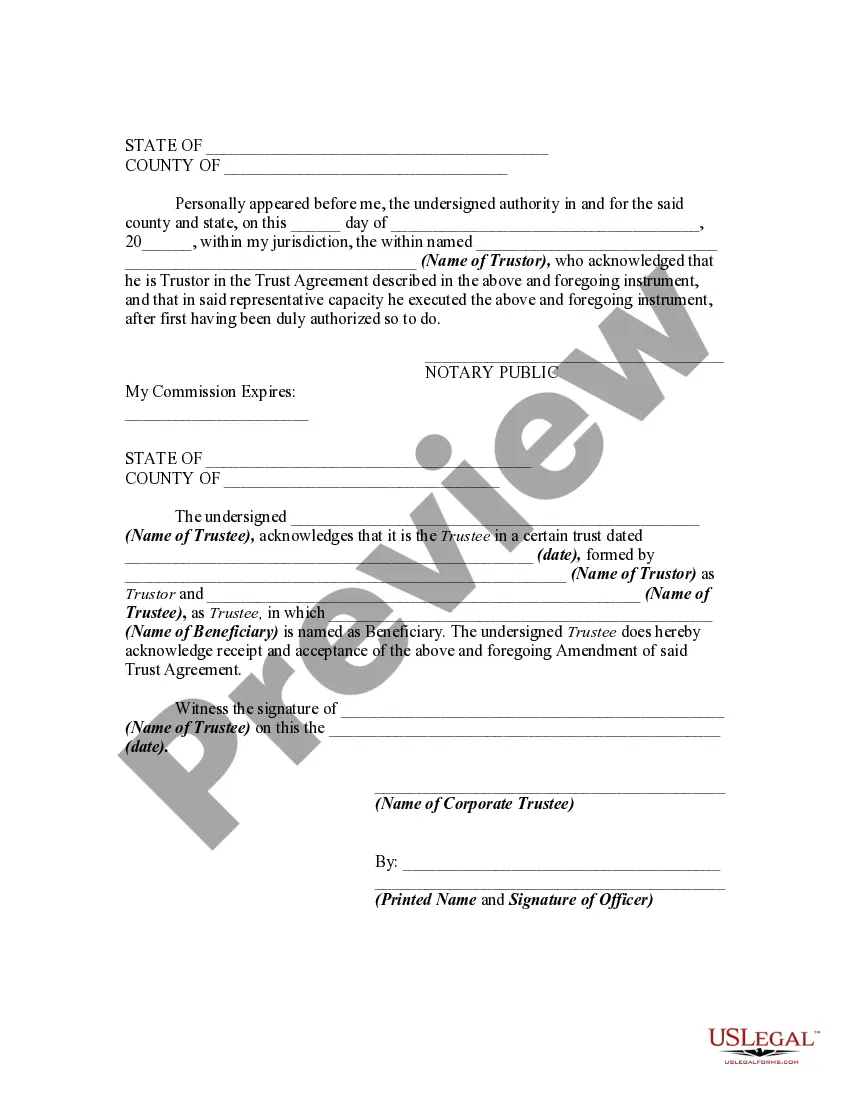

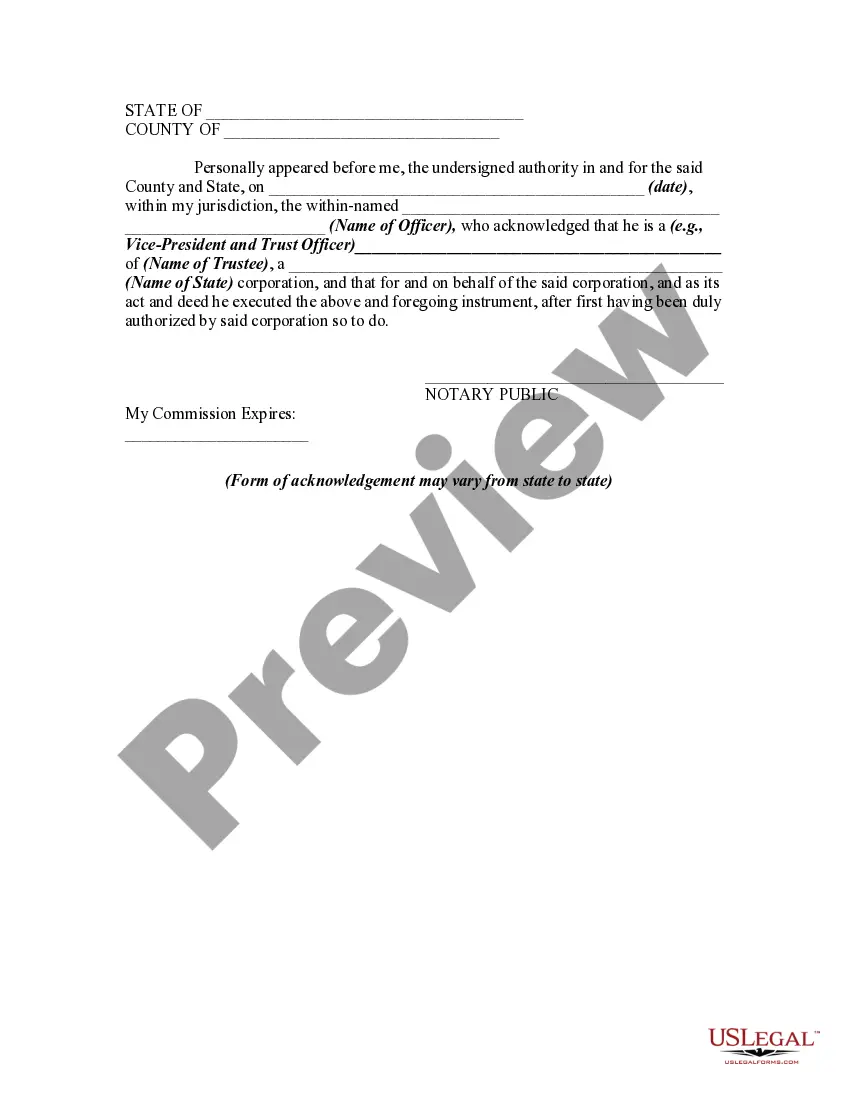

In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oakland Michigan Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a vital legal document that allows modifications and updates to an existing trust agreement in the state of Michigan, specifically in Oakland County. This process typically involves cancelling certain sections or provisions of the original trust document and adding new ones. The consent of the trustee is necessary to validate and execute these changes effectively. This amendment is used when changes are required to adapt the trust to new circumstances, update beneficiaries, address legal or financial issues, or incorporate additional instructions for managing and distributing assets. It provides flexibility for the trust settler or granter who established the trust. Some common types of Oakland Michigan Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee include: 1. Cancellation of Outdated Provisions: This type of amendment allows for the removal or cancellation of specific sections that are no longer relevant or accurate due to changes in personal circumstances, beneficiary preferences, or legal requirements. 2. Addition of New Trust Provisions: This amendment permits the addition of entirely new sections or provisions to the original trust agreement. Various clauses can be introduced, such as those outlining the powers and responsibilities of successor trustees, detailed instructions for asset distribution, the establishment of supplemental needs trusts, or the inclusion of alternate beneficiary designations. 3. Changes in Beneficiary Designations: An amendment may be needed to revise or update the beneficiaries named in the trust. This type of amendment can add or remove beneficiaries, modify their respective shares or specify specific conditions under which they are entitled to receive trust assets. 4. Granter Retained Income Trust (GRIT) Amendments: GRIT amendments involve adjustments related to the transfer of assets, income distributions, and the designation of income beneficiaries. These changes allow the granter to retain income generated by the trust during their lifetime while ultimately transferring the trust's remaining assets to the beneficiaries. It is essential to consult with an experienced attorney specializing in estate planning and trust administration to ensure accuracy and compliance with Michigan laws when executing an Oakland Michigan Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee.Oakland Michigan Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a vital legal document that allows modifications and updates to an existing trust agreement in the state of Michigan, specifically in Oakland County. This process typically involves cancelling certain sections or provisions of the original trust document and adding new ones. The consent of the trustee is necessary to validate and execute these changes effectively. This amendment is used when changes are required to adapt the trust to new circumstances, update beneficiaries, address legal or financial issues, or incorporate additional instructions for managing and distributing assets. It provides flexibility for the trust settler or granter who established the trust. Some common types of Oakland Michigan Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee include: 1. Cancellation of Outdated Provisions: This type of amendment allows for the removal or cancellation of specific sections that are no longer relevant or accurate due to changes in personal circumstances, beneficiary preferences, or legal requirements. 2. Addition of New Trust Provisions: This amendment permits the addition of entirely new sections or provisions to the original trust agreement. Various clauses can be introduced, such as those outlining the powers and responsibilities of successor trustees, detailed instructions for asset distribution, the establishment of supplemental needs trusts, or the inclusion of alternate beneficiary designations. 3. Changes in Beneficiary Designations: An amendment may be needed to revise or update the beneficiaries named in the trust. This type of amendment can add or remove beneficiaries, modify their respective shares or specify specific conditions under which they are entitled to receive trust assets. 4. Granter Retained Income Trust (GRIT) Amendments: GRIT amendments involve adjustments related to the transfer of assets, income distributions, and the designation of income beneficiaries. These changes allow the granter to retain income generated by the trust during their lifetime while ultimately transferring the trust's remaining assets to the beneficiaries. It is essential to consult with an experienced attorney specializing in estate planning and trust administration to ensure accuracy and compliance with Michigan laws when executing an Oakland Michigan Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee.