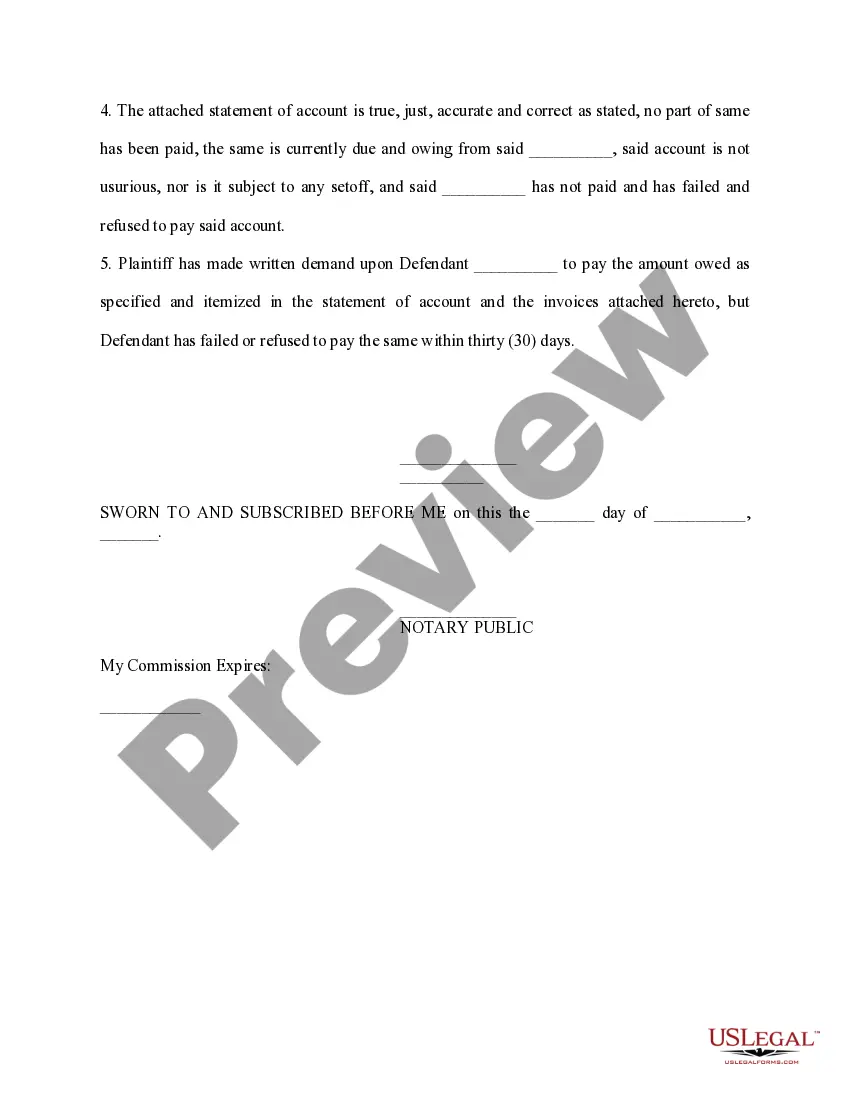

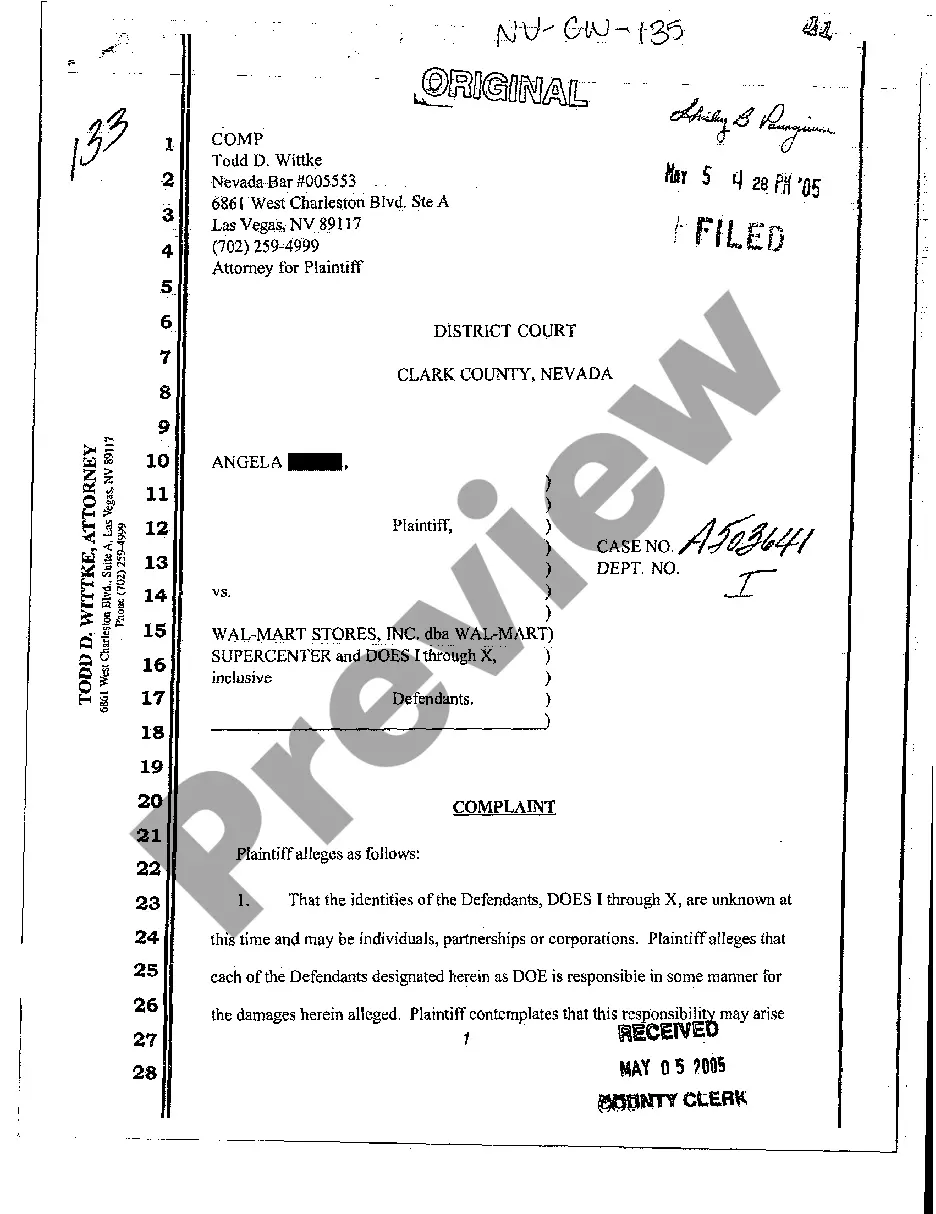

Hillsborough Florida Affidavit of Amount Due on Open Account is a legal document that serves as evidence in a court of law regarding the outstanding debt on an open account. This affidavit is used when a creditor or a business seeks to collect the amount due from a debtor residing in Hillsborough County, Florida. The Hillsborough Florida Affidavit of Amount Due on Open Account is a crucial tool for creditors, as it helps in establishing the validity of the debt and acts as a formal declaration of the outstanding balance. It is a sworn statement that attests to the accuracy of the aforementioned debt and allows creditors to pursue legal action if the debtor fails to fulfill their payment obligations. This affidavit typically includes essential details including the debtor's name, address, and contact information, as well as the creditor's name and contact information. It outlines the specifics of the debt, such as the initial amount owed, any applicable interest charges, and a breakdown of payments made to date. It's important to note that there may be different types of Hillsborough Florida Affidavit of Amount Due on Open Account, which can vary depending on the nature of the debt or the type of business involved. Some examples of variations may include: 1. Individual Debtor: This type of affidavit is used when an individual owes money to a creditor or business in Hillsborough County, Florida. It is the most common form and typically includes personal details of the debtor. 2. Business Debtor: In instances where a business owes money to another business or creditor, a specific Hillsborough Florida Affidavit of Amount Due on Open Account may be necessary. This document may require additional information, such as the business's legal name, tax identification number, and other relevant business details. Overall, the Hillsborough Florida Affidavit of Amount Due on Open Account plays a vital role in the debt collection process, providing a legal avenue for creditors to pursue the outstanding balance owed to them. By presenting accurate and detailed information, creditors can increase their chances of successful debt recovery and hold debtors accountable for their financial obligations.

Hillsborough Florida Affidavit of Amount Due on Open Account

Description

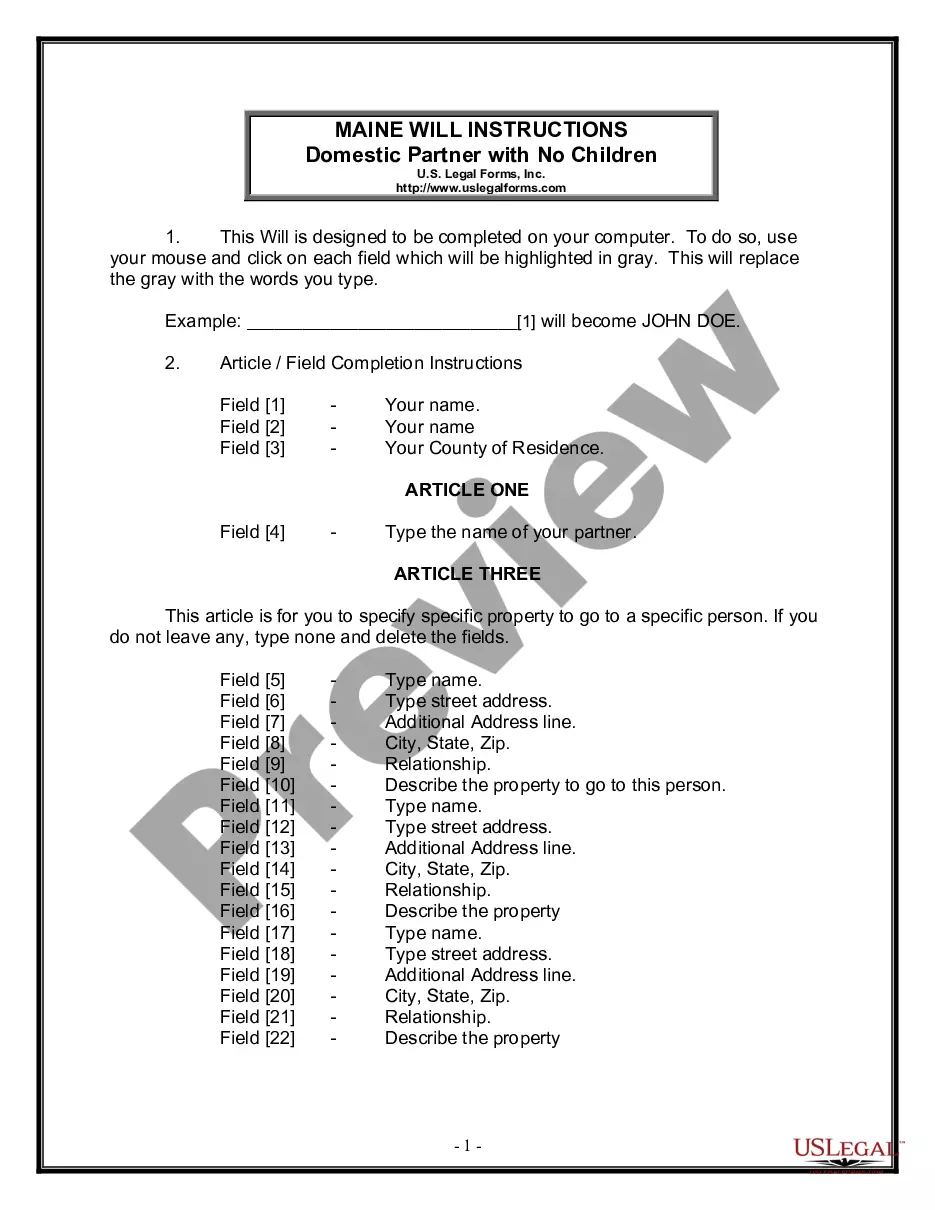

How to fill out Hillsborough Florida Affidavit Of Amount Due On Open Account?

Are you looking to quickly draft a legally-binding Hillsborough Affidavit of Amount Due on Open Account or maybe any other form to handle your personal or business matters? You can go with two options: contact a professional to write a legal document for you or draft it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you receive professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific form templates, including Hillsborough Affidavit of Amount Due on Open Account and form packages. We provide templates for an array of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, double-check if the Hillsborough Affidavit of Amount Due on Open Account is tailored to your state's or county's regulations.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the search again if the template isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Hillsborough Affidavit of Amount Due on Open Account template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the templates we provide are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!