The Nassau New York Certificate of Trust for Mortgage is a legal document that grants a trust the authority to execute mortgage-related transactions in Nassau County, New York. This certificate is necessary when a trust wishes to mortgage property or engage in other mortgage activities within the jurisdiction. It serves as proof that the trust is valid and has the legal capacity to enter into mortgage agreements. The Certificate of Trust for Mortgage in Nassau New York includes specific information about the trust, such as the trust's name, date of establishment, and the names of the trustees authorized to act on behalf of the trust. It also outlines the powers and limitations of the trustees regarding mortgage-related matters. Different types of Nassau New York Certificate of Trust for Mortgage can exist depending on the specific purpose of the trust. Some common types that may be encountered include: 1. Revocable Living Trust Certificate of Trust for Mortgage: This type of certificate is used when a revocable living trust, established by an individual during their lifetime, intends to engage in mortgage transactions. 2. Irrevocable Trust Certificate of Trust for Mortgage: Used when an irrevocable trust, which cannot be altered or revoked once established, wishes to participate in mortgage-related activities. 3. Testamentary Trust Certificate of Trust for Mortgage: This type of certificate is applicable when a trust is created through a person's will and becomes active only after their demise. It allows the testamentary trust to carry out mortgage transactions. 4. Charitable Trust Certificate of Trust for Mortgage: When a trust has been established for charitable purposes, this certificate is employed to enable the trust to engage in mortgage-related activities, such as acquiring property for charitable use. Obtaining a Nassau New York Certificate of Trust for Mortgage is essential for trusts wishing to operate within the jurisdiction. It ensures that the trust's legal capacity to execute mortgage transactions is recognized by lenders, title companies, and other relevant parties involved in the mortgage process. Properly executed certificates provide security and validation for both the trust and the parties with whom they interact in the mortgage industry.

Nassau New York Certificate of Trust for Mortgage

Description

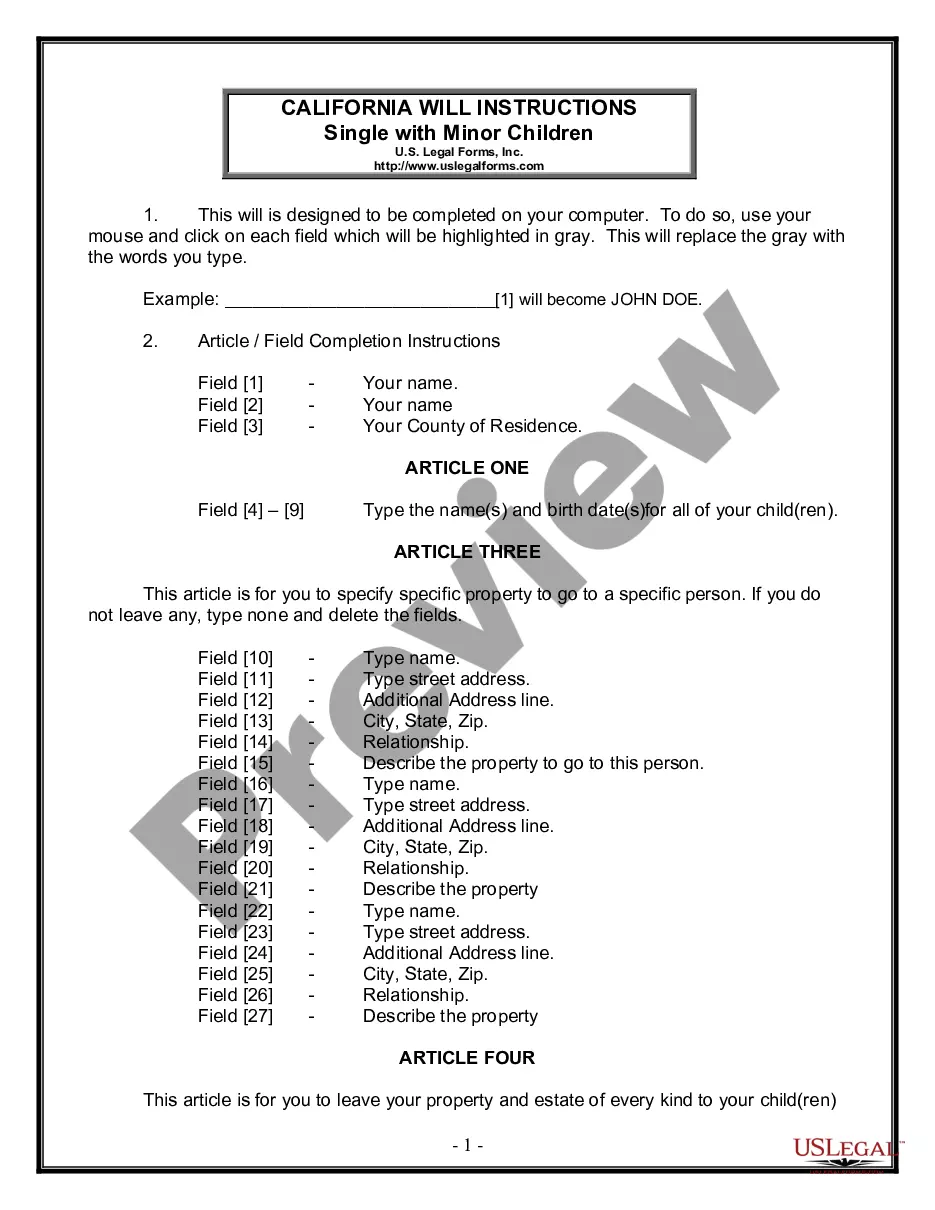

How to fill out Nassau New York Certificate Of Trust For Mortgage?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Nassau Certificate of Trust for Mortgage, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find detailed resources and tutorials on the website to make any tasks related to document completion simple.

Here's how you can locate and download Nassau Certificate of Trust for Mortgage.

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Check the related forms or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and buy Nassau Certificate of Trust for Mortgage.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Nassau Certificate of Trust for Mortgage, log in to your account, and download it. Of course, our website can’t take the place of a legal professional completely. If you need to deal with an exceptionally challenging situation, we recommend using the services of a lawyer to review your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-compliant documents effortlessly!

Form popularity

FAQ

Recording Fees 5 Boroughs, Westchester and Outer CountiesDeed and RP-5217 NYC Filing Fee (Residential)310Subordination Agreement125Nassau CountyDeed and RP-5217 NYC Filing Fee (Residential)60029 more rows

Search for the Property's Owner on NYCityMap The NYCityMap page can give you information on most properties in New York City. You just need to enter the property's address in the search bar. If the address exists, the map will show you the building's location and information, including the real estate's: Owner.

Recording Fees 5 Boroughs, Westchester and Outer CountiesDeed and RP-5217 NYC Filing Fee (Residential)310Subordination Agreement125Nassau CountyDeed and RP-5217 NYC Filing Fee (Residential)60029 more rows

"Should you need any further information, or wish to purchase a certified copy of your deed, you may contact the Suffolk County Clerk's Office at 310 Center Drive in Riverhead or online at .

A title search can take anywhere from a few hours up to five days to complete. There are several factors that can affect the time frame, including: The number and availability of documents that need to be reviewed. The age and transaction history of the property.

Where can I obtain a copy of my deed or mortgage? The fastest way to obtain this information is to come to the Nassau County Clerk's office here at 240 Old Country Rd, Mineola, NY 11501 with the section, block, and lot of the property. If you want to mail your request download the instructions (PDF).

Sign the deed in the presence of a notary public or other authorized official. Record the deed at the county clerk's office in the county where the property is located for a valid transfer. Contact the same office to confirm accepted forms of payment.

You can request a certified or uncertified copy of property records online or in person. Certified copies cost $4 per page. Uncertified copies printed at a City Register Office cost $1 per page. There is no charge for ACRIS copies printed from a personal computer.

How do I find out who currently owns a property in Nassau County? Property information is available online at US Land Records page or come to the County Clerk's Office (Room B-1) to obtain that information.