes limited liability for the business debts of another entity. The LLC guarantor's liability is typically constrained to its investment or interest in the debtor entity, shielding its members' personal assets. 2. Corporate Guaranty: This variant involves a corporation acting as the guarantor with limited liability for the business indebtedness. The corporation's liability is generally limited to its assets and does not extend to the personal assets of its shareholders. 3. Individual Guaranty with Limited Liability: This type of guaranty involves an individual acting as the guarantor, assuming limited liability for the debtor's business debts. The guarantor's personal assets are protected to a certain extent, ensuring their financial risk remains controlled. These variations may have nuanced differences in terms and conditions depending on the jurisdiction and particular circumstances of the transaction, reinforcing the need to consult legal professionals well-versed in Fairfax Virginia laws and regulations for accurate guidance.Fairfax Virginia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legally binding agreement or contract between a lender and a business entity, wherein a third party, known as the guarantor, agrees to assume responsibility for the repayment of the debtor's outstanding loans or financial obligations in case of default. The guarantor's liability in this type of guaranty is limited, providing a certain level of protection for the guarantor, unlike unlimited guaranties. This type of agreement is primarily used in commercial transactions involving loans, lines of credit, or other forms of business indebtedness. Its purpose is to enhance the lender's confidence in extending credit to the debtor by having an additional party committed to ensuring the debt repayment. The Fairfax Virginia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is tailored to meet the legal requirements and regulations specific to Fairfax County, Virginia. It is important to note that while the general concept and terms of this guaranty may be applicable in other jurisdictions, it is crucial to consult an attorney or legal expert familiar with the specific jurisdiction's laws when drafting or entering into such a contract. Keywords: Fairfax Virginia, continuing guaranty, business indebtedness, guarantor, limited liability, lender, debtor, default, commercial transactions, loans, lines of credit, financial obligations, repayment, credit extension, legal requirements, regulations, Fairfax County. Different types or variations of Fairfax Virginia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability can include: 1. Limited Liability Company (LLC) Guaranty: In this type, an LLC, as the guarantor, assumes limited liability for the business debts of another entity. The LLC guarantor's liability is typically constrained to its investment or interest in the debtor entity, shielding its members' personal assets. 2. Corporate Guaranty: This variant involves a corporation acting as the guarantor with limited liability for the business indebtedness. The corporation's liability is generally limited to its assets and does not extend to the personal assets of its shareholders. 3. Individual Guaranty with Limited Liability: This type of guaranty involves an individual acting as the guarantor, assuming limited liability for the debtor's business debts. The guarantor's personal assets are protected to a certain extent, ensuring their financial risk remains controlled. These variations may have nuanced differences in terms and conditions depending on the jurisdiction and particular circumstances of the transaction, reinforcing the need to consult legal professionals well-versed in Fairfax Virginia laws and regulations for accurate guidance.