A guaranty is an undertaking on the part of one person (the guarantor) which binds the guarantor to performing the obligation of the debtor or obligor in the event of default by the debtor or obligor. The contract of guaranty may be absolute or it may be conditional. An absolute or unconditional guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A guaranty may be either continuing or restricted. The contract is restricted if it is limited to the guaranty of a single transaction or to a limited number of specific transactions and is not effective as to transactions other than those guaranteed. The contract is continuing if it contemplates a future course of dealing during an indefinite period, or if it is intended to cover a series of transactions or a succession of credits, or if its purpose is to give to the principal debtor a standing credit to be used by him or her from time to time.

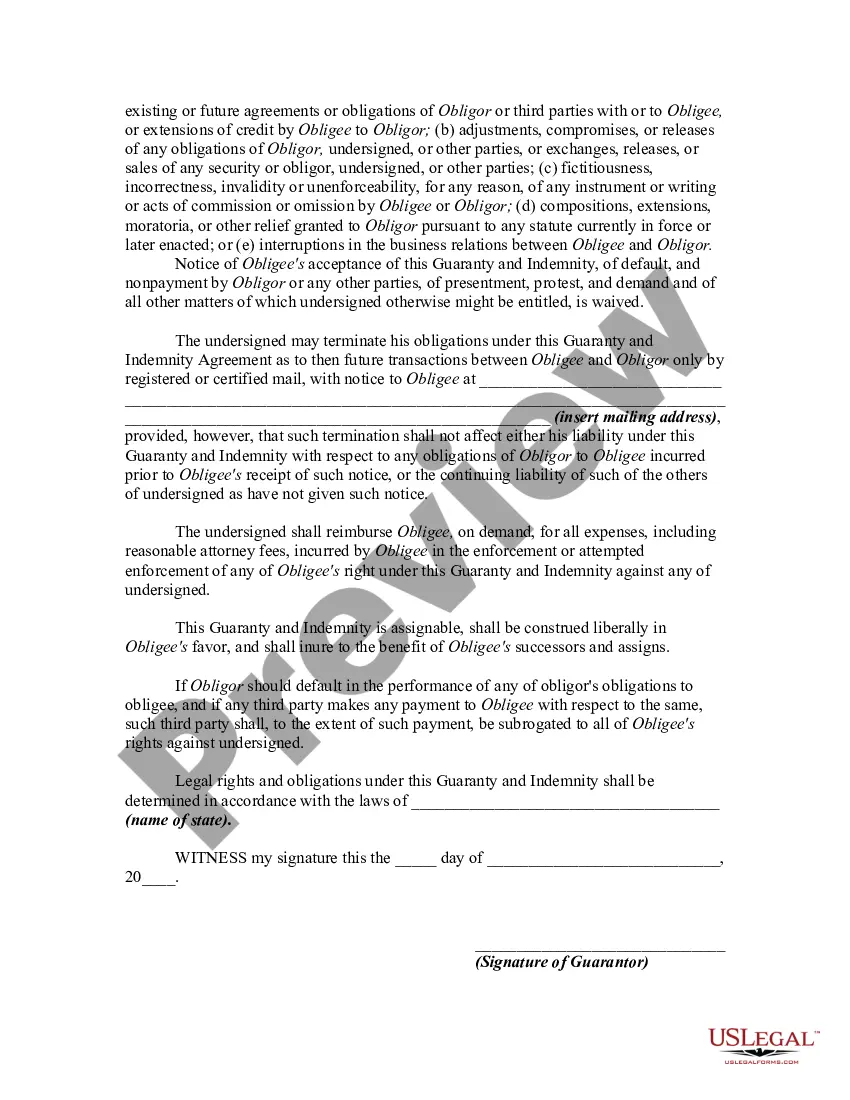

Lima, Arizona Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legally binding document that provides assurance and security to lenders or creditors when extending credit or loans to businesses. This guaranty ensures that in the event the borrowing business defaults on its liabilities, the guarantor, typically an individual or another business entity, will assume responsibility for the outstanding debts. This type of guaranty is typically utilized for various business-related financial obligations such as loans, lines of credit, leases, or any other form of business indebtedness. It acts as a safeguard for lenders by offering an additional layer of assurance that the borrowed funds will be repaid, mitigating the risk of financial loss. The Lima, Arizona Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement usually includes specific clauses and provisions that outline the obligations and responsibilities of the guarantor. Some key aspects covered in the agreement are: 1. Continuing and Unconditional: This implies that the guarantor's obligation to repay the debts and liabilities of the borrower remains in effect until the obligations are fully satisfied, even if the borrowing business undergoes changes in ownership or structure. 2. Indemnity Agreement: This clause ensures that the guarantor indemnifies and holds the lender harmless against any losses, costs, or damages incurred due to the borrower's default. This provides further protection to the lender and encourages the guarantor to maintain the borrower's financial obligations. 3. Scope of Indebtedness: The agreement may outline the specific loans or obligations that fall under the guaranty, including limitations or exclusions. It highlights the maximum liability the guarantor assumes and clarifies the types of debts covered. 4. Joint and Several liabilities: In certain cases, multiple guarantors may be involved, and this clause establishes that each guarantor is individually responsible for the full amount of the indebtedness. The lender can pursue any guarantor for payment without having to first exhaust remedies against the borrower. 5. Notice Requirements: The agreement may specify the notice provisions required for the lender to demand payment from the guarantor. This allows the guarantor an opportunity to rectify any defaults before payment is sought. It is important to note that there may be different variations or revisions of the Lima, Arizona Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement, depending on specific circumstances or lender preferences. These variations may address specific industry regulations, collateral requirements, or additional guarantor obligations. Overall, this legal agreement plays a crucial role in facilitating business financing and providing assurance to lenders, enabling businesses to access the necessary funds for their operations and expansion while protecting the interests of all parties involved.

Lima, Arizona Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legally binding document that provides assurance and security to lenders or creditors when extending credit or loans to businesses. This guaranty ensures that in the event the borrowing business defaults on its liabilities, the guarantor, typically an individual or another business entity, will assume responsibility for the outstanding debts. This type of guaranty is typically utilized for various business-related financial obligations such as loans, lines of credit, leases, or any other form of business indebtedness. It acts as a safeguard for lenders by offering an additional layer of assurance that the borrowed funds will be repaid, mitigating the risk of financial loss. The Lima, Arizona Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement usually includes specific clauses and provisions that outline the obligations and responsibilities of the guarantor. Some key aspects covered in the agreement are: 1. Continuing and Unconditional: This implies that the guarantor's obligation to repay the debts and liabilities of the borrower remains in effect until the obligations are fully satisfied, even if the borrowing business undergoes changes in ownership or structure. 2. Indemnity Agreement: This clause ensures that the guarantor indemnifies and holds the lender harmless against any losses, costs, or damages incurred due to the borrower's default. This provides further protection to the lender and encourages the guarantor to maintain the borrower's financial obligations. 3. Scope of Indebtedness: The agreement may outline the specific loans or obligations that fall under the guaranty, including limitations or exclusions. It highlights the maximum liability the guarantor assumes and clarifies the types of debts covered. 4. Joint and Several liabilities: In certain cases, multiple guarantors may be involved, and this clause establishes that each guarantor is individually responsible for the full amount of the indebtedness. The lender can pursue any guarantor for payment without having to first exhaust remedies against the borrower. 5. Notice Requirements: The agreement may specify the notice provisions required for the lender to demand payment from the guarantor. This allows the guarantor an opportunity to rectify any defaults before payment is sought. It is important to note that there may be different variations or revisions of the Lima, Arizona Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement, depending on specific circumstances or lender preferences. These variations may address specific industry regulations, collateral requirements, or additional guarantor obligations. Overall, this legal agreement plays a crucial role in facilitating business financing and providing assurance to lenders, enabling businesses to access the necessary funds for their operations and expansion while protecting the interests of all parties involved.