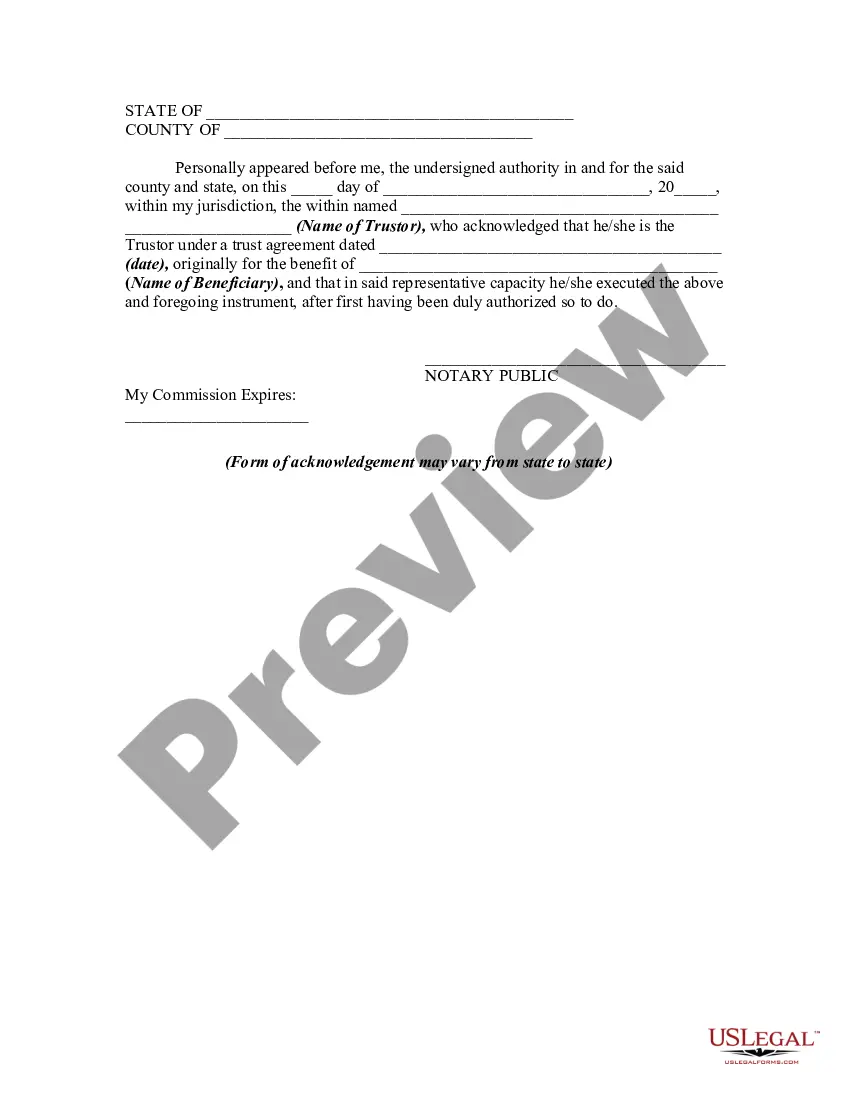

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Philadelphia Pennsylvania Amendment to Trust Agreement in Order to Change Beneficiaries refers to a legal document that modifies or alters the terms of a trust agreement established in Philadelphia, Pennsylvania. This amendment is specifically used to change the beneficiaries named in the trust agreement. A trust agreement is a legal arrangement wherein a trustee holds assets on behalf of beneficiaries. It grants the trustee the authority to manage and distribute the assets according to the specified terms outlined within the agreement. However, circumstances may arise where the original beneficiaries need to be changed, and this is where the Philadelphia Pennsylvania Amendment to Trust Agreement in Order to Change Beneficiaries comes into play. In Philadelphia, Pennsylvania, there are different types of amendments that can be made to a trust agreement to change beneficiaries, including: 1. Amendment to Add or Remove Beneficiaries: This type of amendment allows for the addition or removal of beneficiaries to the trust agreement. It may be necessary due to a change in circumstances, such as a birth, death, marriage, or divorce. 2. Amendment to Change Beneficiary Shares: This amendment adjusts the allocation or distribution of assets among the existing beneficiaries. It may be required if the original distribution scheme no longer aligns with the intentions of the granter or if the beneficiaries' financial situations have changed since the creation of the trust. 3. Amendment to Specify Alternate or Contingent Beneficiaries: This type of amendment identifies alternative beneficiaries who will receive the assets if the primary beneficiaries named in the trust agreement are unable to receive them for any reason. 4. Amendment to Address Tax Planning or Financial Considerations: In some cases, an amendment to the trust agreement may be made to optimize tax planning or address specific financial considerations, such as reducing estate tax liability or safeguarding assets from creditors. These amendments ensure that the beneficiaries receive the maximum benefit from the trust while adhering to the relevant laws and regulations. When executing a Philadelphia Pennsylvania Amendment to Trust Agreement in Order to Change Beneficiaries, it is essential to consult with a qualified attorney specializing in trust and estate law. They will help ensure that the amendment is properly drafted, executed, and complies with all applicable laws in Philadelphia, Pennsylvania.Philadelphia Pennsylvania Amendment to Trust Agreement in Order to Change Beneficiaries refers to a legal document that modifies or alters the terms of a trust agreement established in Philadelphia, Pennsylvania. This amendment is specifically used to change the beneficiaries named in the trust agreement. A trust agreement is a legal arrangement wherein a trustee holds assets on behalf of beneficiaries. It grants the trustee the authority to manage and distribute the assets according to the specified terms outlined within the agreement. However, circumstances may arise where the original beneficiaries need to be changed, and this is where the Philadelphia Pennsylvania Amendment to Trust Agreement in Order to Change Beneficiaries comes into play. In Philadelphia, Pennsylvania, there are different types of amendments that can be made to a trust agreement to change beneficiaries, including: 1. Amendment to Add or Remove Beneficiaries: This type of amendment allows for the addition or removal of beneficiaries to the trust agreement. It may be necessary due to a change in circumstances, such as a birth, death, marriage, or divorce. 2. Amendment to Change Beneficiary Shares: This amendment adjusts the allocation or distribution of assets among the existing beneficiaries. It may be required if the original distribution scheme no longer aligns with the intentions of the granter or if the beneficiaries' financial situations have changed since the creation of the trust. 3. Amendment to Specify Alternate or Contingent Beneficiaries: This type of amendment identifies alternative beneficiaries who will receive the assets if the primary beneficiaries named in the trust agreement are unable to receive them for any reason. 4. Amendment to Address Tax Planning or Financial Considerations: In some cases, an amendment to the trust agreement may be made to optimize tax planning or address specific financial considerations, such as reducing estate tax liability or safeguarding assets from creditors. These amendments ensure that the beneficiaries receive the maximum benefit from the trust while adhering to the relevant laws and regulations. When executing a Philadelphia Pennsylvania Amendment to Trust Agreement in Order to Change Beneficiaries, it is essential to consult with a qualified attorney specializing in trust and estate law. They will help ensure that the amendment is properly drafted, executed, and complies with all applicable laws in Philadelphia, Pennsylvania.