In real estate, a short sale occurs when a bank or mortgage lender agrees to discount a loan balance due to an economic hardship on the part of the mortgagor (i.e., the seller). Circumstances determine whether or not banks will discount a loan balance. These circumstances are usually related to the current real estate market climate and the individual borrower's financial situation. A short sale typically is executed to prevent a home foreclosure. Often a bank will choose to allow a short sale if they believe that it will result in a smaller financial loss than foreclosing.

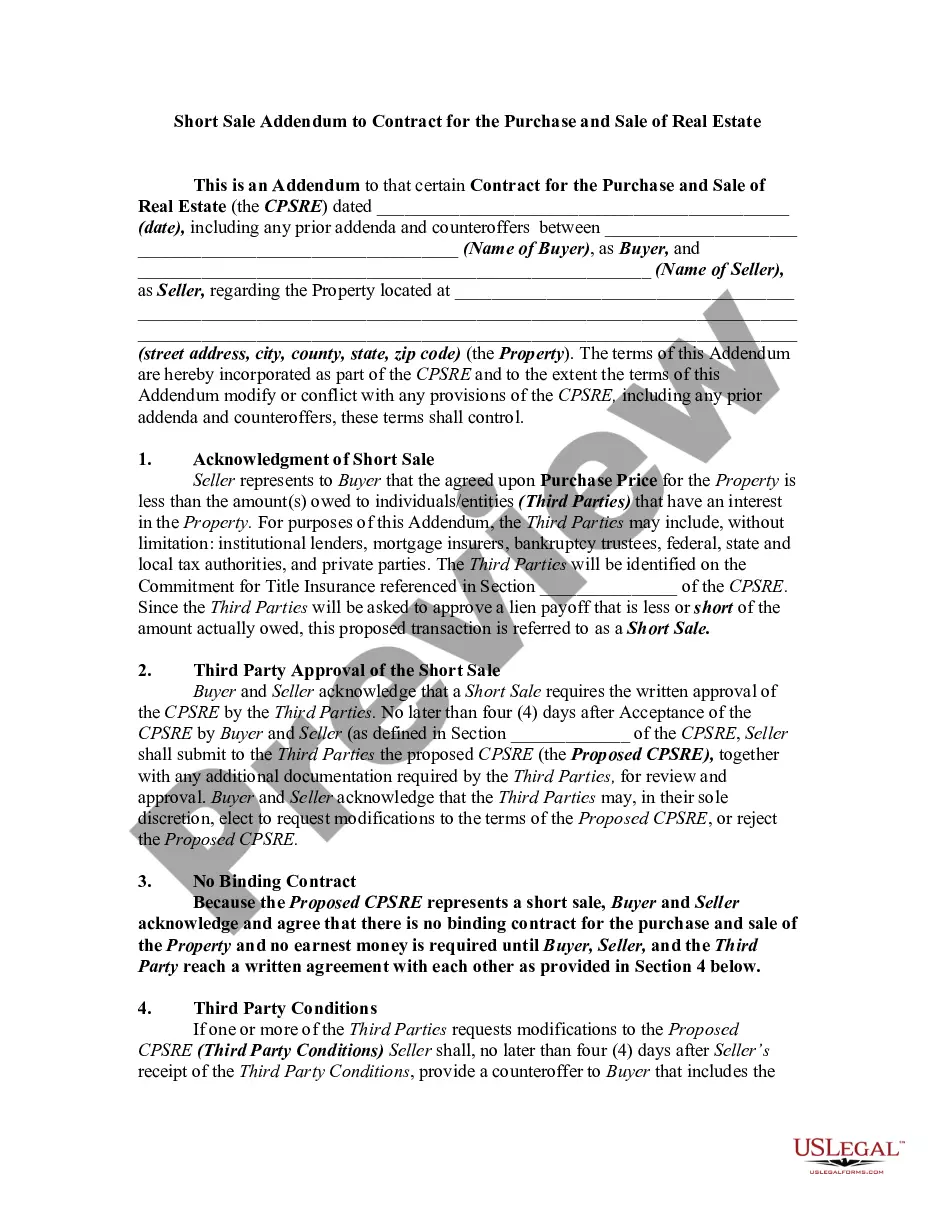

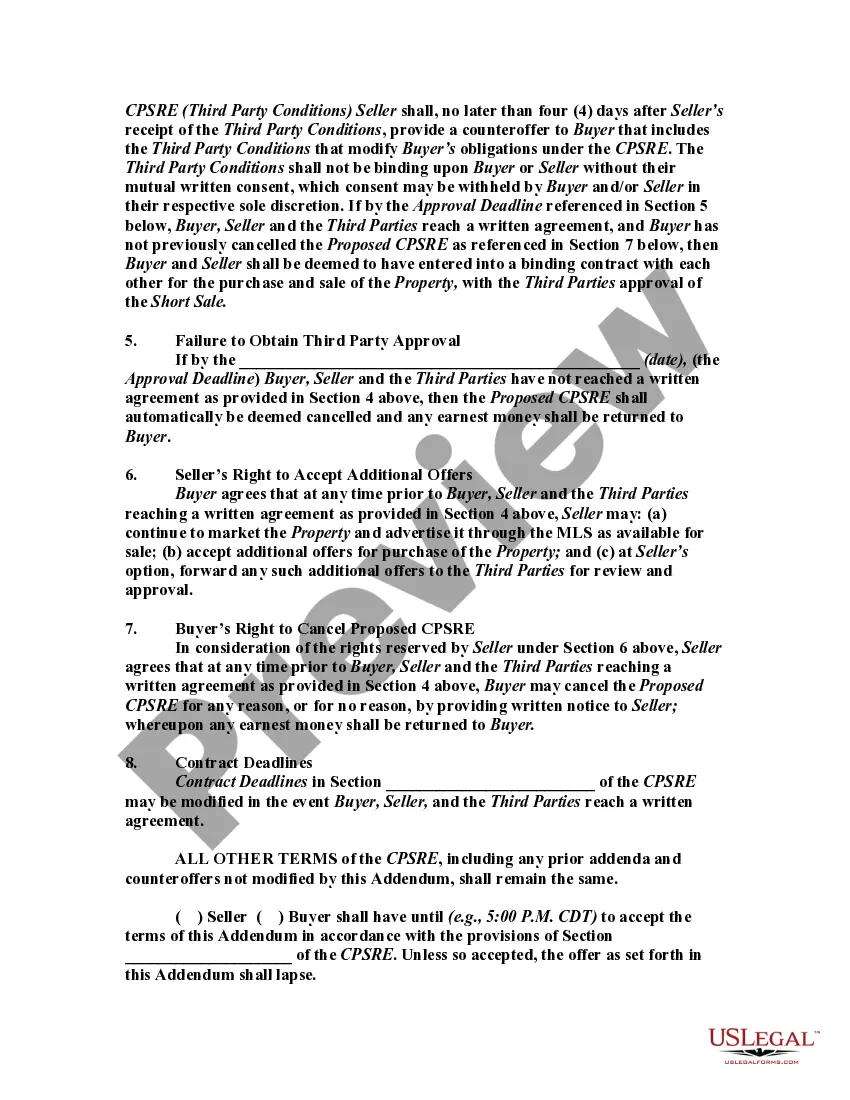

This form is a sample of an Addendum to a standard real estate sales contract in order to incorporate the short sales provisions. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The San Bernardino California Short Sale Addendum to Contract for the Price, Purchase, and Sale of Real Estate is a legally binding document that outlines the specific terms and conditions related to a short sale transaction in San Bernardino, California. This addendum is typically included in the purchase agreement and serves to protect the interests of all parties involved, including the buyer, seller, and the lender. There may be different types of San Bernardino California Short Sale Addendums, depending on the specific circumstances of the transaction or the requirements of the lender. Some common variations of this addendum include: 1. Financial Terms: This type of addendum focuses on the financial aspects of the short sale, such as the purchase price, seller concessions, and any credits or adjustments agreed upon by the parties. 2. Contingencies and Disclosures: This addendum outlines the contingencies and disclosures specific to a short sale transaction, including the requirement for lender approval, inspection contingencies, and the disclosure of any known property defects or issues. 3. Lender Approval: This addendum addresses the process and timeline for obtaining lender approval of the short sale, including the submission of required documentation, the negotiation of terms, and the conditions for cancellation or termination if the lender does not approve the sale. 4. Occupancy and Condition: This type of addendum details the condition of the property at the time of sale and any agreed-upon repairs or improvements, as well as the occupancy terms for the buyer and seller during the short sale process. 5. Closing and Escrow: This addendum focuses on the closing and escrow process, including the timeline for completing the sale, the distribution of funds, and any closing costs or fees to be paid by the buyer or seller. In all variations of the San Bernardino California Short Sale Addendum, it is crucial for all parties to carefully review and understand the terms, as well as consult with their respective real estate agents or attorneys to ensure compliance with local laws and regulations.The San Bernardino California Short Sale Addendum to Contract for the Price, Purchase, and Sale of Real Estate is a legally binding document that outlines the specific terms and conditions related to a short sale transaction in San Bernardino, California. This addendum is typically included in the purchase agreement and serves to protect the interests of all parties involved, including the buyer, seller, and the lender. There may be different types of San Bernardino California Short Sale Addendums, depending on the specific circumstances of the transaction or the requirements of the lender. Some common variations of this addendum include: 1. Financial Terms: This type of addendum focuses on the financial aspects of the short sale, such as the purchase price, seller concessions, and any credits or adjustments agreed upon by the parties. 2. Contingencies and Disclosures: This addendum outlines the contingencies and disclosures specific to a short sale transaction, including the requirement for lender approval, inspection contingencies, and the disclosure of any known property defects or issues. 3. Lender Approval: This addendum addresses the process and timeline for obtaining lender approval of the short sale, including the submission of required documentation, the negotiation of terms, and the conditions for cancellation or termination if the lender does not approve the sale. 4. Occupancy and Condition: This type of addendum details the condition of the property at the time of sale and any agreed-upon repairs or improvements, as well as the occupancy terms for the buyer and seller during the short sale process. 5. Closing and Escrow: This addendum focuses on the closing and escrow process, including the timeline for completing the sale, the distribution of funds, and any closing costs or fees to be paid by the buyer or seller. In all variations of the San Bernardino California Short Sale Addendum, it is crucial for all parties to carefully review and understand the terms, as well as consult with their respective real estate agents or attorneys to ensure compliance with local laws and regulations.