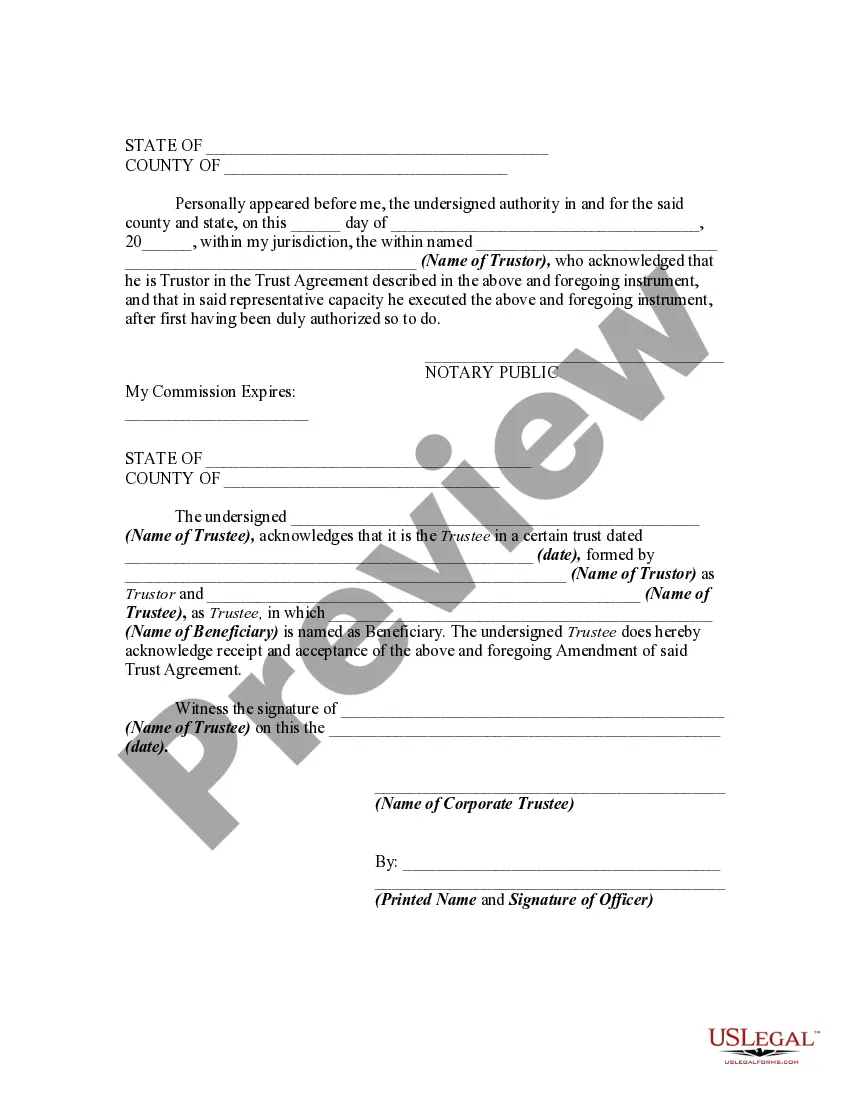

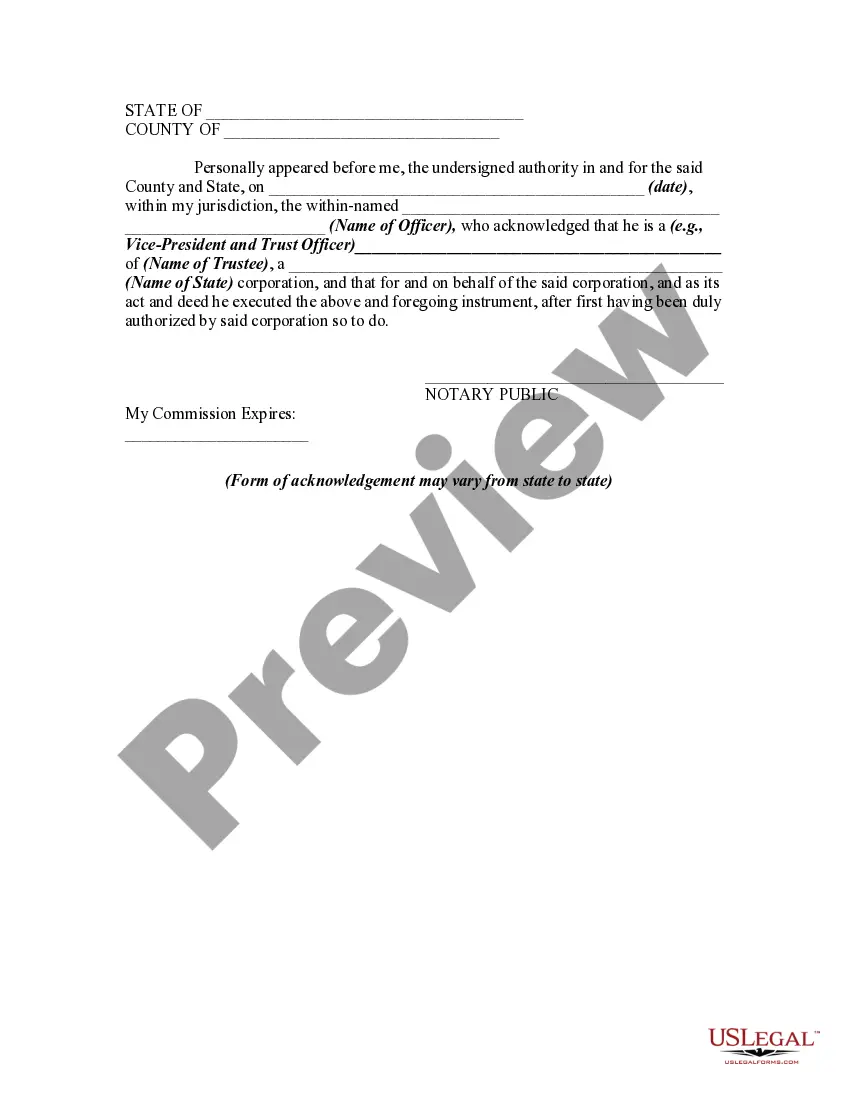

In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Middlesex Massachusetts Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a legal document that allows for modifications to be made to a trust established in Middlesex County, Massachusetts. This amendment is necessary when changes need to be made to the existing terms, provisions, or provisions of the trust. It enables trustees to cancel specific sections of the current trust document while adding new sections that better align with the trust's objectives or accommodate the evolving needs of the beneficiaries. This amendment is a critical tool in ensuring that the trust remains up-to-date and relevant to the changing circumstances and legal requirements. It helps in addressing any ambiguities or shortcomings that may have arisen since the trust's original creation. The Middlesex Massachusetts Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is applicable in various scenarios, depending on the specific circumstances of the trust. Some common types of amendments include: 1. Amendment for Beneficiary Changes: This occurs when there is a change in the beneficiaries of the trust, such as the birth, death, or marriage of individuals named in the original trust document. 2. Amendment for Asset Modifications: This type of amendment allows for changes in the assets held by the trust, such as the addition or removal of certain properties, investments, or accounts. 3. Amendment for Administrative Updates: In certain cases, an amendment may be necessary to update administrative details within the trust, such as the appointment or removal of trustees, modification of their powers or duties, or change in the trust's administrative provisions. 4. Amendment for Tax Planning: Changes in tax laws or the beneficiaries' tax situation may prompt an amendment to incorporate tax planning strategies that can optimize the trust's benefits or reduce tax liabilities. 5. Amendment for Distribution Modifications: Sometimes, amendments are needed to alter the distribution terms, frequencies, or methods to better suit the beneficiaries' needs or financial circumstances. Before executing a Middlesex Massachusetts Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, it is crucial to consult with a qualified legal professional specializing in estate planning and trust law. They can provide guidance and ensure that the amendment complies with all the legal formalities and requirements established by Massachusetts law.Middlesex Massachusetts Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a legal document that allows for modifications to be made to a trust established in Middlesex County, Massachusetts. This amendment is necessary when changes need to be made to the existing terms, provisions, or provisions of the trust. It enables trustees to cancel specific sections of the current trust document while adding new sections that better align with the trust's objectives or accommodate the evolving needs of the beneficiaries. This amendment is a critical tool in ensuring that the trust remains up-to-date and relevant to the changing circumstances and legal requirements. It helps in addressing any ambiguities or shortcomings that may have arisen since the trust's original creation. The Middlesex Massachusetts Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is applicable in various scenarios, depending on the specific circumstances of the trust. Some common types of amendments include: 1. Amendment for Beneficiary Changes: This occurs when there is a change in the beneficiaries of the trust, such as the birth, death, or marriage of individuals named in the original trust document. 2. Amendment for Asset Modifications: This type of amendment allows for changes in the assets held by the trust, such as the addition or removal of certain properties, investments, or accounts. 3. Amendment for Administrative Updates: In certain cases, an amendment may be necessary to update administrative details within the trust, such as the appointment or removal of trustees, modification of their powers or duties, or change in the trust's administrative provisions. 4. Amendment for Tax Planning: Changes in tax laws or the beneficiaries' tax situation may prompt an amendment to incorporate tax planning strategies that can optimize the trust's benefits or reduce tax liabilities. 5. Amendment for Distribution Modifications: Sometimes, amendments are needed to alter the distribution terms, frequencies, or methods to better suit the beneficiaries' needs or financial circumstances. Before executing a Middlesex Massachusetts Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, it is crucial to consult with a qualified legal professional specializing in estate planning and trust law. They can provide guidance and ensure that the amendment complies with all the legal formalities and requirements established by Massachusetts law.