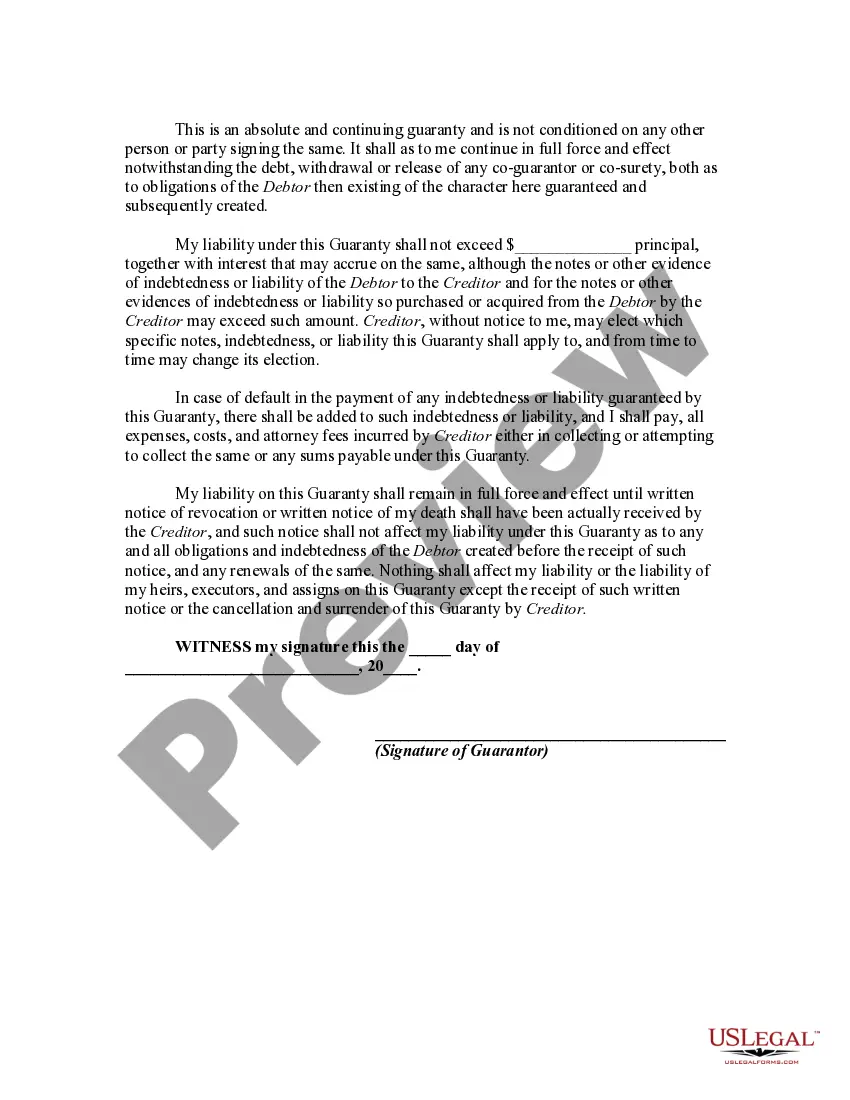

A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Hennepin Minnesota Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legally binding document that provides a guarantee for the repayment of business debts in Hennepin County, Minnesota. This type of guaranty is usually utilized when a business entity seeks financing from a lender, and the lender requires additional reassurance that the debt will be repaid. The Hennepin Minnesota Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability serves as a protective measure for lenders, as it ensures that the guarantor will assume responsibility for the debt in case the primary borrower defaults. This guaranty can help mitigate the lender's risk and increase the likelihood of securing financing for the business. There are several types of Hennepin Minnesota Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, including: 1. Personal Guaranty: In this type of guaranty, an individual acts as the guarantor and pledges to repay the business debt using their personal assets if the borrower defaults. The guarantor retains limited liability, meaning their liability is capped at a predetermined amount or only covers specific debts. 2. Corporate Guaranty: This form of guaranty involves a corporation as the guarantor, assuming responsibility for the business debt. The corporation typically has limited liability, as stated in its bylaws or articles of incorporation, safeguarding its shareholders from personal liability for the debt. 3. Limited Partnership (LP) Guaranty: An LP organizes business operations with one or more general partners who assume full liability for the partnership's debts. However, limited partners' liability is restricted to the extent of their investment. In this type of guaranty, a limited partner agrees to provide additional assurance to lenders by assuming some level of liability for the business debt. 4. Limited Liability Company (LLC) Guaranty: In an LLC, members enjoy limited liability protection, shielding their personal assets from business debts. However, with an LLC guaranty, one or more members accept liability, up to a certain amount or only for specific debts, ensuring the lender's confidence in the debt repayment. It is essential for both lenders and guarantors to carefully review and understand the terms and conditions of the Hennepin Minnesota Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Consulting with legal professionals experienced in business law, specifically in Hennepin County, is highly recommended ensuring compliance with local regulations and secure the interests of all parties involved.Hennepin Minnesota Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legally binding document that provides a guarantee for the repayment of business debts in Hennepin County, Minnesota. This type of guaranty is usually utilized when a business entity seeks financing from a lender, and the lender requires additional reassurance that the debt will be repaid. The Hennepin Minnesota Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability serves as a protective measure for lenders, as it ensures that the guarantor will assume responsibility for the debt in case the primary borrower defaults. This guaranty can help mitigate the lender's risk and increase the likelihood of securing financing for the business. There are several types of Hennepin Minnesota Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, including: 1. Personal Guaranty: In this type of guaranty, an individual acts as the guarantor and pledges to repay the business debt using their personal assets if the borrower defaults. The guarantor retains limited liability, meaning their liability is capped at a predetermined amount or only covers specific debts. 2. Corporate Guaranty: This form of guaranty involves a corporation as the guarantor, assuming responsibility for the business debt. The corporation typically has limited liability, as stated in its bylaws or articles of incorporation, safeguarding its shareholders from personal liability for the debt. 3. Limited Partnership (LP) Guaranty: An LP organizes business operations with one or more general partners who assume full liability for the partnership's debts. However, limited partners' liability is restricted to the extent of their investment. In this type of guaranty, a limited partner agrees to provide additional assurance to lenders by assuming some level of liability for the business debt. 4. Limited Liability Company (LLC) Guaranty: In an LLC, members enjoy limited liability protection, shielding their personal assets from business debts. However, with an LLC guaranty, one or more members accept liability, up to a certain amount or only for specific debts, ensuring the lender's confidence in the debt repayment. It is essential for both lenders and guarantors to carefully review and understand the terms and conditions of the Hennepin Minnesota Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Consulting with legal professionals experienced in business law, specifically in Hennepin County, is highly recommended ensuring compliance with local regulations and secure the interests of all parties involved.