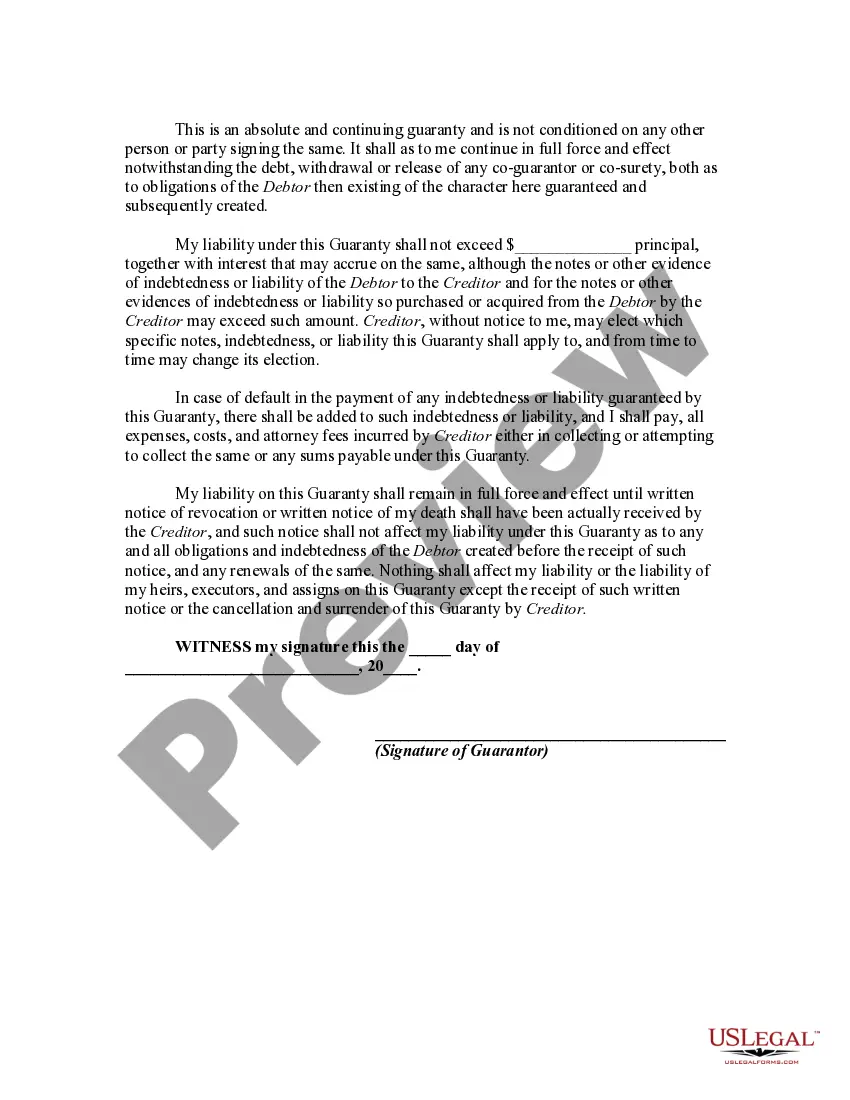

A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Fulton Georgia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal document that sets forth the terms and conditions under which a guarantor assumes limited liability for business debts in Fulton, Georgia. This type of guaranty serves as a safety net for lenders, providing additional protection in case the primary borrower fails to honor their financial obligations. The key purpose of a Fulton Georgia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is to ensure that the guarantor, also known as the limited liability guarantor, assumes a specific level of responsibility for the business's debts while maintaining their personal liability protection. This agreement helps establish a clear understanding of the guarantor's obligations, limitations, and risks associated with the guarantee. In Fulton, Georgia, there are a few variations of Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability: 1. Limited Liability Corporate Guaranty: This type of guaranty is applicable when a corporation acts as the guarantor for a business's indebtedness. It limits the corporation's liability up to a specific amount or under certain conditions, protecting its assets from potential financial risks. 2. Limited Liability Individual Guaranty: This variation involves an individual assuming limited liability as the guarantor for a business's debts, shielding their personal assets from being fully at risk if the borrower defaults. The extent of liability is defined within the agreement. Key Elements of a Fulton Georgia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability: 1. Identification of Parties: The guarantor, borrower, and lender are all identified and their legal names, addresses, and contact details are provided. 2. Indebtedness Coverage: The guaranty outlines the specific indebtedness being guaranteed, including loans, credit lines, and other financial obligations. 3. Limitation of Liability: The agreement specifies the extent of the guarantor's limited liability, whether it is a fixed amount or within certain conditions, providing clarity on the maximum risk they are assuming. 4. Notices and Amendments: Procedures for providing notices and the process for making any amendments to the agreement are defined. 5. Governing Law and Jurisdiction: The governing law of Fulton, Georgia, is acknowledged, and the jurisdiction for any legal disputes related to the agreement is established. In conclusion, a Fulton Georgia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a significant legal document designed to protect both lenders and guarantors in business transactions. It ensures that the guarantor assumes limited liability for business debts in a specified manner while safeguarding their personal assets.Fulton Georgia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal document that sets forth the terms and conditions under which a guarantor assumes limited liability for business debts in Fulton, Georgia. This type of guaranty serves as a safety net for lenders, providing additional protection in case the primary borrower fails to honor their financial obligations. The key purpose of a Fulton Georgia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is to ensure that the guarantor, also known as the limited liability guarantor, assumes a specific level of responsibility for the business's debts while maintaining their personal liability protection. This agreement helps establish a clear understanding of the guarantor's obligations, limitations, and risks associated with the guarantee. In Fulton, Georgia, there are a few variations of Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability: 1. Limited Liability Corporate Guaranty: This type of guaranty is applicable when a corporation acts as the guarantor for a business's indebtedness. It limits the corporation's liability up to a specific amount or under certain conditions, protecting its assets from potential financial risks. 2. Limited Liability Individual Guaranty: This variation involves an individual assuming limited liability as the guarantor for a business's debts, shielding their personal assets from being fully at risk if the borrower defaults. The extent of liability is defined within the agreement. Key Elements of a Fulton Georgia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability: 1. Identification of Parties: The guarantor, borrower, and lender are all identified and their legal names, addresses, and contact details are provided. 2. Indebtedness Coverage: The guaranty outlines the specific indebtedness being guaranteed, including loans, credit lines, and other financial obligations. 3. Limitation of Liability: The agreement specifies the extent of the guarantor's limited liability, whether it is a fixed amount or within certain conditions, providing clarity on the maximum risk they are assuming. 4. Notices and Amendments: Procedures for providing notices and the process for making any amendments to the agreement are defined. 5. Governing Law and Jurisdiction: The governing law of Fulton, Georgia, is acknowledged, and the jurisdiction for any legal disputes related to the agreement is established. In conclusion, a Fulton Georgia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a significant legal document designed to protect both lenders and guarantors in business transactions. It ensures that the guarantor assumes limited liability for business debts in a specified manner while safeguarding their personal assets.