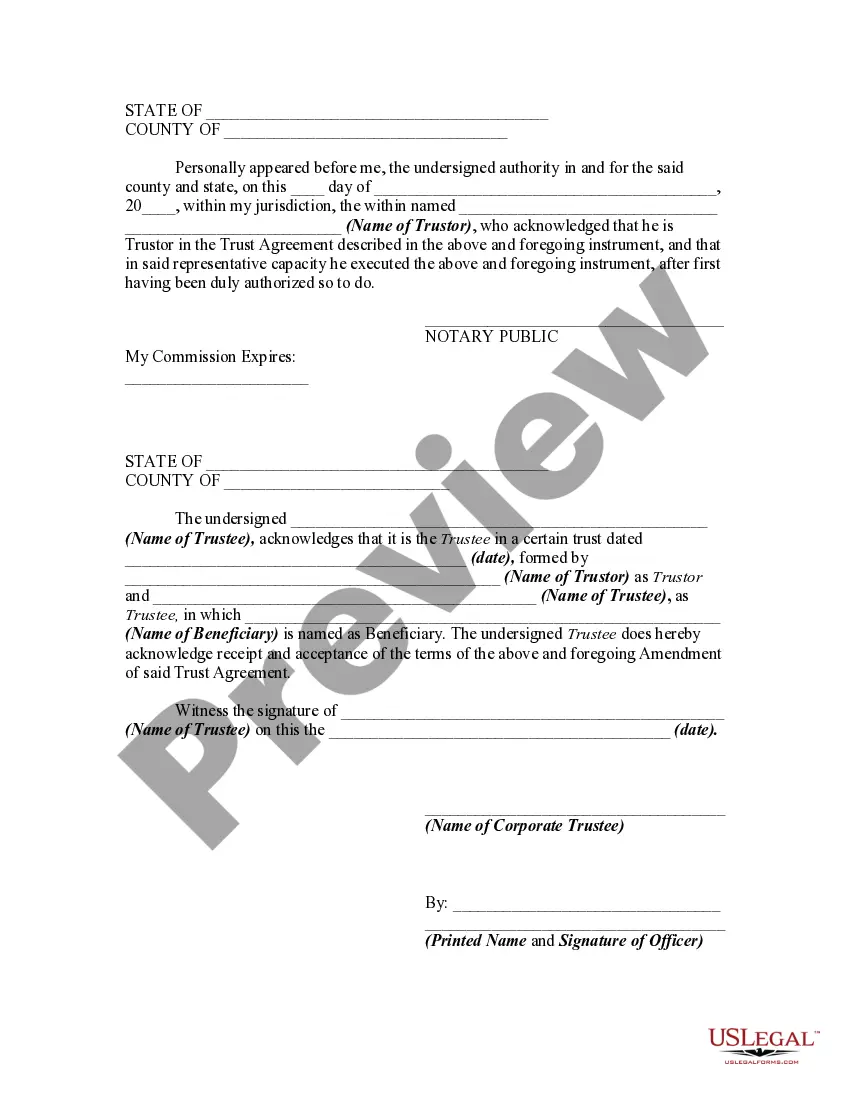

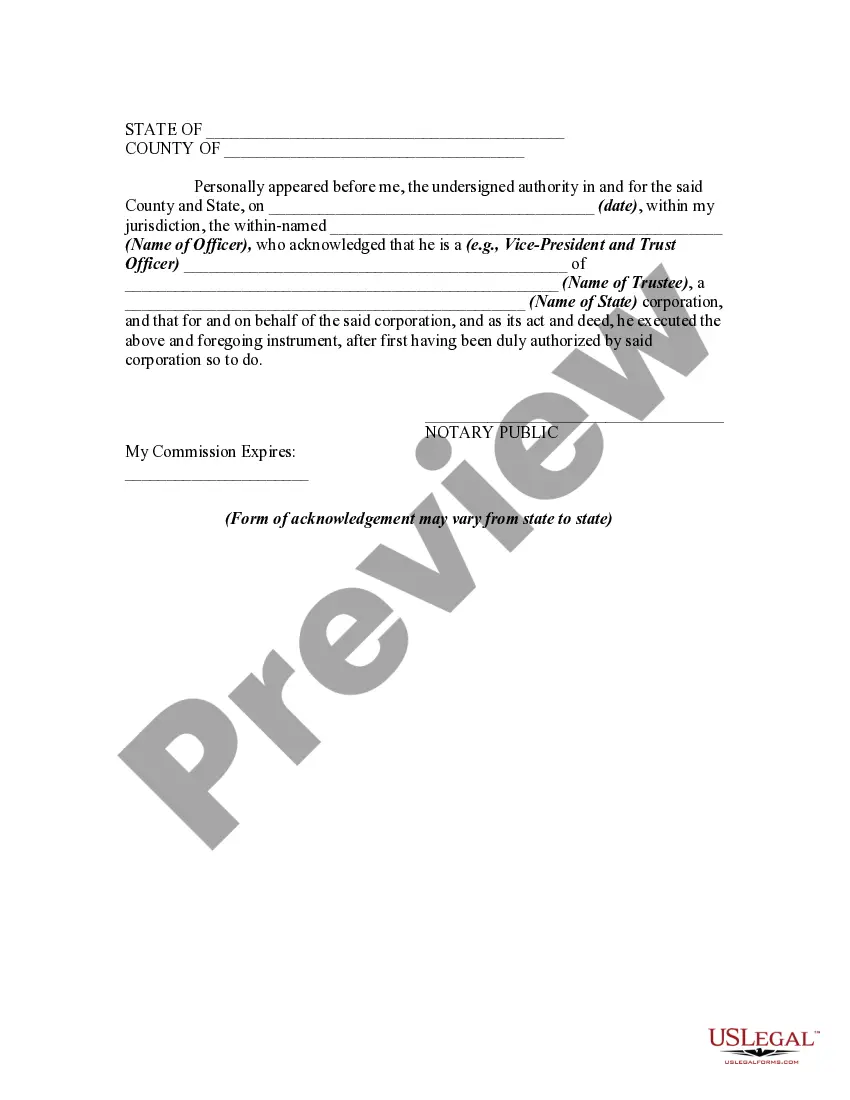

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to withdraw property from the trust. This form is a sample of a trustor amending the trust agreement in order to withdraw property from the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Middlesex Massachusetts Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee grants the beneficiary the ability to remove specific property from the trust, with the agreement and approval of the trustee. This amendment allows for flexibility in managing trust assets and ensures that beneficiaries have the opportunity to make changes based on their changing needs or circumstances. There are different types of Middlesex Massachusetts Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee, which include: 1. Limited Withdrawal Amendment: This type of amendment allows the beneficiary to withdraw a specific portion or specific properties from the trust, subject to the consent of the trustee. It provides the flexibility to tailor the trust assets based on the changing needs of the beneficiary. 2. Complete Withdrawal Amendment: In some cases, a beneficiary may wish to completely withdraw all their interest or properties from the inter vivos trust. The Middlesex Massachusetts Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee enables this option, subject to the trustee's consent. 3. Partial Withdrawal Amendment: This type of amendment enables the beneficiary to withdraw a partial interest in the inter vivos trust, either a specific amount or percentage of the trust assets. The trustee's consent is necessary for the successful execution of this amendment. 4. Conditional Withdrawal Amendment: In certain situations, beneficiaries may desire to withdraw their property from the inter vivos trust only under specific conditions. The Middlesex Massachusetts Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee allows for the inclusion of specific conditions or requirements to be met before the withdrawal can take effect. Overall, the Middlesex Massachusetts Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee offers various options for beneficiaries to modify or remove specific assets from the trust, ensuring flexibility and adaptability based on their individual needs. It is important to consult with legal professionals and follow the appropriate legal procedures when considering any amendments to a trust agreement.