A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to withdraw property from the trust. This form is a sample of a trustor amending the trust agreement in order to withdraw property from the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

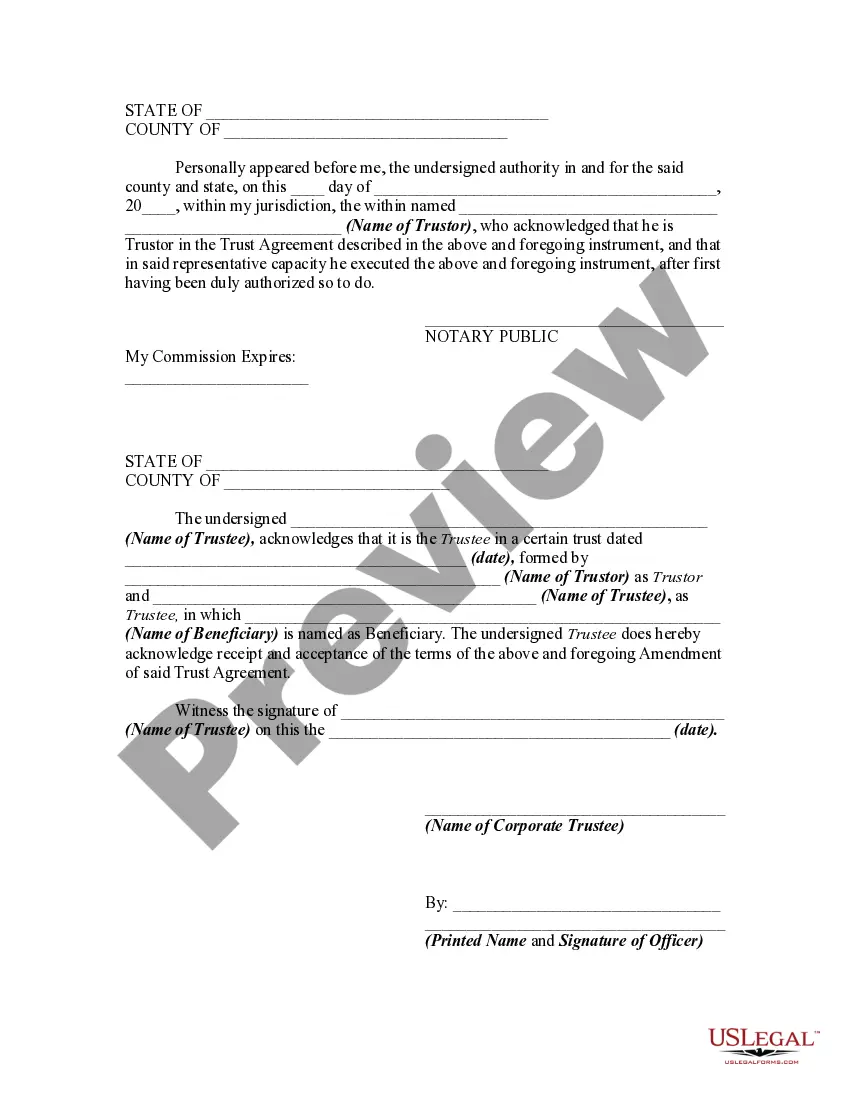

The Collin Texas Amendment to Trust Agreement is a legal document that allows a beneficiary to withdraw property from an inter vivos trust. This amendment is crucial for individuals who have a vested interest in the trust and wish to exercise their rights to access specific assets. One type of Collin Texas Amendment to Trust Agreement that exists pertains to real estate properties. This specific amendment enables beneficiaries to withdraw or transfer ownership of real property held within the inter vivos trust. By providing detailed information about the property, including its physical address and legal description, this amendment constitutes a legally binding document that facilitates the smooth transfer of ownership. Another type of Collin Texas Amendment to Trust Agreement concerns financial assets. In cases where the trust holds stocks, bonds, or other investment instruments, this amendment allows beneficiaries to withdraw their share of these assets. By specifying the type and quantity of the assets in question, beneficiaries can effectively assert their rights to the financial benefits held within the trust. The Consent of Trustee is an essential component of the Collin Texas Amendment to Trust Agreement. This document establishes the trustee's acknowledgment and endorsement of the beneficiary's request to withdraw property from the inter vivos trust. The trustee's consent acts as a safeguard to ensure that the beneficiary's intentions align with the trust's overall objectives and that the withdrawal of property complies with the relevant legal framework. In order to initiate the withdrawal process, beneficiaries must first provide a detailed description of the property they wish to withdraw. This includes information such as the property's location, its legal status, and any relevant identifying documents, such as titles or deeds. Additionally, beneficiaries should clearly state their reasons for wanting to withdraw the property, ensuring transparency and clarity throughout the process. The Collin Texas Amendment to Trust Agreement in Order to Withdraw Property from an Inter Vivos Trust and Consent of Trustee offers beneficiaries the opportunity to exercise their rights and enjoy the benefits of the assets held within the trust. By following the proper legal procedures and obtaining the trustee's consent, beneficiaries can confidently navigate the process of withdrawing property from the trust.The Collin Texas Amendment to Trust Agreement is a legal document that allows a beneficiary to withdraw property from an inter vivos trust. This amendment is crucial for individuals who have a vested interest in the trust and wish to exercise their rights to access specific assets. One type of Collin Texas Amendment to Trust Agreement that exists pertains to real estate properties. This specific amendment enables beneficiaries to withdraw or transfer ownership of real property held within the inter vivos trust. By providing detailed information about the property, including its physical address and legal description, this amendment constitutes a legally binding document that facilitates the smooth transfer of ownership. Another type of Collin Texas Amendment to Trust Agreement concerns financial assets. In cases where the trust holds stocks, bonds, or other investment instruments, this amendment allows beneficiaries to withdraw their share of these assets. By specifying the type and quantity of the assets in question, beneficiaries can effectively assert their rights to the financial benefits held within the trust. The Consent of Trustee is an essential component of the Collin Texas Amendment to Trust Agreement. This document establishes the trustee's acknowledgment and endorsement of the beneficiary's request to withdraw property from the inter vivos trust. The trustee's consent acts as a safeguard to ensure that the beneficiary's intentions align with the trust's overall objectives and that the withdrawal of property complies with the relevant legal framework. In order to initiate the withdrawal process, beneficiaries must first provide a detailed description of the property they wish to withdraw. This includes information such as the property's location, its legal status, and any relevant identifying documents, such as titles or deeds. Additionally, beneficiaries should clearly state their reasons for wanting to withdraw the property, ensuring transparency and clarity throughout the process. The Collin Texas Amendment to Trust Agreement in Order to Withdraw Property from an Inter Vivos Trust and Consent of Trustee offers beneficiaries the opportunity to exercise their rights and enjoy the benefits of the assets held within the trust. By following the proper legal procedures and obtaining the trustee's consent, beneficiaries can confidently navigate the process of withdrawing property from the trust.