A guaranty is an undertaking on the part of one person (the guarantor) which binds the guarantor to performing the obligation of the debtor or obligor in the event of default by the debtor or obligor. The contract of guaranty may be absolute or it may be conditional. An absolute or unconditional guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A guaranty may be either continuing or restricted. The contract is restricted if it is limited to the guaranty of a single transaction or to a limited number of specific transactions and is not effective as to transactions other than those guaranteed. The contract is continuing if it contemplates a future course of dealing during an indefinite period, or if it is intended to cover a series of transactions or a succession of credits, or if its purpose is to give to the principal debtor a standing credit to be used by him or her from time to time.

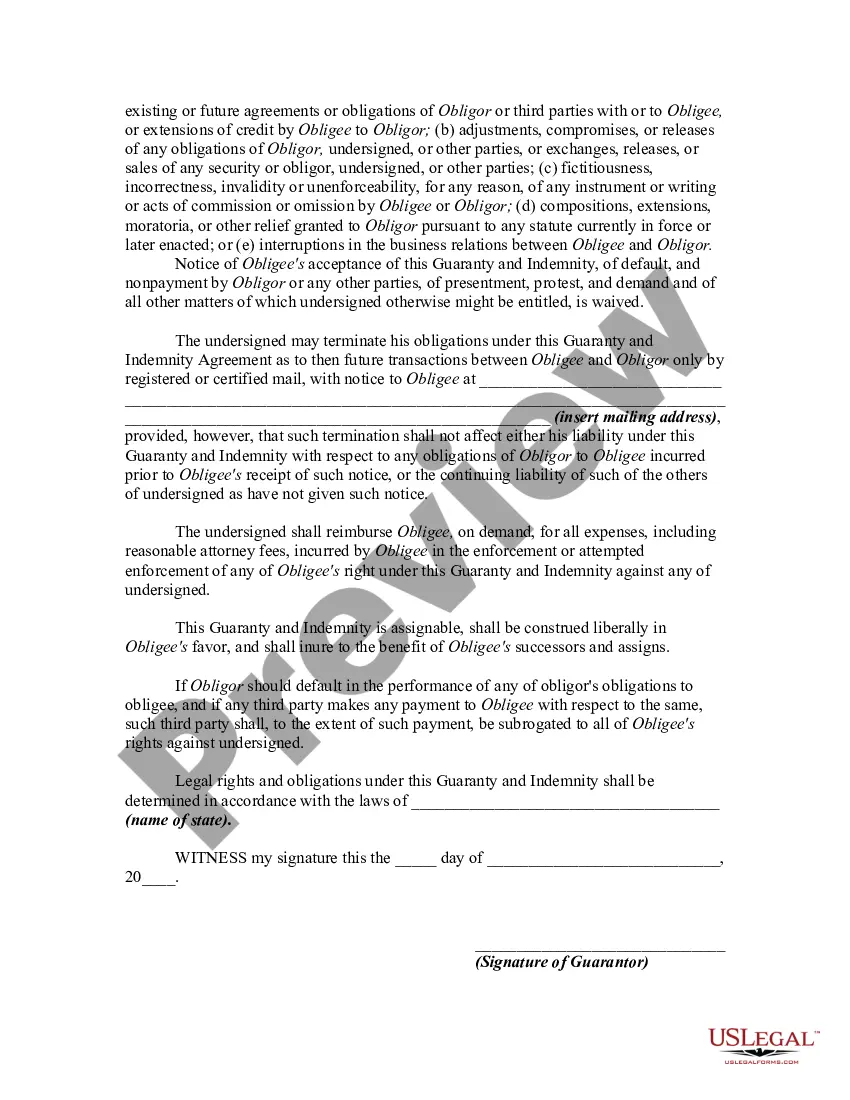

A Salt Lake Utah Continuing and Unconditional Guaranty of Business Indebtedness, including an Indemnity Agreement, is a legally binding contract that provides assurance for the repayment of a business's debt by a third party. This agreement is commonly used in various business transactions, such as loans, credit facilities, or trade agreements, where additional security is required to protect the creditor's interests. The purpose of this guaranty is to ensure that the creditor will be repaid in full, even if the business defaults or is unable to fulfill its obligations. By signing this document, the guarantor assumes full responsibility for the business's indebtedness, making them liable for the repayment, regardless of any external circumstances. Salt Lake Utah offers different types of Continuing and Unconditional Guaranty of Business Indebtedness, including Indemnity Agreements, each serving specific purposes. Some common variations include: 1. General Guaranty: This type of guaranty encompasses all current and future debts incurred by the business, providing broad protection to the creditor. 2. Limited Guaranty: In contrast to the general guaranty, this type covers only specific obligations or debts mentioned in the agreement. The guarantor's liability is limited to those explicitly outlined terms. 3. Joint and Several guaranties: This guaranty is relevant when multiple individuals or entities act as guarantors simultaneously. Each guarantor is individually responsible for the full payment of the entire indebtedness, allowing the creditor to pursue anyone or all of the guarantors for the full amount. 4. Continuing Guaranty: This type of guaranty remains in effect until the debt is fully repaid or until the creditor releases the guarantor from their obligations. It provides ongoing protection to the creditor, even if the debt is refinanced or modified. 5. Unconditional Guaranty: Under an unconditional guaranty, the guarantor's obligation to repay the debt is not dependent on any conditions or events. The creditor can demand payment irrespective of the business's financial condition, performance, or any other external factors. 6. Indemnity Agreement: This agreement stipulates that the guarantor will indemnify the creditor for any losses, costs, or expenses incurred as a result of the business's default. It provides additional protection to the creditor and ensures that they are compensated for any damages suffered during the course of the business relationship. In conclusion, a Salt Lake Utah Continuing and Unconditional Guaranty of Business Indebtedness, including an Indemnity Agreement, is a crucial legal tool that mitigates the financial risks associated with lending or doing business. It offers protection to creditors and provides assurance that they will be repaid, even in the face of default or unforeseen circumstances.A Salt Lake Utah Continuing and Unconditional Guaranty of Business Indebtedness, including an Indemnity Agreement, is a legally binding contract that provides assurance for the repayment of a business's debt by a third party. This agreement is commonly used in various business transactions, such as loans, credit facilities, or trade agreements, where additional security is required to protect the creditor's interests. The purpose of this guaranty is to ensure that the creditor will be repaid in full, even if the business defaults or is unable to fulfill its obligations. By signing this document, the guarantor assumes full responsibility for the business's indebtedness, making them liable for the repayment, regardless of any external circumstances. Salt Lake Utah offers different types of Continuing and Unconditional Guaranty of Business Indebtedness, including Indemnity Agreements, each serving specific purposes. Some common variations include: 1. General Guaranty: This type of guaranty encompasses all current and future debts incurred by the business, providing broad protection to the creditor. 2. Limited Guaranty: In contrast to the general guaranty, this type covers only specific obligations or debts mentioned in the agreement. The guarantor's liability is limited to those explicitly outlined terms. 3. Joint and Several guaranties: This guaranty is relevant when multiple individuals or entities act as guarantors simultaneously. Each guarantor is individually responsible for the full payment of the entire indebtedness, allowing the creditor to pursue anyone or all of the guarantors for the full amount. 4. Continuing Guaranty: This type of guaranty remains in effect until the debt is fully repaid or until the creditor releases the guarantor from their obligations. It provides ongoing protection to the creditor, even if the debt is refinanced or modified. 5. Unconditional Guaranty: Under an unconditional guaranty, the guarantor's obligation to repay the debt is not dependent on any conditions or events. The creditor can demand payment irrespective of the business's financial condition, performance, or any other external factors. 6. Indemnity Agreement: This agreement stipulates that the guarantor will indemnify the creditor for any losses, costs, or expenses incurred as a result of the business's default. It provides additional protection to the creditor and ensures that they are compensated for any damages suffered during the course of the business relationship. In conclusion, a Salt Lake Utah Continuing and Unconditional Guaranty of Business Indebtedness, including an Indemnity Agreement, is a crucial legal tool that mitigates the financial risks associated with lending or doing business. It offers protection to creditors and provides assurance that they will be repaid, even in the face of default or unforeseen circumstances.