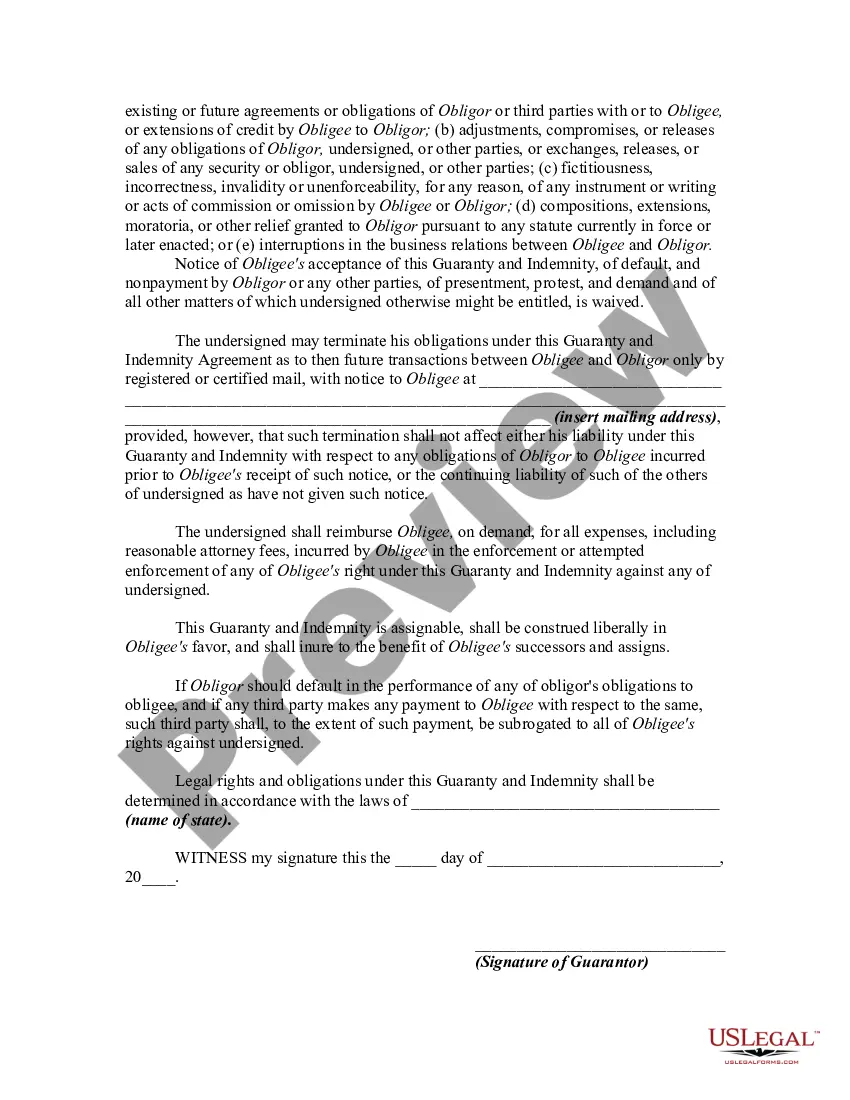

A guaranty is an undertaking on the part of one person (the guarantor) which binds the guarantor to performing the obligation of the debtor or obligor in the event of default by the debtor or obligor. The contract of guaranty may be absolute or it may be conditional. An absolute or unconditional guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A guaranty may be either continuing or restricted. The contract is restricted if it is limited to the guaranty of a single transaction or to a limited number of specific transactions and is not effective as to transactions other than those guaranteed. The contract is continuing if it contemplates a future course of dealing during an indefinite period, or if it is intended to cover a series of transactions or a succession of credits, or if its purpose is to give to the principal debtor a standing credit to be used by him or her from time to time.

A San Diego California Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legally binding document that outlines the terms and conditions under which a guarantor assumes responsibility for the repayment of a business's debts. This agreement serves as a form of financial security for lenders or creditors, providing them with recourse in case the borrower is unable to fulfill its repayment obligations. The agreement typically includes a guarantee by the guarantor that they will personally repay all outstanding debts owed by the business in the event of default. It is crucial to note that this guarantee is continuing, meaning that it remains in effect until all obligations are fully discharged, even if the business undergoes changes in ownership or structure. The San Diego California Continuing and Unconditional Guaranty of Business Indebtedness may include additional provisions such as an indemnity agreement. This agreement acts as a further protection for the lender or creditor, ensuring that they will be reimbursed for any losses or damages incurred due to a default or breach of contract by the borrower. Different types or variations of the San Diego California Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement may exist depending on factors such as the nature of the indebtedness, the specific terms negotiated between the parties, and the legal requirements of the jurisdiction. For example, there may be a specific type of guaranty for real estate-related debts, commonly referred to as a "Real Estate Guaranty." This variant is designed to address the unique characteristics of real estate transactions, such as mortgage financing or lease agreements. Another potential type could be a "Secured Guaranty," which incorporates collateral or assets as additional security for the lender or creditor. This form of guaranty ensures that if the borrower defaults, the lender can seize and liquidate the pledged assets to recover the outstanding debts. It is crucial to consult with legal professionals familiar with San Diego California law to ensure that the San Diego California Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is tailored to the specific needs and requirements of the parties involved.A San Diego California Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legally binding document that outlines the terms and conditions under which a guarantor assumes responsibility for the repayment of a business's debts. This agreement serves as a form of financial security for lenders or creditors, providing them with recourse in case the borrower is unable to fulfill its repayment obligations. The agreement typically includes a guarantee by the guarantor that they will personally repay all outstanding debts owed by the business in the event of default. It is crucial to note that this guarantee is continuing, meaning that it remains in effect until all obligations are fully discharged, even if the business undergoes changes in ownership or structure. The San Diego California Continuing and Unconditional Guaranty of Business Indebtedness may include additional provisions such as an indemnity agreement. This agreement acts as a further protection for the lender or creditor, ensuring that they will be reimbursed for any losses or damages incurred due to a default or breach of contract by the borrower. Different types or variations of the San Diego California Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement may exist depending on factors such as the nature of the indebtedness, the specific terms negotiated between the parties, and the legal requirements of the jurisdiction. For example, there may be a specific type of guaranty for real estate-related debts, commonly referred to as a "Real Estate Guaranty." This variant is designed to address the unique characteristics of real estate transactions, such as mortgage financing or lease agreements. Another potential type could be a "Secured Guaranty," which incorporates collateral or assets as additional security for the lender or creditor. This form of guaranty ensures that if the borrower defaults, the lender can seize and liquidate the pledged assets to recover the outstanding debts. It is crucial to consult with legal professionals familiar with San Diego California law to ensure that the San Diego California Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is tailored to the specific needs and requirements of the parties involved.