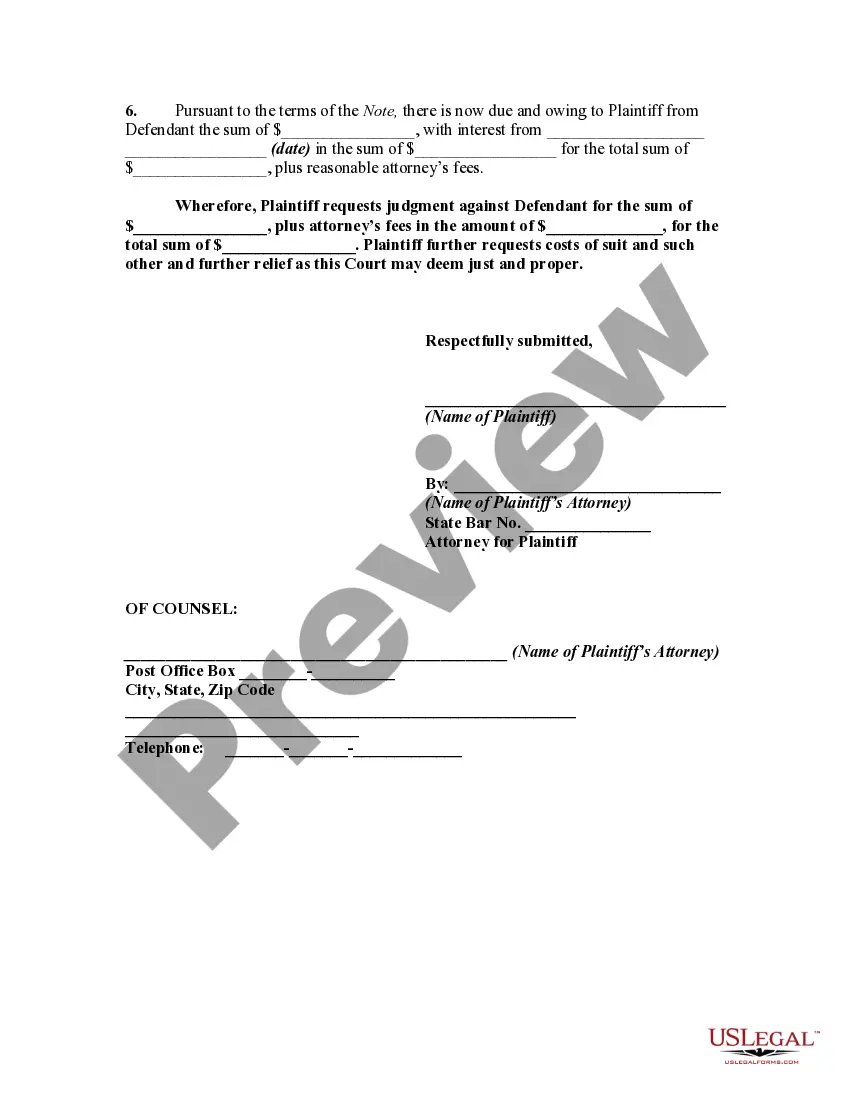

The form is a complaint for a default on payments due pursuant to a promissory note. The complaint adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Chicago Illinois Complaint for Past Due Promissory Note is a legal document filed in the state of Illinois when a borrower fails to fulfill their obligations under a promissory note. A promissory note is a written contract where one party promises to pay a specific amount of money to another party within a defined period. In Chicago, there are several types of Complaints for Past Due Promissory Note that can be filed based on the circumstances of the default. These may include: 1. Chicago Illinois Complaint for Non-payment: This type of complaint is filed when the borrower completely fails to make any payment as agreed upon in the promissory note. 2. Chicago Illinois Complaint for Late Payments: This complaint is filed when the borrower has made partial payments but has consistently been late or irregular in meeting the payment schedule outlined in the promissory note. 3. Chicago Illinois Complaint for Default on Specific Terms: This type of complaint is filed when the borrower fails to meet specific conditions or terms mentioned in the promissory note, such as providing collateral or insurance as agreed upon. 4. Chicago Illinois Complaint for Breach of Agreement: This complaint is filed when the borrower violates any other terms or provisions of the promissory note, not specifically related to payment or default. The Illinois Complaint for Past Due Promissory Note typically includes key information relevant to the case, such as: 1. Introduction: It identifies the plaintiff (lender) and the defendant (borrower) and states their respective addresses. 2. Promissory Note Details: It provides a detailed description of the promissory note, including the date of execution, the principal amount borrowed, the repayment terms, the interest rate, and any additional terms agreed upon. 3. Amount Due: It specifies the total amount due from the borrower, including principal, interest, and any additional charges or fees as outlined in the promissory note. 4. Default Notice: It indicates the date on which the borrower was informed about the default and any subsequent notices sent to rectify the situation. 5. Damages and Relief Sought: It outlines the damages suffered by the lender due to the borrower's default and requests the court to order the borrower to pay the outstanding amount along with any legal costs incurred. It is important to consult with an attorney familiar with Illinois laws to ensure the accurate preparation and filing of the Complaint for Past Due Promissory Note in Chicago.Chicago Illinois Complaint for Past Due Promissory Note is a legal document filed in the state of Illinois when a borrower fails to fulfill their obligations under a promissory note. A promissory note is a written contract where one party promises to pay a specific amount of money to another party within a defined period. In Chicago, there are several types of Complaints for Past Due Promissory Note that can be filed based on the circumstances of the default. These may include: 1. Chicago Illinois Complaint for Non-payment: This type of complaint is filed when the borrower completely fails to make any payment as agreed upon in the promissory note. 2. Chicago Illinois Complaint for Late Payments: This complaint is filed when the borrower has made partial payments but has consistently been late or irregular in meeting the payment schedule outlined in the promissory note. 3. Chicago Illinois Complaint for Default on Specific Terms: This type of complaint is filed when the borrower fails to meet specific conditions or terms mentioned in the promissory note, such as providing collateral or insurance as agreed upon. 4. Chicago Illinois Complaint for Breach of Agreement: This complaint is filed when the borrower violates any other terms or provisions of the promissory note, not specifically related to payment or default. The Illinois Complaint for Past Due Promissory Note typically includes key information relevant to the case, such as: 1. Introduction: It identifies the plaintiff (lender) and the defendant (borrower) and states their respective addresses. 2. Promissory Note Details: It provides a detailed description of the promissory note, including the date of execution, the principal amount borrowed, the repayment terms, the interest rate, and any additional terms agreed upon. 3. Amount Due: It specifies the total amount due from the borrower, including principal, interest, and any additional charges or fees as outlined in the promissory note. 4. Default Notice: It indicates the date on which the borrower was informed about the default and any subsequent notices sent to rectify the situation. 5. Damages and Relief Sought: It outlines the damages suffered by the lender due to the borrower's default and requests the court to order the borrower to pay the outstanding amount along with any legal costs incurred. It is important to consult with an attorney familiar with Illinois laws to ensure the accurate preparation and filing of the Complaint for Past Due Promissory Note in Chicago.