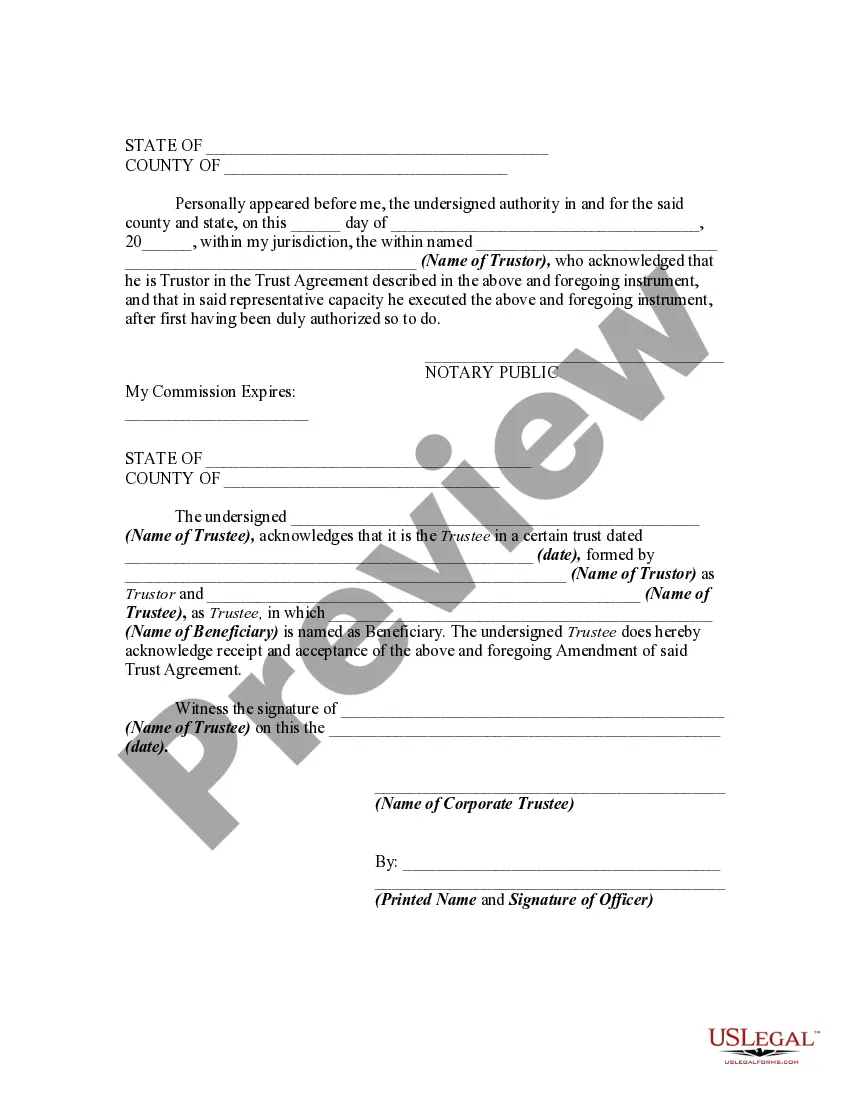

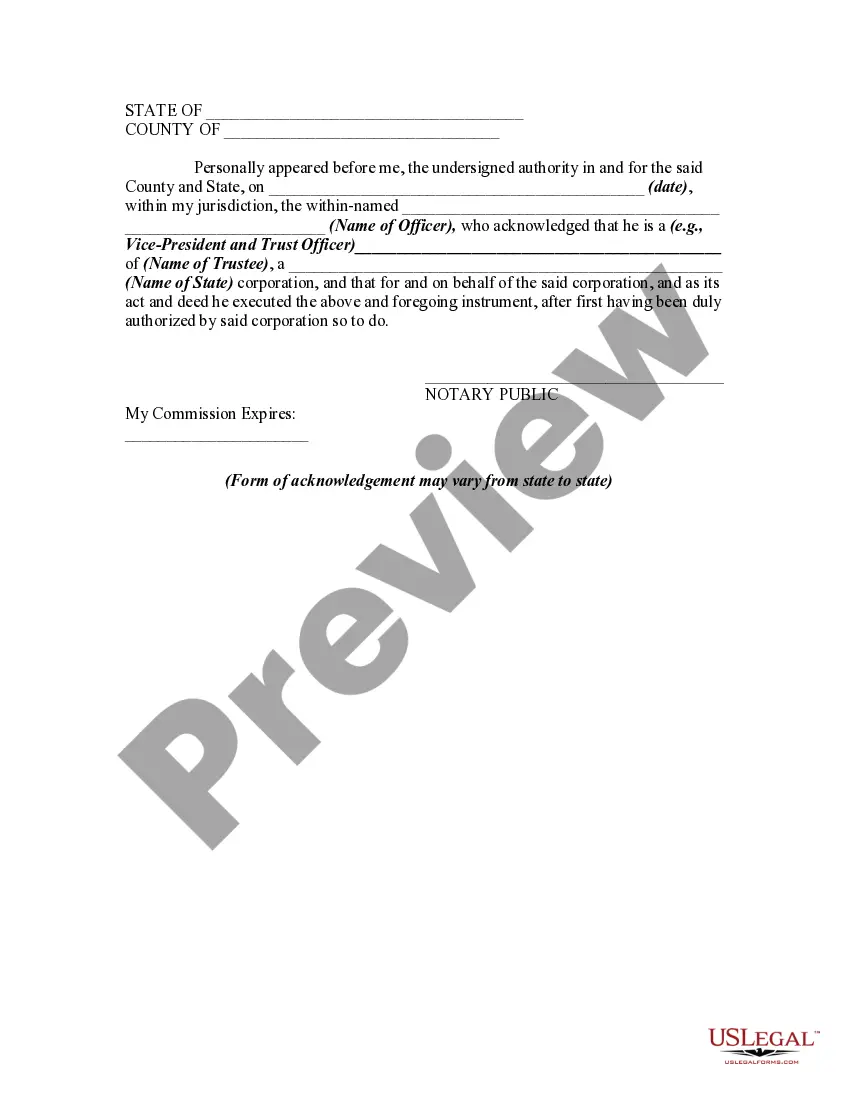

In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tarrant Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a legal document that allows modifications to be made to an existing trust agreement. This amendment is specific to trusts established in Tarrant County, Texas. The purpose of this document is to provide flexibility and accommodate changes in the terms and provisions of the trust as circumstances evolve. The amendment process involves cancelling certain sections of the original Declaration of Trust and adding new sections to reflect the modified terms. The Consent of Trustee is an important component, as it confirms the approval and agreement of the trustee to implement the proposed amendments. There may be different types of Tarrant Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, depending on the nature and extent of the modifications made. These may include: 1. Amendment with Beneficiary Changes: This type of amendment allows for additions or removals of beneficiaries, addressing changes in their circumstances such as births, deaths, or divorces. 2. Amendment for Distribution Modifications: This amendment type is used to modify the provisions related to the distribution of assets within the trust, such as altering the timing or amount of distributions to beneficiaries. 3. Amendment for Administrative Changes: This amendment focuses on administrative aspects of the trust, such as updating contact information for the trustee, changing the trust's name, or adjusting administrative procedures. 4. Amendment for Tax Planning: Trust amendments may also involve tax planning strategies, allowing for the incorporation of updated tax laws or implementing tax-saving measures. When preparing a Tarrant Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, it is crucial to consult with an experienced attorney specializing in estate planning or trust law. This will ensure that the amendment complies with all applicable legal requirements and accurately reflects the intentions of the trust's creator and the trustee's consent.Tarrant Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a legal document that allows modifications to be made to an existing trust agreement. This amendment is specific to trusts established in Tarrant County, Texas. The purpose of this document is to provide flexibility and accommodate changes in the terms and provisions of the trust as circumstances evolve. The amendment process involves cancelling certain sections of the original Declaration of Trust and adding new sections to reflect the modified terms. The Consent of Trustee is an important component, as it confirms the approval and agreement of the trustee to implement the proposed amendments. There may be different types of Tarrant Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, depending on the nature and extent of the modifications made. These may include: 1. Amendment with Beneficiary Changes: This type of amendment allows for additions or removals of beneficiaries, addressing changes in their circumstances such as births, deaths, or divorces. 2. Amendment for Distribution Modifications: This amendment type is used to modify the provisions related to the distribution of assets within the trust, such as altering the timing or amount of distributions to beneficiaries. 3. Amendment for Administrative Changes: This amendment focuses on administrative aspects of the trust, such as updating contact information for the trustee, changing the trust's name, or adjusting administrative procedures. 4. Amendment for Tax Planning: Trust amendments may also involve tax planning strategies, allowing for the incorporation of updated tax laws or implementing tax-saving measures. When preparing a Tarrant Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, it is crucial to consult with an experienced attorney specializing in estate planning or trust law. This will ensure that the amendment complies with all applicable legal requirements and accurately reflects the intentions of the trust's creator and the trustee's consent.