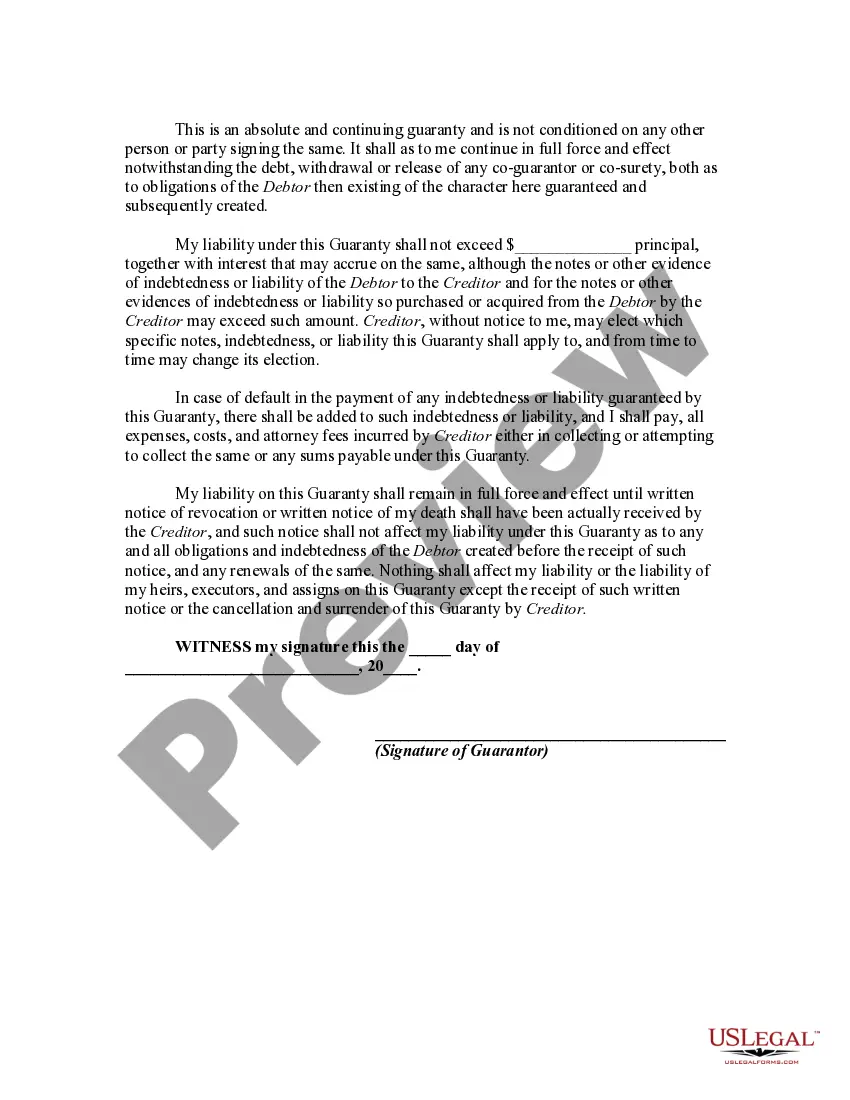

A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Los Angeles California Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legally binding agreement that protects the lender's interests by providing an additional layer of security when businesses seek financial assistance. This guaranty is specifically designed for businesses operating in Los Angeles, California, and serves as a crucial tool in the region's commercial landscape. Keywords: Los Angeles California, continuing guaranty, business indebtedness, guarantor, limited liability, financial agreement. Different types of Los Angeles California Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability may include: 1. Limited Liability Company (LLC) Guaranty: This type of guaranty is specifically tailored for businesses operating as LCS in Los Angeles. It limits the personal liability of the guarantor while ensuring the lender's security in case of default or bankruptcy. 2. Corporation Guaranty: Designed for businesses registered as corporations, this guaranty outlines the limited liability of the guarantor, shielding their personal assets while providing lenders with confidence that their financial interests are protected. 3. Partnership Guaranty: This type of guaranty relates to businesses operating as partnerships. It sets forth the limited liability of each partner individually, ensuring that the guarantor's liability is proportionate to their respective ownership stake in the business. 4. Joint and Several guaranties: This form of guaranty involves multiple guarantors who share equal responsibility for the business indebtedness. In the context of Los Angeles, it offers an added layer of security for lenders by holding all guarantors jointly and severally liable for the debt. 5. Individual Guaranty: This type of guaranty involves a single individual taking on the responsibility of guaranteeing the business indebtedness. It establishes limited liability for the guarantor, protecting their personal assets while providing lenders with reassurance. In summary, Los Angeles California Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal agreement that offers lenders an additional safeguard in providing financial assistance to businesses operating in Los Angeles. Through different types of guaranties tailored for various business structures, this contractual arrangement ensures limited liability for guarantors while bolstering the lenders' confidence in recovering their funds in case of default or bankruptcy.Los Angeles California Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legally binding agreement that protects the lender's interests by providing an additional layer of security when businesses seek financial assistance. This guaranty is specifically designed for businesses operating in Los Angeles, California, and serves as a crucial tool in the region's commercial landscape. Keywords: Los Angeles California, continuing guaranty, business indebtedness, guarantor, limited liability, financial agreement. Different types of Los Angeles California Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability may include: 1. Limited Liability Company (LLC) Guaranty: This type of guaranty is specifically tailored for businesses operating as LCS in Los Angeles. It limits the personal liability of the guarantor while ensuring the lender's security in case of default or bankruptcy. 2. Corporation Guaranty: Designed for businesses registered as corporations, this guaranty outlines the limited liability of the guarantor, shielding their personal assets while providing lenders with confidence that their financial interests are protected. 3. Partnership Guaranty: This type of guaranty relates to businesses operating as partnerships. It sets forth the limited liability of each partner individually, ensuring that the guarantor's liability is proportionate to their respective ownership stake in the business. 4. Joint and Several guaranties: This form of guaranty involves multiple guarantors who share equal responsibility for the business indebtedness. In the context of Los Angeles, it offers an added layer of security for lenders by holding all guarantors jointly and severally liable for the debt. 5. Individual Guaranty: This type of guaranty involves a single individual taking on the responsibility of guaranteeing the business indebtedness. It establishes limited liability for the guarantor, protecting their personal assets while providing lenders with reassurance. In summary, Los Angeles California Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal agreement that offers lenders an additional safeguard in providing financial assistance to businesses operating in Los Angeles. Through different types of guaranties tailored for various business structures, this contractual arrangement ensures limited liability for guarantors while bolstering the lenders' confidence in recovering their funds in case of default or bankruptcy.