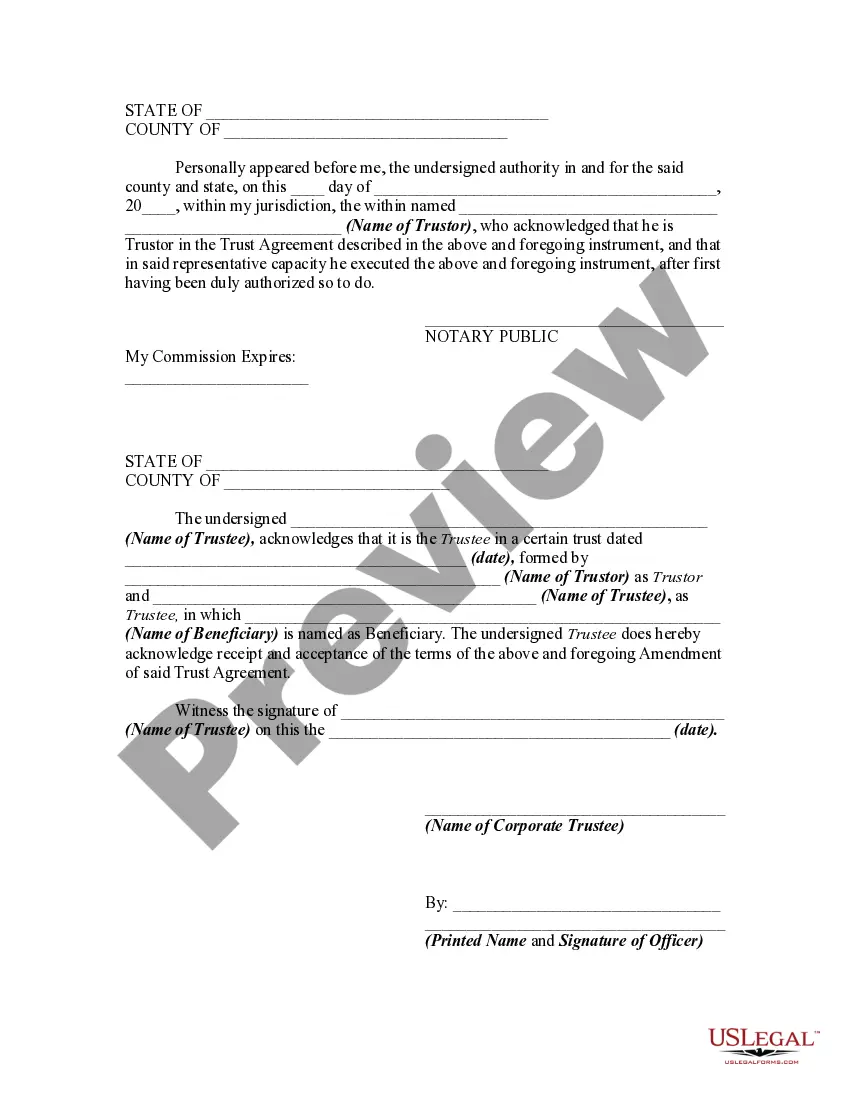

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to withdraw property from the trust. This form is a sample of a trustor amending the trust agreement in order to withdraw property from the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kings New York Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee allows individuals to make changes to their trust agreement in order to withdraw property from an inter vivos trust. This amendment is specific to residents of Kings County, New York, and ensures that the process is legally valid and in accordance with state laws. The amendment grants the settler, or creator of the trust, the ability to remove specific assets from the trust, whether it be real estate, financial accounts, or personal property. This can be beneficial if the individual wishes to sell or transfer ownership of the property outside the trust. The Kings New York Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee includes provisions to obtain the consent of the trustee, who is responsible for managing the trust on behalf of the beneficiaries. The trustee's agreement is necessary to ensure that the withdrawal of the property does not negatively impact the overall administration of the trust or the interests of other beneficiaries. It is important to note that there may be different types of Kings New York Amendments to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee, based on the specific circumstances and needs of the settler. Some potential variations may include: 1. Single-Property Withdrawal Amendment: This type of amendment allows the settler to withdraw a single specific property from the trust, while keeping the remainder of the trust intact. 2. Partial-Withdrawal Amendment: If the settler wishes to withdraw multiple properties or assets from the trust, a partial-withdrawal amendment would be utilized. This amendment specifies the assets to be removed, while the remaining assets continue to be held in the trust. 3. Full-Withdrawal Amendment: In some cases, the settler may decide to completely dissolve the trust and withdraw all remaining property. A full-withdrawal amendment is used to terminate the trust and distribute the assets accordingly. It is strongly advised to consult with a qualified attorney familiar with trust laws in Kings County, New York, to ensure the proper drafting and execution of the Kings New York Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee. This will ensure compliance with all legal requirements and protect the rights and interests of the settler, trustee, and beneficiaries involved.