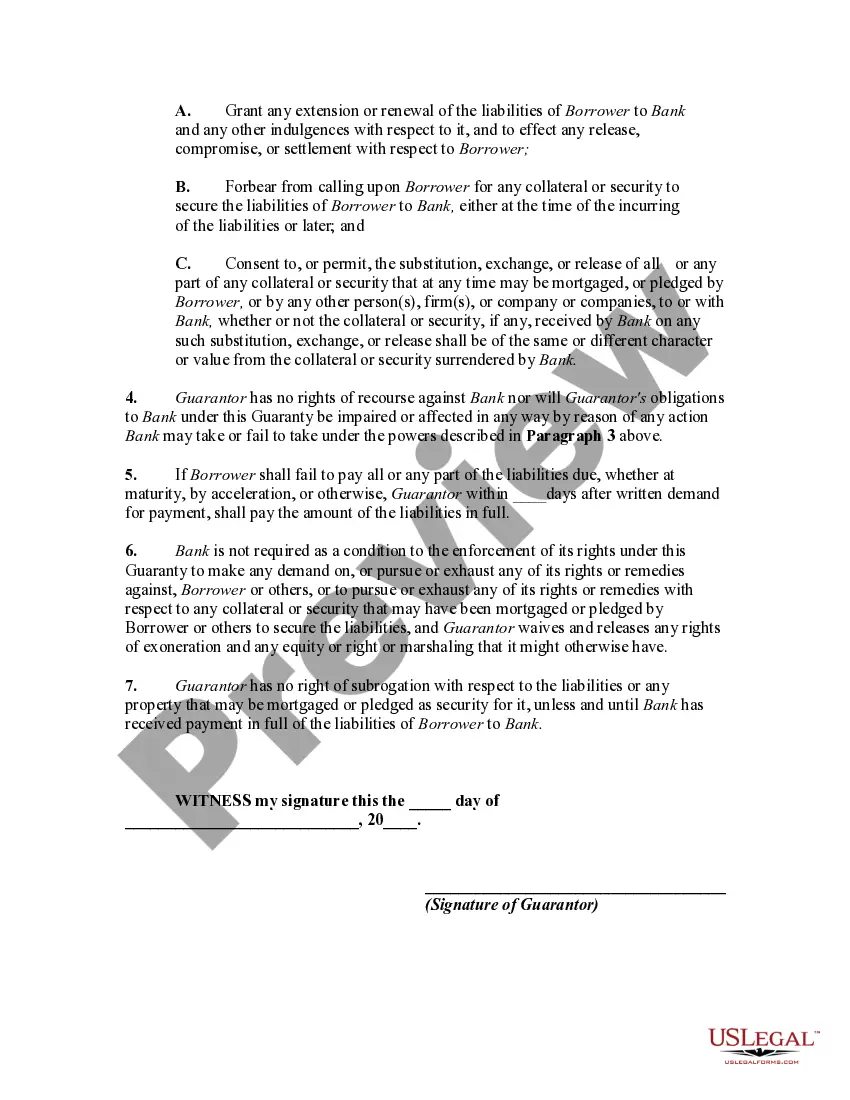

A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor.

The contract of guaranty may be absolute or it may be conditional. An absolute guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A line of credit is an arrangement in which a lender extends a specified amount of credit to borrower for a specified time period.

Chicago Illinois Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit is a legal document that guarantees the full payment of a loan when a line of credit is extended in Chicago, Illinois. This type of guarantee ensures the lender or creditor that they will be reimbursed in full, even if the borrower defaults on the loan. Chicago, Illinois, being a major financial hub, is home to numerous financial institutions and credit facilities, making the Absolute Guaranty of Payment a common practice in the region. This legally binding agreement provides a sense of security to lenders, allowing them to extend lines of credit with confidence. There are different variations of Chicago Illinois Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit, some of which include: 1. Personal Guaranty: This refers to a guarantee provided by an individual personally, where they agree to be personally liable for the loan amount. This type of guaranty is often required when the borrower's financial standing is not strong enough to qualify for credit on their own. 2. Corporate Guaranty: In the case of a business or corporation seeking credit, a corporate guaranty may be required. This means that the business entity itself assumes responsibility for the loan, ensuring repayment. 3. Limited Guaranty: A limited guaranty sets limitations on the guarantor's liability, protecting them from being held fully responsible for the loan in case of default. This type of guaranty may be negotiated between the borrower and the lender, taking into consideration the specific circumstances of the credit extension. 4. Absolute Guaranty: An absolute guaranty is an unconditional promise to repay the loan in full. It holds the guarantor liable for all aspects of the loan, including any interest, fees, or charges that may arise. This type of guaranty is highly comprehensive and offers the highest level of assurance to the lender. When considering an Absolute Guaranty of Payment in consideration of an extension of a line of credit in Chicago, Illinois, it is essential to consult with a legal professional to ensure that all parties fully understand their rights and obligations.Chicago Illinois Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit is a legal document that guarantees the full payment of a loan when a line of credit is extended in Chicago, Illinois. This type of guarantee ensures the lender or creditor that they will be reimbursed in full, even if the borrower defaults on the loan. Chicago, Illinois, being a major financial hub, is home to numerous financial institutions and credit facilities, making the Absolute Guaranty of Payment a common practice in the region. This legally binding agreement provides a sense of security to lenders, allowing them to extend lines of credit with confidence. There are different variations of Chicago Illinois Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit, some of which include: 1. Personal Guaranty: This refers to a guarantee provided by an individual personally, where they agree to be personally liable for the loan amount. This type of guaranty is often required when the borrower's financial standing is not strong enough to qualify for credit on their own. 2. Corporate Guaranty: In the case of a business or corporation seeking credit, a corporate guaranty may be required. This means that the business entity itself assumes responsibility for the loan, ensuring repayment. 3. Limited Guaranty: A limited guaranty sets limitations on the guarantor's liability, protecting them from being held fully responsible for the loan in case of default. This type of guaranty may be negotiated between the borrower and the lender, taking into consideration the specific circumstances of the credit extension. 4. Absolute Guaranty: An absolute guaranty is an unconditional promise to repay the loan in full. It holds the guarantor liable for all aspects of the loan, including any interest, fees, or charges that may arise. This type of guaranty is highly comprehensive and offers the highest level of assurance to the lender. When considering an Absolute Guaranty of Payment in consideration of an extension of a line of credit in Chicago, Illinois, it is essential to consult with a legal professional to ensure that all parties fully understand their rights and obligations.