A guaranty is an undertaking on the part of one person (the guarantor) which binds the guarantor to performing the obligation of the debtor or obligor in the event of default by the debtor or obligor. The contract of guaranty may be absolute or it may be conditional. An absolute or unconditional guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A guaranty may be either continuing or restricted. The contract is restricted if it is limited to the guaranty of a single transaction or to a limited number of specific transactions and is not effective as to transactions other than those guaranteed. The contract is continuing if it contemplates a future course of dealing during an indefinite period, or if it is intended to cover a series of transactions or a succession of credits, or if its purpose is to give to the principal debtor a standing credit to be used by him or her from time to time.

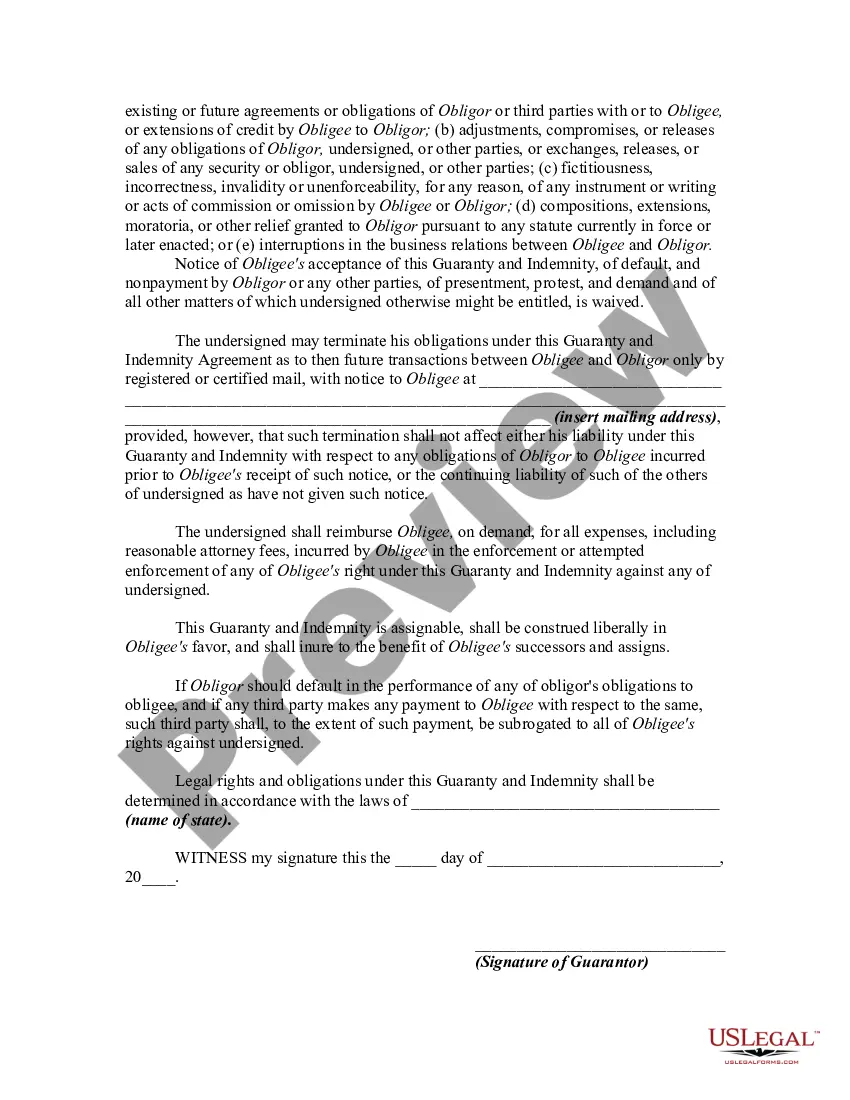

Chicago Illinois Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal document commonly used in the state of Illinois to protect lenders in case a business defaults on its obligations. This guaranty agreement ensures that the guarantor takes full responsibility for the business's debts and provides indemnification to the lender if any losses or damages occur. The Chicago Illinois Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement typically includes the following key elements: 1. Guarantor Identification: The agreement begins by clearly identifying the guarantor, which is usually an individual or entity that agrees to back up the business's debts. 2. Obligation Continuity: It states that the guarantor's obligations will remain in effect until the business's debt is fully repaid and discharged, even if the terms of the underlying loan agreement change or if there is a transfer of rights between the lender and borrower. 3. Unconditional Nature: This agreement emphasizes that the guarantor's obligations are absolute and not subject to any conditions, defenses, or claims against the borrower. Regardless of any disputes or disagreements between the borrower and lender, the guarantor is still liable. 4. Indemnification: The guarantor agrees to indemnify and hold harmless the lender from any losses, costs, expenses, or damages incurred due to the business's default. This provision ensures the lender is protected and can recover any amounts owed. 5. Notice Requirements: It outlines the specific procedures and addresses to which the lender must send any notices or communications regarding the guarantor's obligations. 6. Governing Law and Jurisdiction: The document specifies that it falls under the laws of the state of Illinois and any legal disputes will be resolved within the courts of Chicago, Illinois. Different variations of the Chicago Illinois Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement may exist, depending on the specific requirements or preferences of the lender or guarantor. However, the core elements mentioned above remain integral to these agreements. It is essential to consult with legal professionals experienced in Illinois business law when drafting or executing this document to ensure compliance with state regulations and to protect the interests of all parties involved.Chicago Illinois Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal document commonly used in the state of Illinois to protect lenders in case a business defaults on its obligations. This guaranty agreement ensures that the guarantor takes full responsibility for the business's debts and provides indemnification to the lender if any losses or damages occur. The Chicago Illinois Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement typically includes the following key elements: 1. Guarantor Identification: The agreement begins by clearly identifying the guarantor, which is usually an individual or entity that agrees to back up the business's debts. 2. Obligation Continuity: It states that the guarantor's obligations will remain in effect until the business's debt is fully repaid and discharged, even if the terms of the underlying loan agreement change or if there is a transfer of rights between the lender and borrower. 3. Unconditional Nature: This agreement emphasizes that the guarantor's obligations are absolute and not subject to any conditions, defenses, or claims against the borrower. Regardless of any disputes or disagreements between the borrower and lender, the guarantor is still liable. 4. Indemnification: The guarantor agrees to indemnify and hold harmless the lender from any losses, costs, expenses, or damages incurred due to the business's default. This provision ensures the lender is protected and can recover any amounts owed. 5. Notice Requirements: It outlines the specific procedures and addresses to which the lender must send any notices or communications regarding the guarantor's obligations. 6. Governing Law and Jurisdiction: The document specifies that it falls under the laws of the state of Illinois and any legal disputes will be resolved within the courts of Chicago, Illinois. Different variations of the Chicago Illinois Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement may exist, depending on the specific requirements or preferences of the lender or guarantor. However, the core elements mentioned above remain integral to these agreements. It is essential to consult with legal professionals experienced in Illinois business law when drafting or executing this document to ensure compliance with state regulations and to protect the interests of all parties involved.