Collin Texas Certificate of Trust for Successor Trustee is a legal document that serves as evidence of a trust's existence and appoints a successor trustee to administer the trust upon the original trustee's incapacity, resignation, or death. This certificate provides important information about the trust and its beneficiaries, ensuring a smooth transition of power and continuation of trust management. The primary purpose of the Collin Texas Certificate of Trust for Successor Trustee is to allow the successor trustee to assert their authority and access the trust's assets without the need for a full public disclosure of the trust's terms. This document is particularly useful when dealing with financial institutions or third parties who require proof of the trustee's powers, but don't need access to confidential trust details. The Collin Texas Certificate of Trust for Successor Trustee typically includes essential information such as the trust's legal name, the original trustee's name, and their authority to act as trustee. It may also contain details about the beneficiaries, their rights, and the specific powers granted to the successor trustee. Additionally, it may outline the legal requirements and procedures for the successor trustee to follow when managing the trust. Different types of Collin Texas Certificate of Trust for Successor Trustee may include variations in language or formatting, but the essential elements remain consistent. Some common variations may include certificates for revocable living trusts, irrevocable trusts, special needs trusts, charitable trusts, or testamentary trusts. Each type of trust may have slight differences in terms of the designated successor trustee's powers or the specific requirements for the certificate's content. It is crucial to consult an experienced attorney or trust professional to draft a Collin Texas Certificate of Trust for Successor Trustee, ensuring compliance with both state laws and the specific terms of the trust. This document plays a vital role in facilitating the transfer of power and maintaining the privacy of the trust's details, providing peace of mind to all involved parties.

Collin Texas Certificate of Trust for Successor Trustee

Description

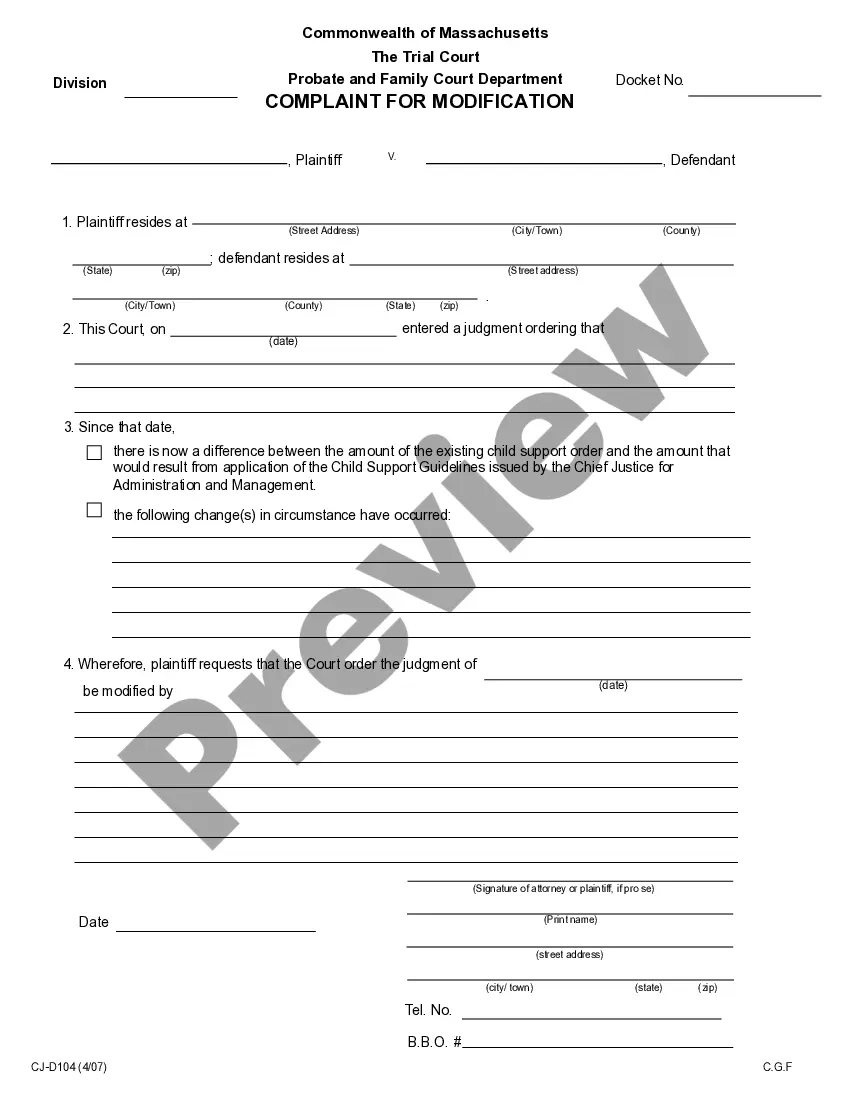

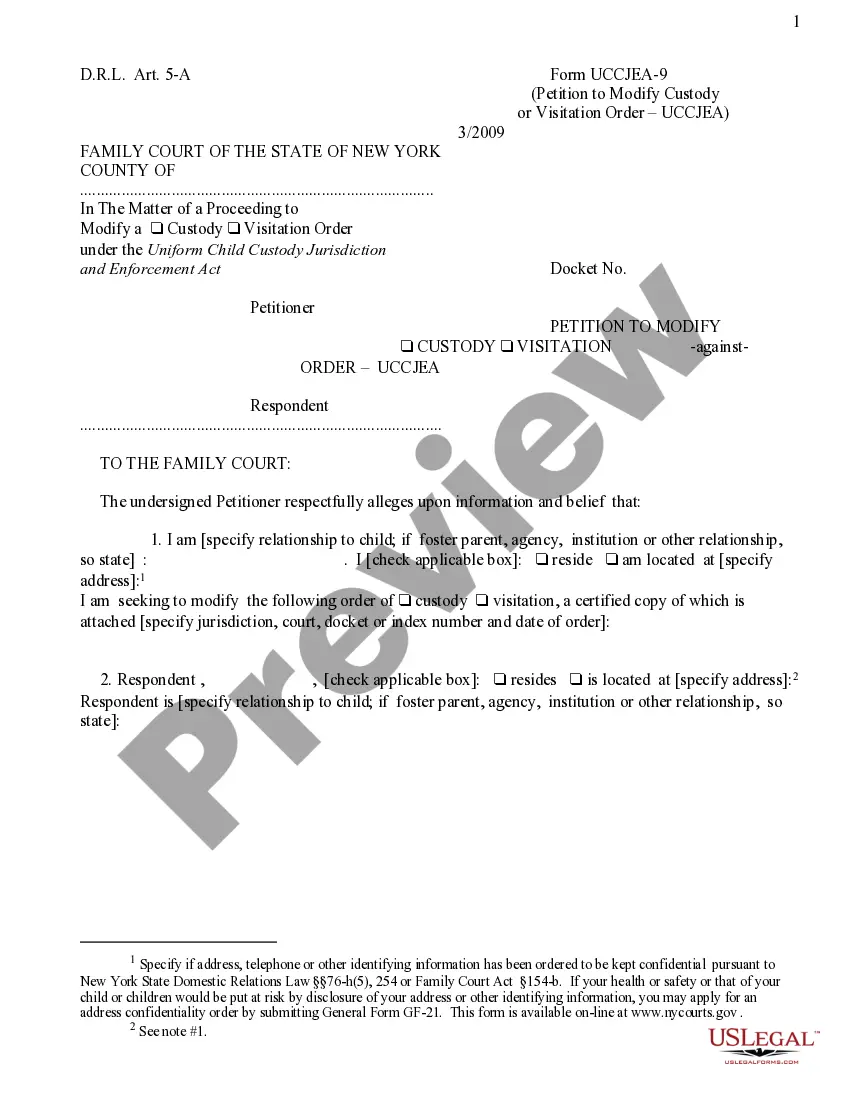

How to fill out Collin Texas Certificate Of Trust For Successor Trustee?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the Collin Certificate of Trust for Successor Trustee.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Collin Certificate of Trust for Successor Trustee will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Collin Certificate of Trust for Successor Trustee:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Collin Certificate of Trust for Successor Trustee on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

An executor operates under the supervision of the probate court. A successor trustee is answerable to the beneficiaries of the trust.

California Certificate of Trust Information A certificate of trust is used by an acting trustee or trustees of a trust to prove to financial institutions or other third parties that he/she/they has/have the authority to act on behalf of the trust.

As a Trust, you need to prepare the Trust Deed on stamp paper.In addition to this, you need to pay a fee of Rs.Once you submit the papers, you can collect a certified copy of the Trust Deed within one week's time from the registrar's office.

Successor Trustee is the person or institution who takes over the management of a living trust property when the original trustee has died or become incapacitated. The exact responsibilities of a successor trustee will vary depending on the instructions left by the creator of the trust (called the Grantor).

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

Successor Trustee is the person or institution who takes over the management of a living trust property when the original trustee has died or become incapacitated. The exact responsibilities of a successor trustee will vary depending on the instructions left by the creator of the trust (called the Grantor).

A successor trustee is named to step in and manage the trust when the trustee is no longer able to continue (usually due to incapacity or death). Typically, several are named in succession in case one or more cannot act.

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.

A trustee, who can either be the trustor or another responsible party, may be appointed while the trustor is still alive; a successor trustee is charged with administering a trust after the trustor or the appointed trustee (if they are different from the trustor) becomes incapacitated or dies.

An executor operates under the supervision of the probate court. A successor trustee is answerable to the beneficiaries of the trust.