The Franklin Ohio Certificate of Trust for Mortgage is a legal document that pertains to mortgage transactions in Franklin County, Ohio. This certificate serves as a proof of ownership and legal authority for trustees involved in mortgage agreements. It guarantees that the trustee named in the certificate has the power to act on behalf of a trust in matters related to mortgages. The Franklin Ohio Certificate of Trust for Mortgage is an essential document in ensuring the transparency and legality of mortgage transactions. It provides confidence to lenders and borrowers that the trustee has the proper authority to act on behalf of the trust. This certificate is typically required during the mortgage closing process to establish the validity of the trust and the trustee's ability to execute mortgage agreements. Different types of Franklin Ohio Certificate of Trust for Mortgage may include: 1. Revocable Trust Mortgage Certificate: This type of certificate applies to revocable trusts, where the trust creator maintains the power to modify or revoke the trust at any time. The trustee listed in this certificate has the authority to act on behalf of the revocable trust regarding mortgage matters. 2. Irrevocable Trust Mortgage Certificate: Irrevocable trust certificates are used when the trust creator relinquishes their power to modify or revoke the trust. In this case, the trustee named in the certificate has permanent authority to handle mortgage-related activities for the irrevocable trust. 3. Testamentary Trust Mortgage Certificate: This type of certificate is relevant when a trust is created through a will and takes effect upon the death of the trust creator. The trustee specified in this certificate has the authority to initiate and execute mortgage-related tasks on behalf of the testamentary trust. The Franklin Ohio Certificate of Trust for Mortgage establishes the credibility and validity of the trustee's authority, providing assurance to both lenders and borrowers involved in mortgage transactions. It is crucial for all parties to carefully review and understand the contents of this certificate to ensure compliance with legal requirements and protect their rights and interests.

Franklin Ohio Certificate of Trust for Mortgage

Description

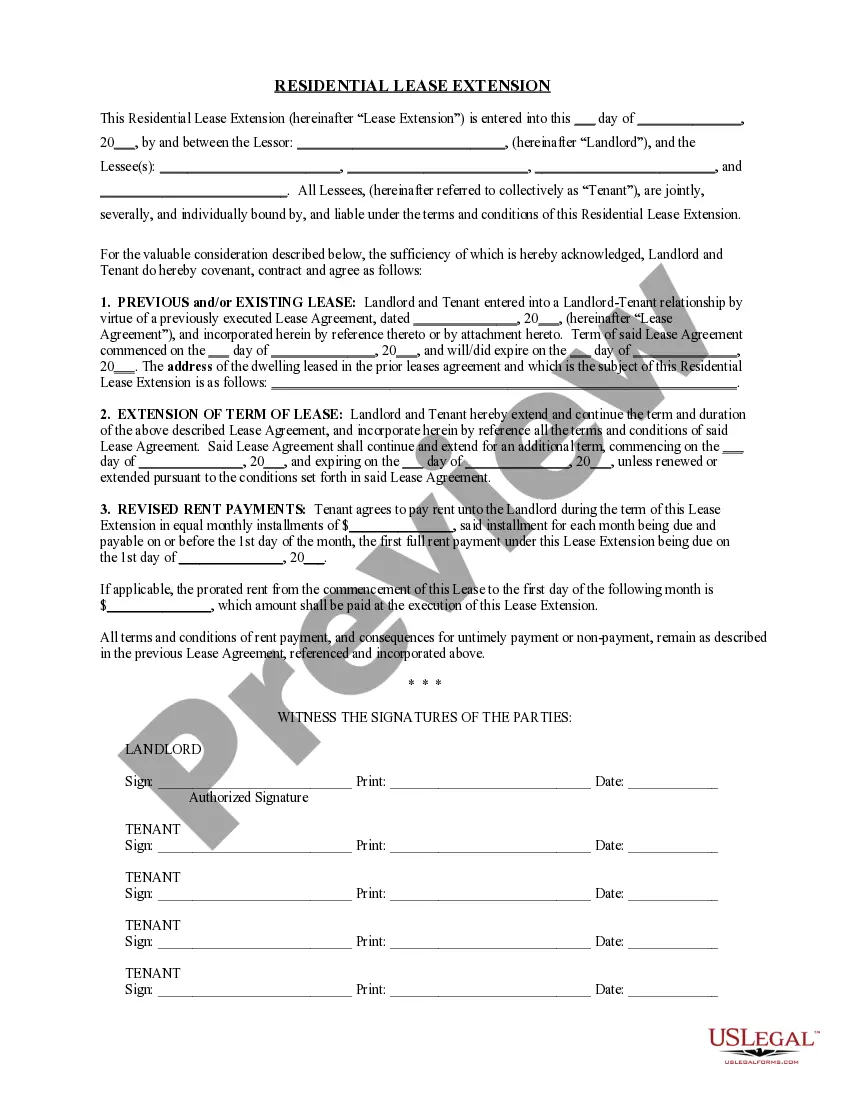

How to fill out Franklin Ohio Certificate Of Trust For Mortgage?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Franklin Certificate of Trust for Mortgage, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Therefore, if you need the current version of the Franklin Certificate of Trust for Mortgage, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Franklin Certificate of Trust for Mortgage:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Franklin Certificate of Trust for Mortgage and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

State property records will show whether your lien is released. You can find information on property records by contacting your local Secretary of State or county recorder of deeds. After you pay off your mortgage, your lender should also return the original note to you.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

The lender must indicate to the local government that the loan has been paid in full. This typically happens through the filing of a certificate of satisfaction or deed of reconveyance, depending on the state.

Once your mortgage is paid off, you'll receive a number of documents from your lender that show your loan has been paid in full and that the bank no longer has a lien on your house. These papers are often called a mortgage release or mortgage satisfaction.

A trust can get a mortgage or loan from a traditional lender if the trust is considered a living or revocable trust. The original trustee who created the trust would still need to be alive for the trust to obtain the traditional mortgage or loan.

We're pleased to announce as of August 1, 2018, Franklin American Mortgage Company is now part of Citizens Bank N.A., one of the nation's oldest and largest financial institutions.

Summary. A mortgage in trust may be something that you have never previously considered, but it may be appropriate. Anyone who owns property can put their mortgage in a revocable living trust so as to not deal with the probate process after death and utilize other estate planning benefits.

You can find information on property records by contacting your local Secretary of State or county recorder of deeds. After you pay off your mortgage, your lender should also return the original note to you.

It can take 30 to 60 days for a lender to report a loan account closure to the credit bureaus, so there may be a few months' lag between when you make your last payment and when your credit reports are updated to reflect it.

A trust loan is a loan offered typically by specialized private lenders directly to an irrevocable trust. This type of loan utilizes property from the trust as collateral. To take out a trust loan, trust documents must permit trustees to use trust property as collateral for the loan.