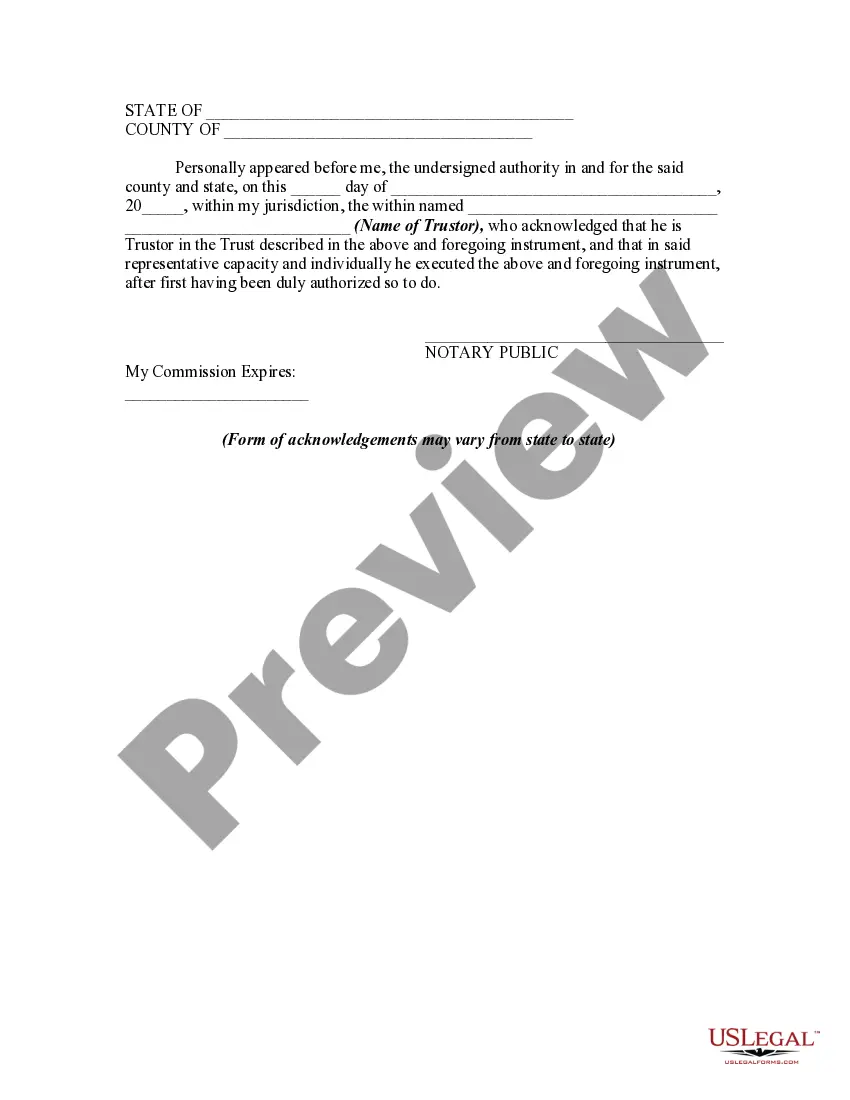

A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Dallas Texas Receipt by Trust or for Trust Property Upon Revocation of Trust is a legal document that provides an acknowledgment from the Trust or, the individual who created the trust, regarding the return of trust property upon the revocation of the trust. This receipt serves as evidence and confirmation of the Trust or's receipt of the trust property after the trust has been terminated. It is an essential document for both parties involved in the revocation process to ensure a transparent and lawful transfer of property. The Dallas Texas Receipt by Trust or for Trust Property Upon Revocation of Trust document contains various elements that are important to include: 1. Trust or Information: The receipt should include the full legal name, contact details, and address of the Trust or to identify the specific individual who created the trust. 2. Trust Property Details: This section requires a comprehensive description of the trust property being returned to the Trust or. It should include details such as the type of property, its location, any unique identifiers (such as serial numbers or titles), and other distinguishing factors. For instance, if it is a real estate property, the receipt must include the property address, size, and other relevant information. 3. Revocation Date: It is crucial to specify the exact date on which the trust was revoked, as it serves as a reference point for legal purposes. 4. Signatures: The Trust or must sign the receipt, along with any additional witnesses, to confirm their agreement and understanding of the property transfer. It is also advisable to include the date on which the receipt was signed. Types of Dallas Texas Receipt by Trust or for Trust Property Upon Revocation of Trust may include: 1. Real Estate Property Receipt: This type of receipt is used when the trust property comprises one or more real estate assets, such as residential homes, commercial buildings, or vacant land. 2. Personal Belongings Receipt: In cases where the trust property consists of personal belongings, such as vehicles, jewelry, artwork, or furniture, a specific receipt can be created to document the return of these items. 3. Financial Instrument Receipt: If the trust property involves financial instruments like stocks, bonds, or investment accounts, a separate receipt focusing on these assets can be drafted. It is important to note that the specific terms and details contained in the Dallas Texas Receipt by Trust or for Trust Property Upon Revocation of Trust may vary based on individual circumstances and legal requirements. Consulting with a qualified attorney is strongly recommended ensuring the accuracy and legality of the document for all parties involved.