Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

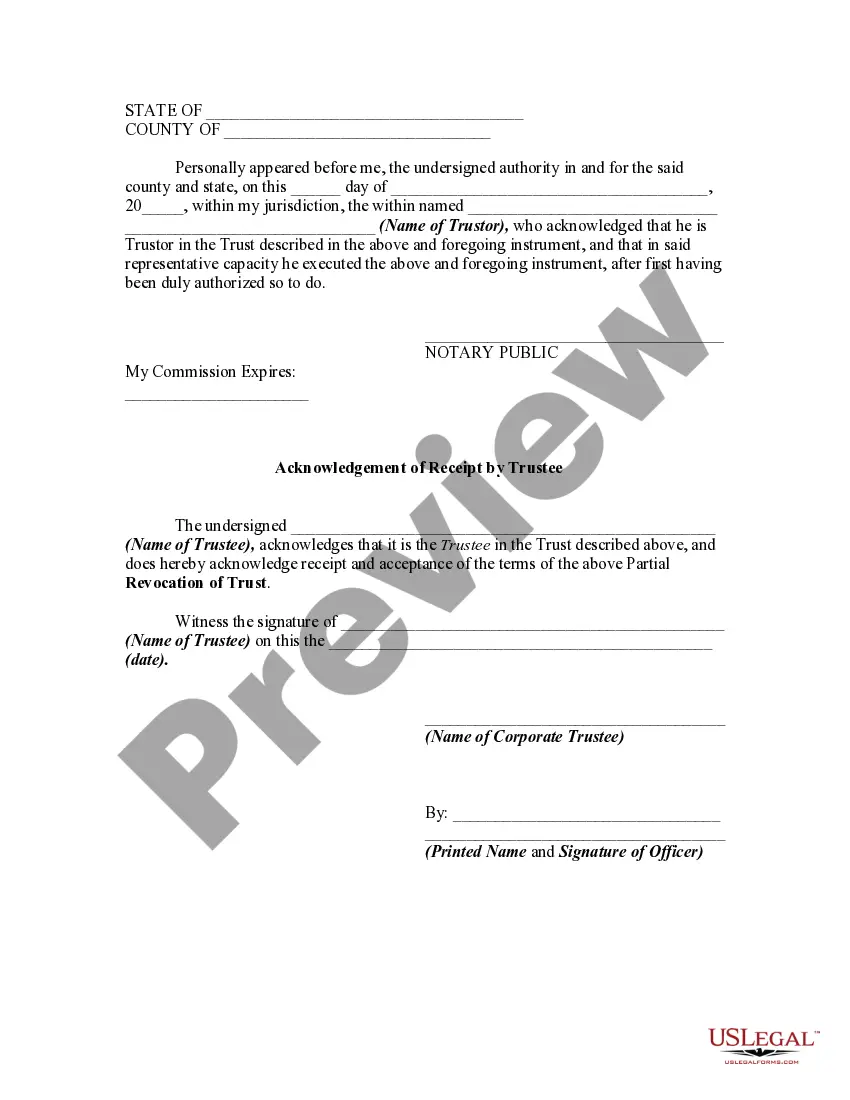

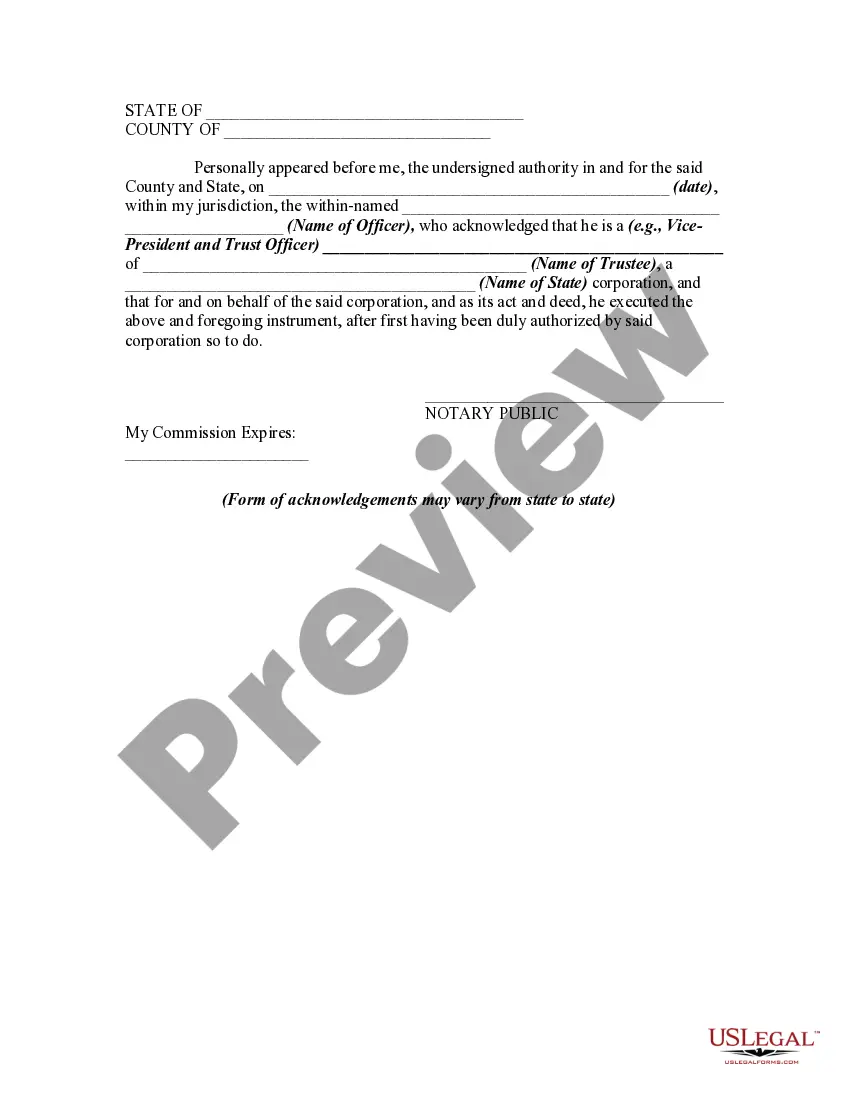

Orange California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee is a legal process that involves modifying or altering certain provisions within a trust agreement based in Orange, California. This action can be done by the trustee of the trust to address specific changes or circumstances that necessitate a partial revocation. Some different types of Orange California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee include: 1. Partial Revocation of Trust Beneficiaries: This type of partial revocation focuses on modifying the beneficiaries of the trust. It may involve adding or removing individuals or organizations who are set to benefit from the trust proceeds or assets. 2. Partial Revocation of Trust Assets: This type of partial revocation aims to alter the assets held within the trust. It may involve adding or removing specific properties, investments, or other types of assets that are included in the trust agreement. 3. Partial Revocation of Trust Terms: This type of partial revocation focuses on modifying specific terms or conditions outlined within the trust agreement. It may involve revising the distribution terms, conditions for beneficiaries, or any other provisions that need to be updated or changed. The Acknowledgment of Receipt of Notice of Partial Revocation by Trustee is a document that confirms the trustee's acknowledgment and understanding of the partial revocation process. This acknowledgment typically includes the following relevant keywords: — Trustee: The person or entity appointed to manage and administer the trust assets. — Partial revocation: The legal action of modifying specific provisions within the trust agreement. — Notice of partial revocation: Formal communication sent to the trustee, informing them of the intent to partially revoke the trust. — Receipt: Acknowledgment of receiving the notice of partial revocation. — Trust agreement: The legal document that outlines the terms, conditions, and provisions of the trust. — Beneficiaries: Individuals or entities entitled to benefit from the trust assets. — Assets: Properties, investments, or other valuable items held within the trust. — Terms: Conditions, requirements, or provisions outlined within the trust agreement. — Orange, California: The specific location where the trust is based, indicating the jurisdiction in which the partial revocation is taking place. When initiating an Orange California Partial Revocation of Trust and completing the Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, it is crucial to consult with a legal professional to ensure compliance with local laws, the specific trust agreement, and to address any potential tax and estate planning implications.Orange California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee is a legal process that involves modifying or altering certain provisions within a trust agreement based in Orange, California. This action can be done by the trustee of the trust to address specific changes or circumstances that necessitate a partial revocation. Some different types of Orange California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee include: 1. Partial Revocation of Trust Beneficiaries: This type of partial revocation focuses on modifying the beneficiaries of the trust. It may involve adding or removing individuals or organizations who are set to benefit from the trust proceeds or assets. 2. Partial Revocation of Trust Assets: This type of partial revocation aims to alter the assets held within the trust. It may involve adding or removing specific properties, investments, or other types of assets that are included in the trust agreement. 3. Partial Revocation of Trust Terms: This type of partial revocation focuses on modifying specific terms or conditions outlined within the trust agreement. It may involve revising the distribution terms, conditions for beneficiaries, or any other provisions that need to be updated or changed. The Acknowledgment of Receipt of Notice of Partial Revocation by Trustee is a document that confirms the trustee's acknowledgment and understanding of the partial revocation process. This acknowledgment typically includes the following relevant keywords: — Trustee: The person or entity appointed to manage and administer the trust assets. — Partial revocation: The legal action of modifying specific provisions within the trust agreement. — Notice of partial revocation: Formal communication sent to the trustee, informing them of the intent to partially revoke the trust. — Receipt: Acknowledgment of receiving the notice of partial revocation. — Trust agreement: The legal document that outlines the terms, conditions, and provisions of the trust. — Beneficiaries: Individuals or entities entitled to benefit from the trust assets. — Assets: Properties, investments, or other valuable items held within the trust. — Terms: Conditions, requirements, or provisions outlined within the trust agreement. — Orange, California: The specific location where the trust is based, indicating the jurisdiction in which the partial revocation is taking place. When initiating an Orange California Partial Revocation of Trust and completing the Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, it is crucial to consult with a legal professional to ensure compliance with local laws, the specific trust agreement, and to address any potential tax and estate planning implications.