A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to add property to the trust. This form is a sample of a trustor amending the trust agreement in order to add property to the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

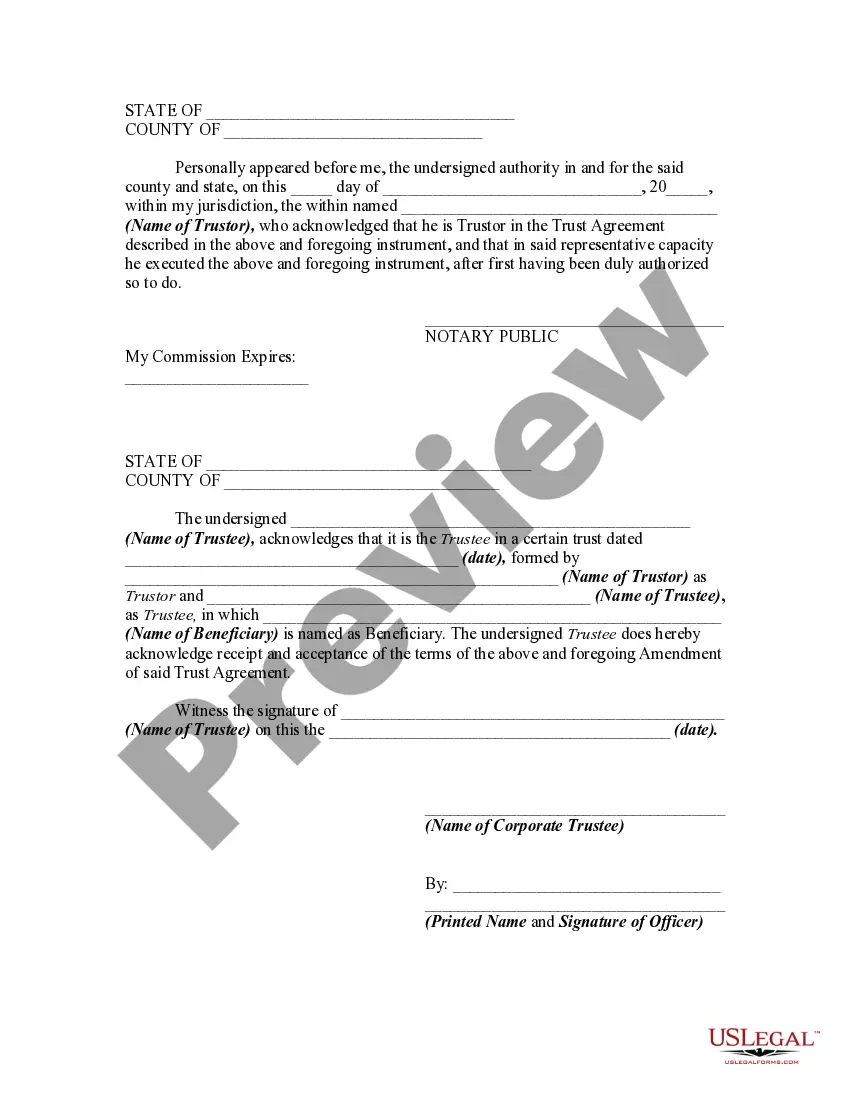

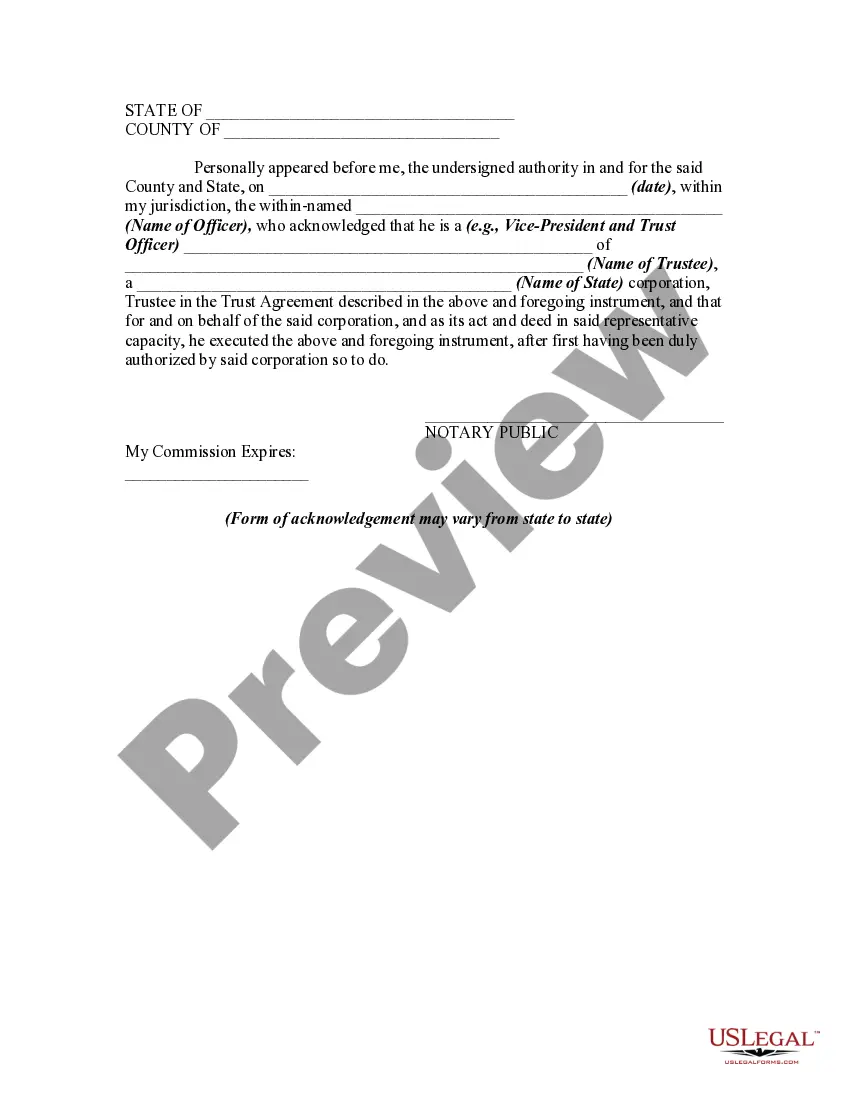

The Santa Clara California Amendment to Trust Agreement is a legal document that allows individuals in Santa Clara, California, to add a property from an Inter Vivos Trust to their existing trust agreement. This amendment ensures that the property is properly incorporated into the existing trust structure, enabling smooth management and distribution of assets according to the individual's wishes. The primary purpose of this amendment is to grant approval for the integration of the property into the trust agreement. It outlines the necessary steps and conditions required for the addition, taking into consideration acquisition details, legal ownership, and any related financial considerations. The Consent of Trustee, an essential component of the amendment, confirms that the trustee agrees to the inclusion of the property in the trust. The trustee is responsible for managing the trust assets, ensuring compliance with the trust's provisions, and facilitating any necessary transactions or transfers. Their consent is vital to ensure legality and smooth execution. There are several types of Santa Clara California Amendment to Trust Agreement that allows individuals to add property from an Inter Vivos Trust and obtain the Consent of Trustee. These include: 1. Santa Clara California Amendment to Trust Agreement for Real Estate: This specific amendment focuses on adding real estate property to the existing trust agreement. It addresses issues related to title deeds, property valuation, and potential tax implications associated with the transfer. 2. Santa Clara California Amendment to Trust Agreement for Financial Assets: This amendment pertains to the addition of financial assets, such as stocks, bonds, or bank accounts, to the trust agreement. It outlines procedures for account transfers, valuation, and necessary documentation. 3. Santa Clara California Amendment to Trust Agreement for Business Assets: This type of amendment deals with the inclusion of business assets, such as ownership interests in a company or partnership, into the trust. It takes into consideration legal and financial aspects unique to business assets, succession planning, and potential tax consequences. In all cases, it is advisable to consult with a qualified attorney specializing in estate planning and trust administration to ensure compliance with Santa Clara California laws, the specific trust agreement, and to address any particular circumstances or concerns related to the amendment process.The Santa Clara California Amendment to Trust Agreement is a legal document that allows individuals in Santa Clara, California, to add a property from an Inter Vivos Trust to their existing trust agreement. This amendment ensures that the property is properly incorporated into the existing trust structure, enabling smooth management and distribution of assets according to the individual's wishes. The primary purpose of this amendment is to grant approval for the integration of the property into the trust agreement. It outlines the necessary steps and conditions required for the addition, taking into consideration acquisition details, legal ownership, and any related financial considerations. The Consent of Trustee, an essential component of the amendment, confirms that the trustee agrees to the inclusion of the property in the trust. The trustee is responsible for managing the trust assets, ensuring compliance with the trust's provisions, and facilitating any necessary transactions or transfers. Their consent is vital to ensure legality and smooth execution. There are several types of Santa Clara California Amendment to Trust Agreement that allows individuals to add property from an Inter Vivos Trust and obtain the Consent of Trustee. These include: 1. Santa Clara California Amendment to Trust Agreement for Real Estate: This specific amendment focuses on adding real estate property to the existing trust agreement. It addresses issues related to title deeds, property valuation, and potential tax implications associated with the transfer. 2. Santa Clara California Amendment to Trust Agreement for Financial Assets: This amendment pertains to the addition of financial assets, such as stocks, bonds, or bank accounts, to the trust agreement. It outlines procedures for account transfers, valuation, and necessary documentation. 3. Santa Clara California Amendment to Trust Agreement for Business Assets: This type of amendment deals with the inclusion of business assets, such as ownership interests in a company or partnership, into the trust. It takes into consideration legal and financial aspects unique to business assets, succession planning, and potential tax consequences. In all cases, it is advisable to consult with a qualified attorney specializing in estate planning and trust administration to ensure compliance with Santa Clara California laws, the specific trust agreement, and to address any particular circumstances or concerns related to the amendment process.