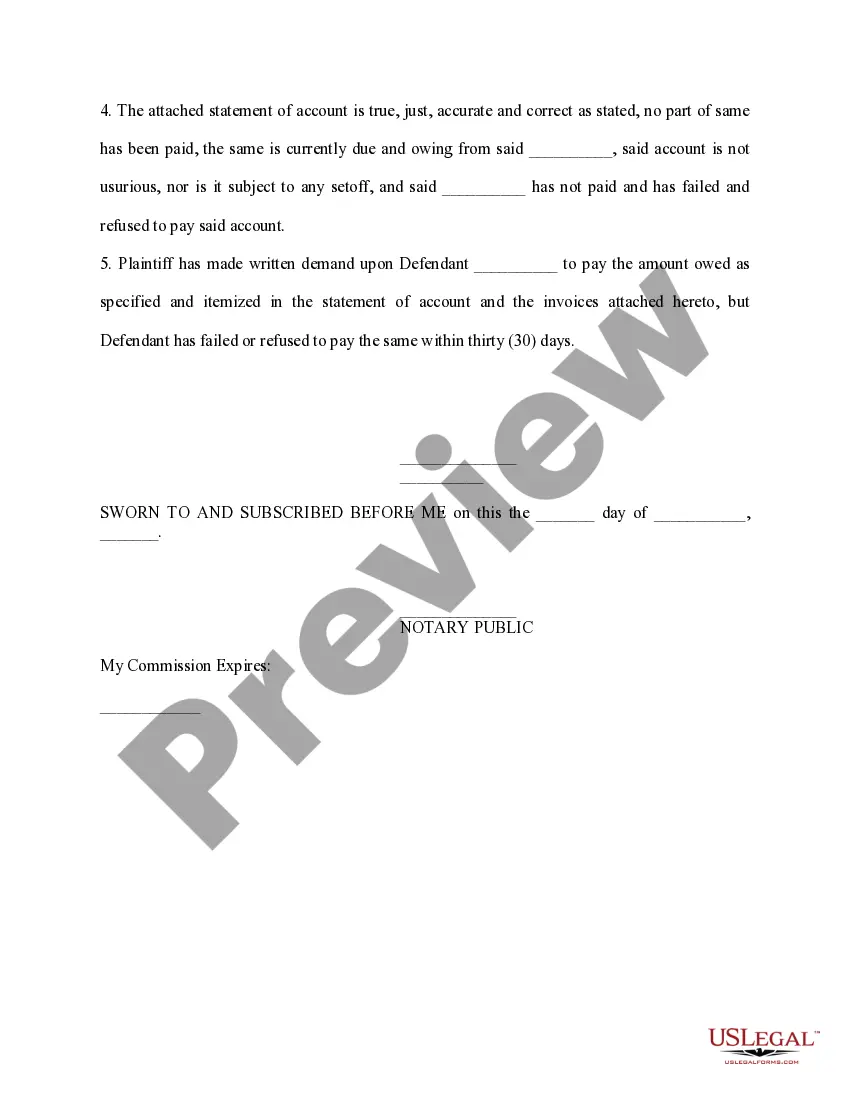

The Fulton Georgia Affidavit of Amount Due on Open Account is a legal document that serves as evidence of a debt owed on an open account in Fulton County, Georgia. This affidavit is commonly used in legal proceedings, such as debt collection or disputes between creditors and debtors. This affidavit is typically filed by a creditor or the party seeking to collect a debt. It outlines the specific details of the debt, including the amount owed, the date the account was opened, and any relevant terms and conditions. The Fulton Georgia Affidavit of Amount Due on Open Account must be signed by the creditor or an authorized representative and notarized to ensure its authenticity and admissibility in court. Keywords: Fulton Georgia, Affidavit of Amount Due, open account, debt, legal document, evidence, debt collection, disputes, creditors, debtors, filed, details, amount owed, date, terms and conditions, signed, authorized representative, notarized, authenticity, admissibility, court. Different types of Fulton Georgia Affidavit of Amount Due on Open Account may include variations based on specific industries or types of debts, such as retail accounts, credit card debts, or business-to-business debts. These variations might exist to address different legal requirements or to accommodate different types of debtors and creditors. It is important to note that while this description provides a general overview of the Fulton Georgia Affidavit of Amount Due on Open Account, it is always recommended consulting with a legal professional to ensure compliance with specific state and local laws as well as industry regulations.

The Fulton Georgia Affidavit of Amount Due on Open Account is a legal document that serves as evidence of a debt owed on an open account in Fulton County, Georgia. This affidavit is commonly used in legal proceedings, such as debt collection or disputes between creditors and debtors. This affidavit is typically filed by a creditor or the party seeking to collect a debt. It outlines the specific details of the debt, including the amount owed, the date the account was opened, and any relevant terms and conditions. The Fulton Georgia Affidavit of Amount Due on Open Account must be signed by the creditor or an authorized representative and notarized to ensure its authenticity and admissibility in court. Keywords: Fulton Georgia, Affidavit of Amount Due, open account, debt, legal document, evidence, debt collection, disputes, creditors, debtors, filed, details, amount owed, date, terms and conditions, signed, authorized representative, notarized, authenticity, admissibility, court. Different types of Fulton Georgia Affidavit of Amount Due on Open Account may include variations based on specific industries or types of debts, such as retail accounts, credit card debts, or business-to-business debts. These variations might exist to address different legal requirements or to accommodate different types of debtors and creditors. It is important to note that while this description provides a general overview of the Fulton Georgia Affidavit of Amount Due on Open Account, it is always recommended consulting with a legal professional to ensure compliance with specific state and local laws as well as industry regulations.