The Montgomery Maryland Certificate of Trust for Mortgage is a crucial legal document that serves to protect the interests of lenders and borrowers involved in mortgage transactions. This certificate establishes the existence and legitimacy of a trust that holds the mortgage, providing transparency and confidence to all parties involved. Keywords: Montgomery Maryland, Certificate of Trust, Mortgage, legal document, protect, lenders, borrowers, transparency, confidence. There are primarily two types of Montgomery Maryland Certificates of Trust for Mortgage: 1. Irrevocable Certificate of Trust: This type of certificate establishes a trust that cannot be altered or revoked without the consent of all beneficiaries involved. It provides lenders with a sense of security, knowing that the agreement cannot be easily modified or terminated by the borrower or other parties. 2. Revocable Certificate of Trust: Unlike an irrevocable certificate, a revocable certificate allows for modifications, amendments, or revocation of the trust agreement by the granter or other authorized individuals. This type is useful when the borrower or granter wants flexibility in managing the trust's assets. Both types of certificates typically contain similar information and provisions. They outline the trust's purpose, identify the trustee(s) responsible for managing the trust, specify the beneficiaries who are entitled to receive the mortgage's benefits, and describe the terms and conditions that govern the mortgage. A Montgomery Maryland Certificate of Trust for Mortgage ensures the protection of the lender's financial interest in adding a layer of security to the mortgage transaction. It offers transparency by clearly designating the trustee(s), verifying the trust's existence, and establishing the legal framework governing the mortgage agreement. By providing lenders and borrowers with confidence in the validity of the trust, this certificate streamlines the mortgage process and promotes a smoother transaction experience.

Montgomery Maryland Certificate of Trust for Mortgage

Description

How to fill out Montgomery Maryland Certificate Of Trust For Mortgage?

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Montgomery Certificate of Trust for Mortgage without professional assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Montgomery Certificate of Trust for Mortgage on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Montgomery Certificate of Trust for Mortgage:

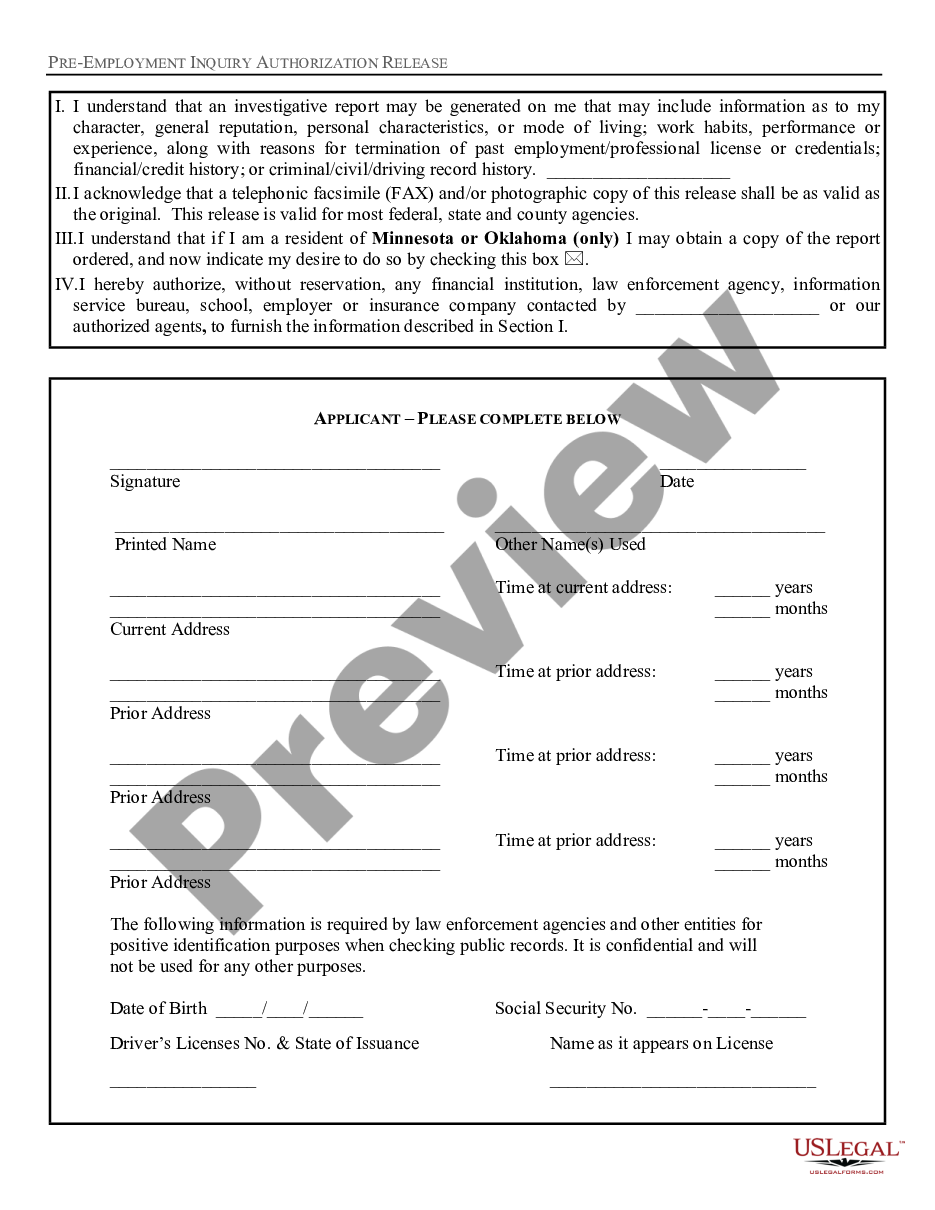

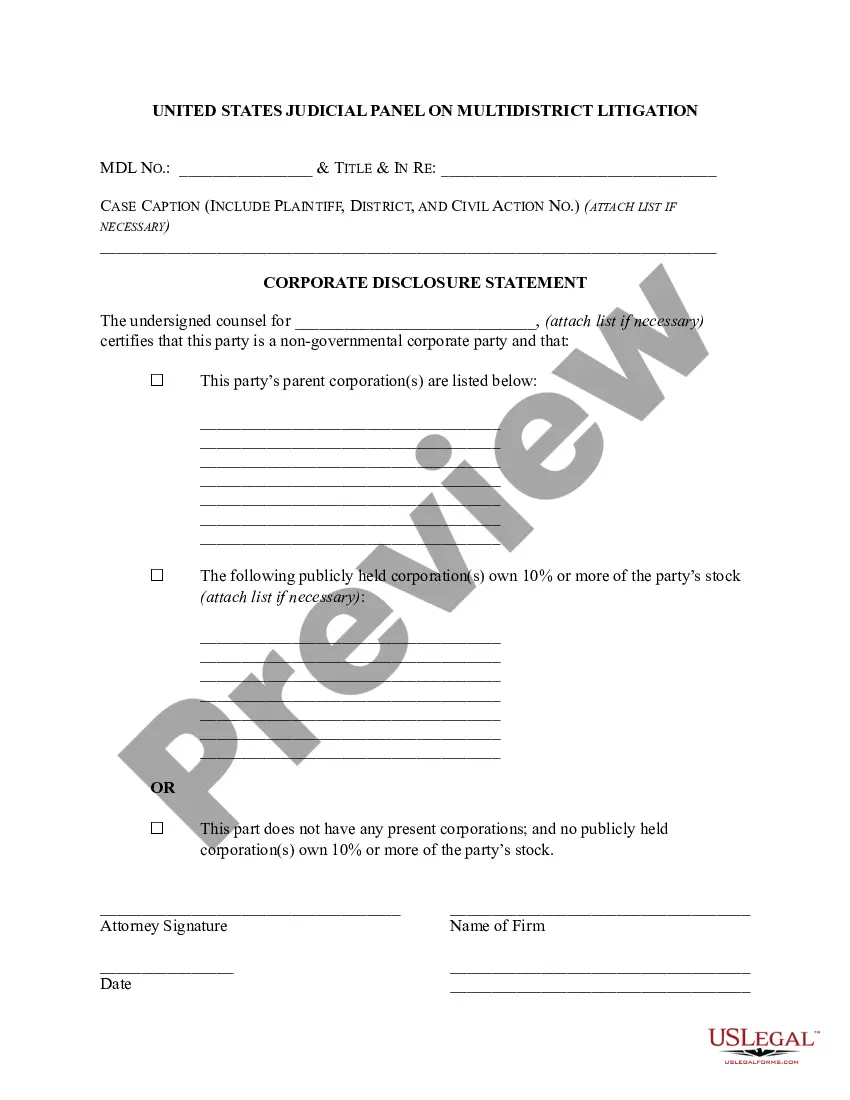

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!