A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

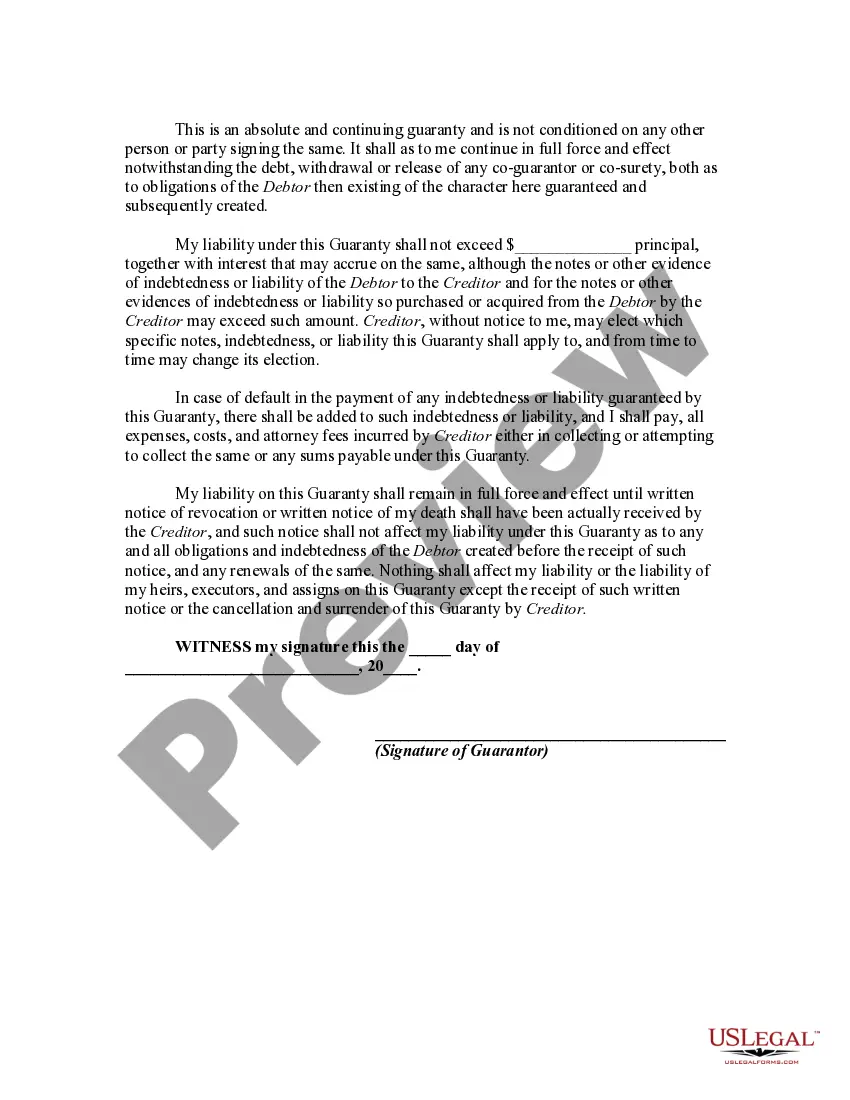

A Harris Texas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal document that outlines the terms and conditions of a guarantor's liability for a business's indebtedness. This type of guarantee is commonly used in commercial transactions where a business entity requires additional financial backing to secure a loan or line of credit. The guarantor, who may be an individual or another business entity, agrees to assume limited liability for the business's obligations and debts. One key aspect of the Harris Texas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is that it provides protection to the guarantor by limiting their liability to a specific amount or up to a certain time duration. This means that the guarantor is only responsible for the guaranteed amount and not the entire debt of the business. This provision is particularly important for guarantors who wish to mitigate their risks while supporting the business financially. Another important feature of this type of guaranty is its "continuing" nature. It implies that the guarantor's liability remains in effect for the entire duration of the indebtedness, including any extensions or renewals of the original loan or credit arrangement. Consequently, if the business fails to meet its repayment obligations or defaults on the debt, the guarantor can be held liable for the outstanding amount. In the context of Harris Texas, there might be variations or subtypes of the Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. These could include: 1. Limited Personal Guaranty: This type of guaranty limits the guarantor's personal liability for the business's indebtedness to a specific amount or duration. It safeguards the guarantor's personal assets from being fully exposed in case of default. 2. Corporate Guaranty with Limited Liability: This subtype involves a corporate entity acting as a guarantor for another business's indebtedness. However, the corporate guarantor's liability is restricted to a certain limit or a predetermined time period. 3. Limited Guaranty with Multiple Guarantors: In some cases, multiple guarantors may jointly assume limited liability for the business's indebtedness. This ensures that the burden of guaranteeing the debt is shared among different parties, reducing the individual risk for each guarantor. It is important to consult with legal professionals or specialists in Harris Texas to understand the specific requirements, provisions, and variations of the Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, as the details can vary based on jurisdiction and individual circumstances.A Harris Texas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal document that outlines the terms and conditions of a guarantor's liability for a business's indebtedness. This type of guarantee is commonly used in commercial transactions where a business entity requires additional financial backing to secure a loan or line of credit. The guarantor, who may be an individual or another business entity, agrees to assume limited liability for the business's obligations and debts. One key aspect of the Harris Texas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is that it provides protection to the guarantor by limiting their liability to a specific amount or up to a certain time duration. This means that the guarantor is only responsible for the guaranteed amount and not the entire debt of the business. This provision is particularly important for guarantors who wish to mitigate their risks while supporting the business financially. Another important feature of this type of guaranty is its "continuing" nature. It implies that the guarantor's liability remains in effect for the entire duration of the indebtedness, including any extensions or renewals of the original loan or credit arrangement. Consequently, if the business fails to meet its repayment obligations or defaults on the debt, the guarantor can be held liable for the outstanding amount. In the context of Harris Texas, there might be variations or subtypes of the Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. These could include: 1. Limited Personal Guaranty: This type of guaranty limits the guarantor's personal liability for the business's indebtedness to a specific amount or duration. It safeguards the guarantor's personal assets from being fully exposed in case of default. 2. Corporate Guaranty with Limited Liability: This subtype involves a corporate entity acting as a guarantor for another business's indebtedness. However, the corporate guarantor's liability is restricted to a certain limit or a predetermined time period. 3. Limited Guaranty with Multiple Guarantors: In some cases, multiple guarantors may jointly assume limited liability for the business's indebtedness. This ensures that the burden of guaranteeing the debt is shared among different parties, reducing the individual risk for each guarantor. It is important to consult with legal professionals or specialists in Harris Texas to understand the specific requirements, provisions, and variations of the Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, as the details can vary based on jurisdiction and individual circumstances.