Houston Texas Certificate of Trust for Mortgage

Description

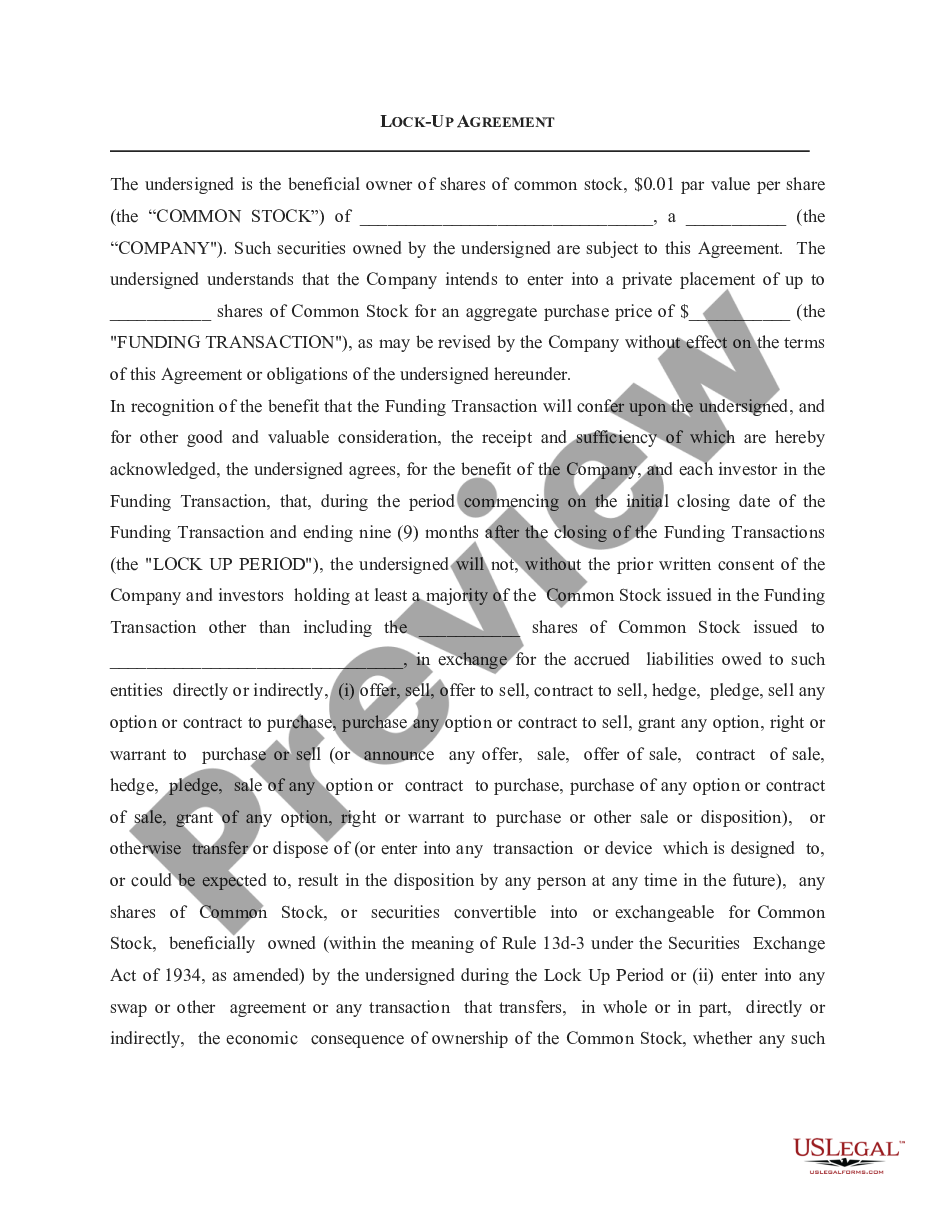

How to fill out Certificate Of Trust For Mortgage?

Organizing documentation for the business or individual requirements is consistently a significant obligation.

When formulating a contract, a public service solicitation, or a power of attorney, it is vital to take into account all federal and state statutes and regulations applicable to the specific region.

Nevertheless, small counties and even municipalities also possess legislative stipulations that you must contemplate.

To discover the one that meets your needs, leverage the search tab in the page header. Verify that the template adheres to legal standards and click Buy Now. Choose the subscription option, then Log In or create an account with US Legal Forms. Use your credit card or PayPal account to pay for your subscription. Download the selected document in your preferred format, print it, or complete it electronically. The remarkable aspect of the US Legal Forms library is that every document you have ever acquired remains accessible - you can retrieve it from your profile within the My documents tab at any time. Join the platform and swiftly obtain verified legal templates for any situation with just a few clicks!

- All these factors contribute to the pressure and time consumption involved in generating a Houston Certificate of Trust for Mortgage without professional assistance.

- It is simple to avoid incurring costs on lawyers for drafting your paperwork and create a legally binding Houston Certificate of Trust for Mortgage independently, utilizing the US Legal Forms online library.

- This is the premier online compilation of state-specific legal documents that are expertly verified, ensuring their legitimacy when selecting a template for your county.

- Previously subscribed users merely need to Log In to their accounts to retrieve the necessary document.

- If you do not yet have a subscription, adhere to the step-by-step guidelines below to acquire the Houston Certificate of Trust for Mortgage.

- Browse the page you have opened and confirm if it contains the required document.

- To accomplish this, utilize the form description and preview if these features are available.

Form popularity

FAQ

Record keeping for a trust involves maintaining comprehensive, organized records of all trust activities, including transactions, distributions, and meetings. Good record-keeping practices help demonstrate compliance with legal requirements and protect the trustee. Utilizing resources like US Legal Forms can simplify the process of tracking and documenting your Houston Texas Certificate of Trust for Mortgage.

The certificate of trust is typically created by the trustee or the attorney who drafted the trust document. This certificate serves as a verification of the trust's existence, including its terms and the authority of the trustee. If you need assistance, US Legal Forms can offer guidance in preparing a valid Houston Texas Certificate of Trust for Mortgage.

Filling out a certification of trust requires you to provide essential details about the trust, including its name, date of creation, and the trustee's information. It’s important to use the correct format and include the Houston Texas Certificate of Trust for Mortgage. Platforms like US Legal Forms can assist you with templates and guidance to ensure accurate completion.

To add a trust to your mortgage, you need to contact your lender to understand their specific requirements. Typically, you will need to provide a copy of the trust agreement and the Houston Texas Certificate of Trust for Mortgage. This ensures that the lender recognizes the trust as a legal entity that can hold property.

Proper bookkeeping for a trust involves tracking all income, expenses, and distributions related to the trust. It's important to maintain detailed records to ensure compliance and transparency. You can use dedicated software or online platforms like US Legal Forms to streamline the process and generate necessary documentation, including statements relevant to the Houston Texas Certificate of Trust for Mortgage.

In Texas, a certificate of trust typically does not need to be recorded unless it involves real property. For trusts managing property, ensuring documentation is filed correctly is crucial. Using a Houston Texas Certificate of Trust for Mortgage can help clarify ownership and authority. For assistance with filing, consider using uslegalforms to access reliable legal resources.

Recording a certificate of trust is not always necessary, but it can be beneficial in certain situations, particularly when dealing with property. For the Houston Texas Certificate of Trust for Mortgage, having it on file may strengthen the trust’s standing in legal matters. Always consult legal advice or trusted resources like uslegalforms to determine the best course of action.

Filling out a certificate of trust requires you to include essential information, such as the trust's name, the appointing trustee, and the beneficiaries. When completing a Houston Texas Certificate of Trust for Mortgage, ensure that all legal names and details are accurate. You can find helpful templates and guidelines through uslegalforms, which can make this process more straightforward.

While a trust itself does not typically need to be recorded in Texas, any property held within a trust may need to be deeded properly. For real estate properties, such as those included in a Houston Texas Certificate of Trust for Mortgage, recording the deed with the local county is essential. This ensures that claims against the property are clear and legally enforceable. Uslegalforms can guide you through these processes.

To place your house in a trust while it has an existing mortgage, you must first review your mortgage agreement. Many lenders allow this, but some may have restrictions. After reviewing your options, you can create a Houston Texas Certificate of Trust for Mortgage that specifies the property and its terms. Services like uslegalforms provide useful templates for creating such documents.