Unless the continuation of a trust is necessary to carry out a material purpose of the trust (such as tax benefits), the trust may be terminated by agreement of all the beneficiaries if none of them is mentally incompetent or underage (e.g., under 21 in some states). However, termination generally cannot take place when it is contrary to the clearly expressed intention of the trustor. In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

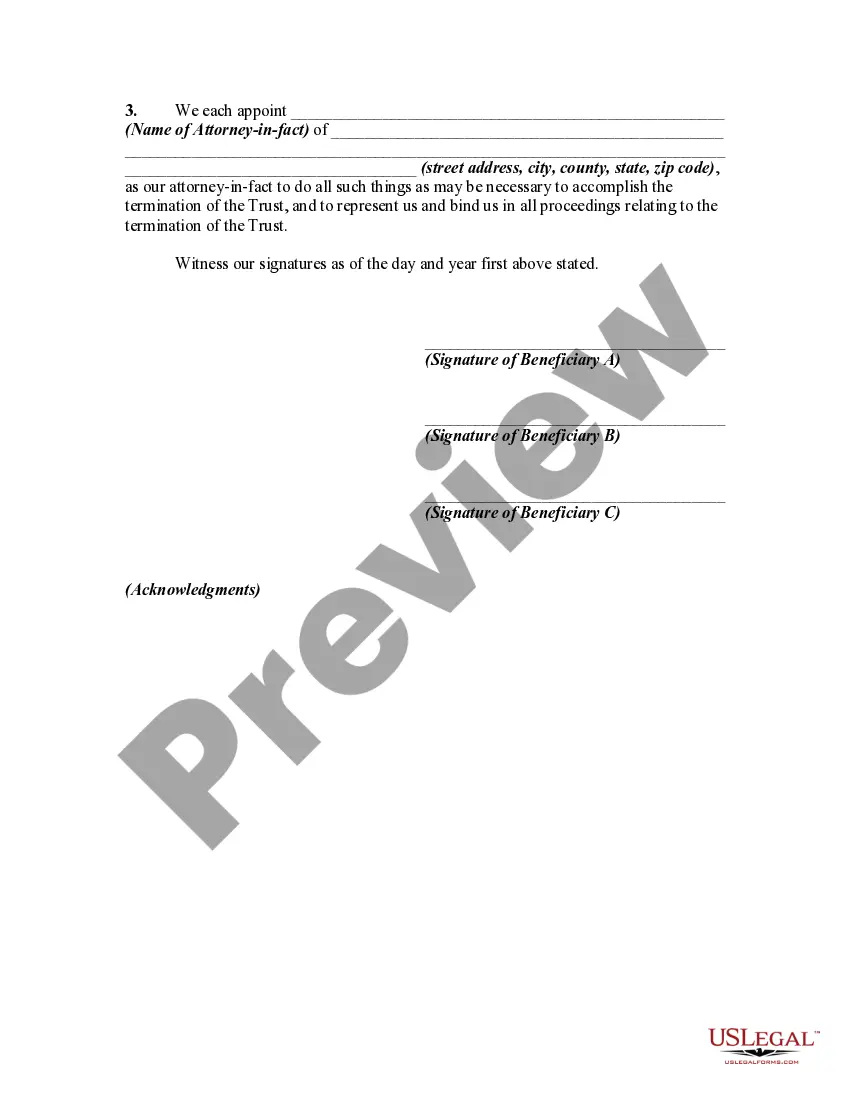

Santa Clara, California, Agreement Among Beneficiaries to Terminate Trust is a legally binding document that allows beneficiaries of a trust in Santa Clara, California to come together and agree to terminate the trust. This agreement can be used for various types of trusts, including revocable living trusts, testamentary trusts, special needs trusts, and charitable trusts. The Agreement Among Beneficiaries to Terminate Trust serves as a means for all parties involved in the trust to agree on terminating the trust and distributing the trust assets among the beneficiaries. By obtaining a consensus, beneficiaries can avoid the need for lengthy and often expensive legal proceedings. This agreement typically outlines the terms and conditions under which the trust will be terminated. It addresses important aspects such as the distribution of trust assets, the rights and obligations of the beneficiaries, and the legal implications of terminating the trust. The agreement also often includes provisions for any necessary tax filings and the release of the trustee from their responsibilities. In Santa Clara, California, there are several types of Agreement Among Beneficiaries to Terminate Trust that can be used depending on the specific circumstances: 1. Revocable Living Trust Termination Agreement: This type of agreement is used when the trust was created as a revocable living trust. It allows the beneficiaries to terminate the trust during the lifetime of the settler (the trust creator) and distribute the assets accordingly. 2. Testamentary Trust Termination Agreement: If the trust was created through a will and is effective upon the death of the testator, beneficiaries can use this agreement to terminate the trust and distribute the assets as per the agreed terms. 3. Special Needs Trust Termination Agreement: Specifically applicable to special needs trusts, this agreement enables beneficiaries to terminate the trust and utilize the trust assets for the benefit of the individual with special needs in accordance with the applicable laws. 4. Charitable Trust Termination Agreement: In cases where a trust was established for charitable purposes, this agreement allows beneficiaries to terminate the trust and distribute the assets to the designated charitable organizations. In conclusion, the Santa Clara, California, Agreement Among Beneficiaries to Terminate Trust is a legally binding document that provides a systematic and agreed-upon approach for beneficiaries to terminate different types of trusts. Whether it is a revocable living trust, testamentary trust, special needs trust, or charitable trust, this agreement ensures smooth resolution and equitable distribution of trust assets among the beneficiaries.Santa Clara, California, Agreement Among Beneficiaries to Terminate Trust is a legally binding document that allows beneficiaries of a trust in Santa Clara, California to come together and agree to terminate the trust. This agreement can be used for various types of trusts, including revocable living trusts, testamentary trusts, special needs trusts, and charitable trusts. The Agreement Among Beneficiaries to Terminate Trust serves as a means for all parties involved in the trust to agree on terminating the trust and distributing the trust assets among the beneficiaries. By obtaining a consensus, beneficiaries can avoid the need for lengthy and often expensive legal proceedings. This agreement typically outlines the terms and conditions under which the trust will be terminated. It addresses important aspects such as the distribution of trust assets, the rights and obligations of the beneficiaries, and the legal implications of terminating the trust. The agreement also often includes provisions for any necessary tax filings and the release of the trustee from their responsibilities. In Santa Clara, California, there are several types of Agreement Among Beneficiaries to Terminate Trust that can be used depending on the specific circumstances: 1. Revocable Living Trust Termination Agreement: This type of agreement is used when the trust was created as a revocable living trust. It allows the beneficiaries to terminate the trust during the lifetime of the settler (the trust creator) and distribute the assets accordingly. 2. Testamentary Trust Termination Agreement: If the trust was created through a will and is effective upon the death of the testator, beneficiaries can use this agreement to terminate the trust and distribute the assets as per the agreed terms. 3. Special Needs Trust Termination Agreement: Specifically applicable to special needs trusts, this agreement enables beneficiaries to terminate the trust and utilize the trust assets for the benefit of the individual with special needs in accordance with the applicable laws. 4. Charitable Trust Termination Agreement: In cases where a trust was established for charitable purposes, this agreement allows beneficiaries to terminate the trust and distribute the assets to the designated charitable organizations. In conclusion, the Santa Clara, California, Agreement Among Beneficiaries to Terminate Trust is a legally binding document that provides a systematic and agreed-upon approach for beneficiaries to terminate different types of trusts. Whether it is a revocable living trust, testamentary trust, special needs trust, or charitable trust, this agreement ensures smooth resolution and equitable distribution of trust assets among the beneficiaries.